Answered step by step

Verified Expert Solution

Question

1 Approved Answer

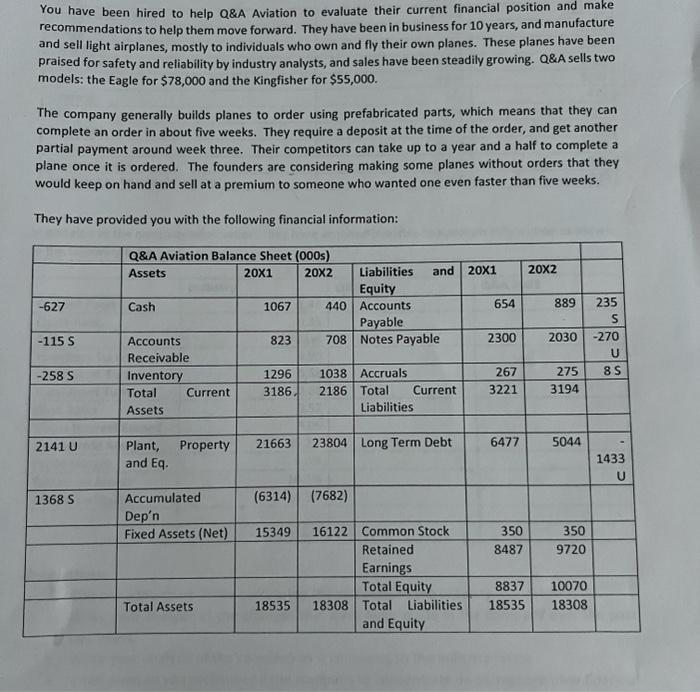

You have been hired to help Q&A Aviation to evaluate their current financial position and make recommendations to help them move forward. They have

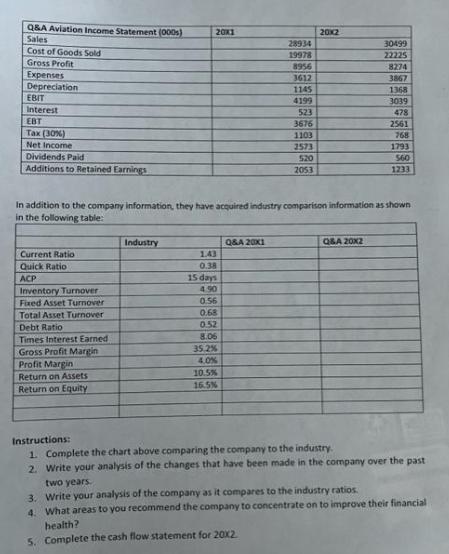

You have been hired to help Q&A Aviation to evaluate their current financial position and make recommendations to help them move forward. They have been in business for 10 years, and manufacture and sell light airplanes, mostly to individuals who own and fly their own planes. These planes have been praised for safety and reliability by industry analysts, and sales have been steadily growing. Q&A sells two models: the Eagle for $78,000 and the Kingfisher for $55,000. The company generally builds planes to order using prefabricated parts, which means that they can complete an order in about five weeks. They require a deposit at the time of the order, and get another partial payment around week three. Their competitors can take up to a year and a half to complete a plane once it is ordered. The founders are considering making some planes without orders that they would keep on hand and sell at a premium to someone who wanted one even faster than five weeks. They have provided you with the following financial information: -627 -115 S -258 S 2141 U 1368 S Q&A Aviation Balance Sheet (000s) Assets 20X1 20X2 Cash Accounts Receivable Inventory Total Assets Current Plant, Property and Eq. Accumulated Dep'n Fixed Assets (Net) Total Assets 1067 823 1296 3186 21663 Liabilities and 20X1 Equity 440 Accounts Payable 708 Notes Payable 1038 Accruals 2186 Total Liabilities Current 23804 Long Term Debt (6314) (7682) 15349 16122 Common Stock Retained Earnings Total Equity 18535 18308 Total Liabilities and Equity 654 2300 267 3221 6477 350 8487 8837 18535 20X2 889 2030 275 3194 5044 350 9720 10070 18308 235 S -270 U 8 S 1433 U Q&A Aviation Income Statement (000) Sales Cost of Goods Sold Gross Profit Expenses Depreciation EBIT Interest EBT Tax (30%) Net Income Dividends Paid Additions to Retained Earnings Current Ratio Quick Ratio ACP Inventory Turnover Fixed Asset Turnover Total Asset Turnover Debt Ratio Times Interest Earned Gross Profit Margin Profit Margin Return on Assets Return on Equity 20X1 Industry 1.43 0.38 15 days 4.90 0.56 0.68 0.52 8.06 In addition to the company information, they have acquired industry comparison information as shown in the following table: 35.2% 4.0% 10.5% 16.5% 28934 19978 8956 Q&A 20X1 3612 1145 4199 523 3676 1103 2573 520 2053 2012 30499 22225 Q&A 20X2 8274 3867 1368 3039 478 2561 768 1793 560 1233 Instructions: 1. Complete the chart above comparing the company to the industry. 2. Write your analysis of the changes that have been made in the company over the past two years. 3. Write your analysis of the company as it compares to the industry ratios. 4. What areas to you recommend the company to concentrate on to improve their financial health? 5. Complete the cash flow statement for 20X2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the chart comparing the company to the industry calculate the ratios for QA Aviation based on the provided financial information 1 Current Ratio Current Ratio Total Current Assets Total Cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started