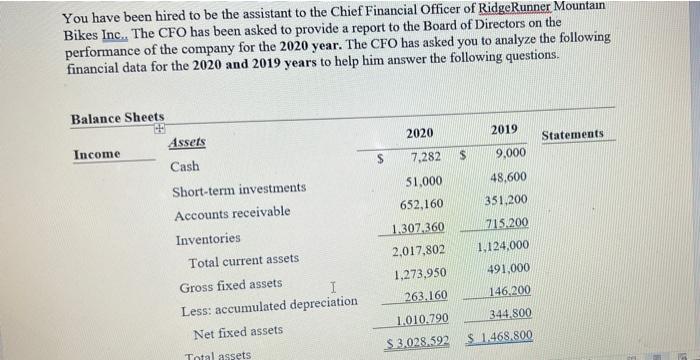

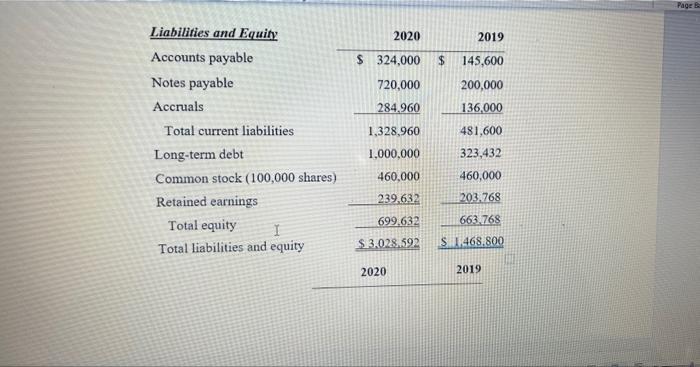

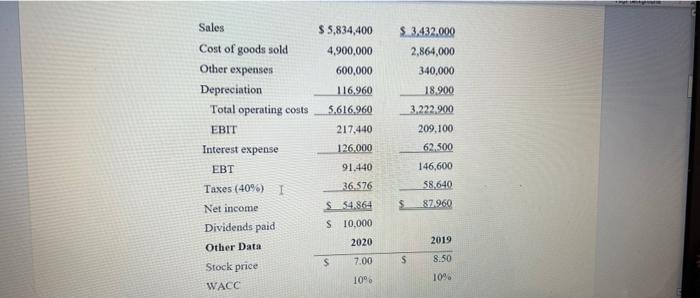

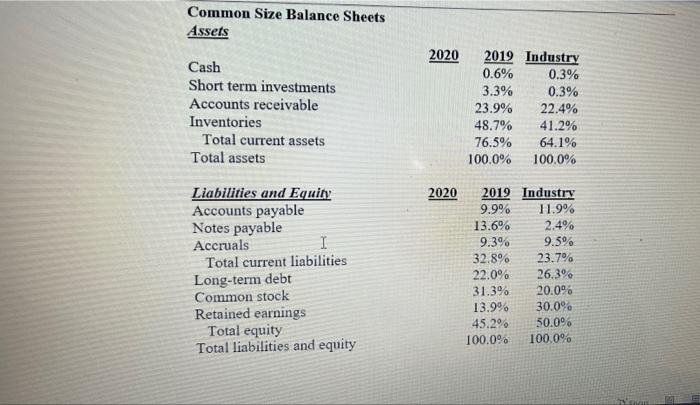

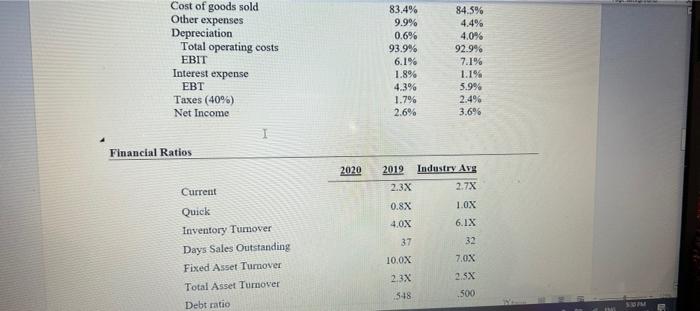

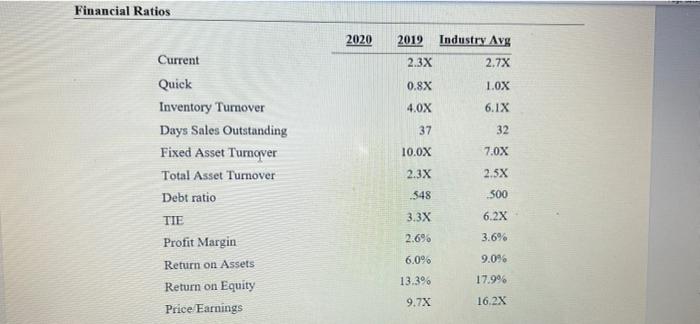

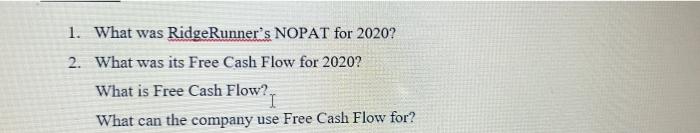

You have been hired to be the assistant to the Chief Financial Officer of Ridge Runner Mountain Bikes Inc.. The CFO has been asked to provide a report to the Board of Directors on the performance of the company for the 2020 year. The CFO has asked you to analyze the following financial data for the 2020 and 2019 years to help him answer the following questions. Balance Sheets 2020 2019 Statements Income S Assets Cash Short-term investments Accounts receivable Inventories Total current assets Gross fixed assets I Less: accumulated depreciation Net fixed assets 7.282 S 9,000 51,000 48,600 652,160 351,200 1.307 360 715.200 2.017.802 1,124,000 1,273,950 491,000 263.160 146,200 1,010 790 344.800 $ 3.028.592 $ 1.468.800 Total assets Page 2020 2019 $ 324,000 $ Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock (100,000 shares) Retained earnings Total equity I Total liabilities and equity 720,000 284.960 1,328,960 1,000,000 460,000 145,600 200,000 136,000 481,600 323,432 460,000 239.632 203.768 699.632 663 768 $ 3.028.592 S11468.800 2020 2019 Sales Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net income Dividends paid Other Data Stock price WACC $ 5,834,400 4,900,000 600,000 116.960 5.616.960 217,440 126.000 91.440 36.576 S. 3.432.000 2,864,000 340,000 18.900 3.222.900 209.100 62.500 146,600 58,640 87.960 S 54.864 $ 10,000 2020 2019 7.00 $ 8.50 10% 1096 Common Size Balance Sheets Assets 2020 Cash Short term investments Accounts receivable Inventories Total current assets Total assets 2019 Industry 0.6% 0.3% 3.3% 0.3% 23.9% 22.4% 48.7% 41.2% 76.5% 64.1% 100.0% 100.0% 2020 Liabilities and Equity Accounts payable Notes payable Accruals I Total current liabilities Long-term debt Common stock Retained earnings Total equity Total liabilities and equity 2019 Industry 9.9% 11.9% 13.6% 2.4% 9.3% 9.5% 32.8% 23.7% 22.0% 26.39 31.39% 20.0% 13.9% 30.0% 45.29% 50.0% 100.0% 100.0% Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net Income I Financial Ratios 83.4% 9.9% 0.6% 93.9% 6.1% 1.8% 4.3% 1.7% 2.6% 84.5% 4.4% 4.0% 92.9% 7.1% 1.196 5.99 2.496 3.696 2020 2019 2.3X Industry Avg 2.7X Current 1.OX 0.8X 4.0X 6.1X 37 32 Quick Inventory Tumover Days Sales Outstanding Fixed Asset Turnover Total Asset Turnover Debt ratio 10.0X 7.0X 2.5X 2.3X 548 500 SOM Financial Ratios 2020 2012 Industry Avg 2.3X 2.7% 0.8X 1.OX 4.0X 6. IX Current Quick Inventory Turnover Days Sales Outstanding Fixed Asset Turnover Total Asset Turnover Debt ratio 37 32 7.0X 10.0X 2.3X 2.5X 548 500 TIE 3.3X 6.2x Profit Margin 2.696 3.69 Return on Assets 6.0% 9.0% 17.9% 13.39 Return on Equity Price Earnings 9.7X 16.2X 1. What was RidgeRunner's NOPAT for 2020? 2. What was its Free Cash Flow for 2020? What is Free Cash Flow? I What can the company use Free Cash Flow for