Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Skysong Inc. wishes to lease machinery to Sheridan Company. Sheridan wants the machinery for 4 years, although it has a useful life of 10

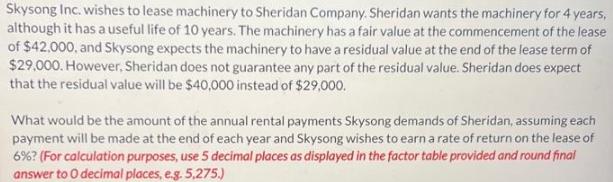

Skysong Inc. wishes to lease machinery to Sheridan Company. Sheridan wants the machinery for 4 years, although it has a useful life of 10 years. The machinery has a fair value at the commencement of the lease of $42,000, and Skysong expects the machinery to have a residual value at the end of the lease term of $29,000. However, Sheridan does not guarantee any part of the residual value. Sheridan does expect that the residual value will be $40,000 instead of $29,000. What would be the amount of the annual rental payments Skysong demands of Sheridan, assuming each payment will be made at the end of each year and Skysong wishes to earn a rate of return on the lease of 6%? (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to 0 decimal places, e.g. 5,275.)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To solve it we need to find the present value of the minimum lease payments MLP that Skysong expects ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started