Answered step by step

Verified Expert Solution

Question

1 Approved Answer

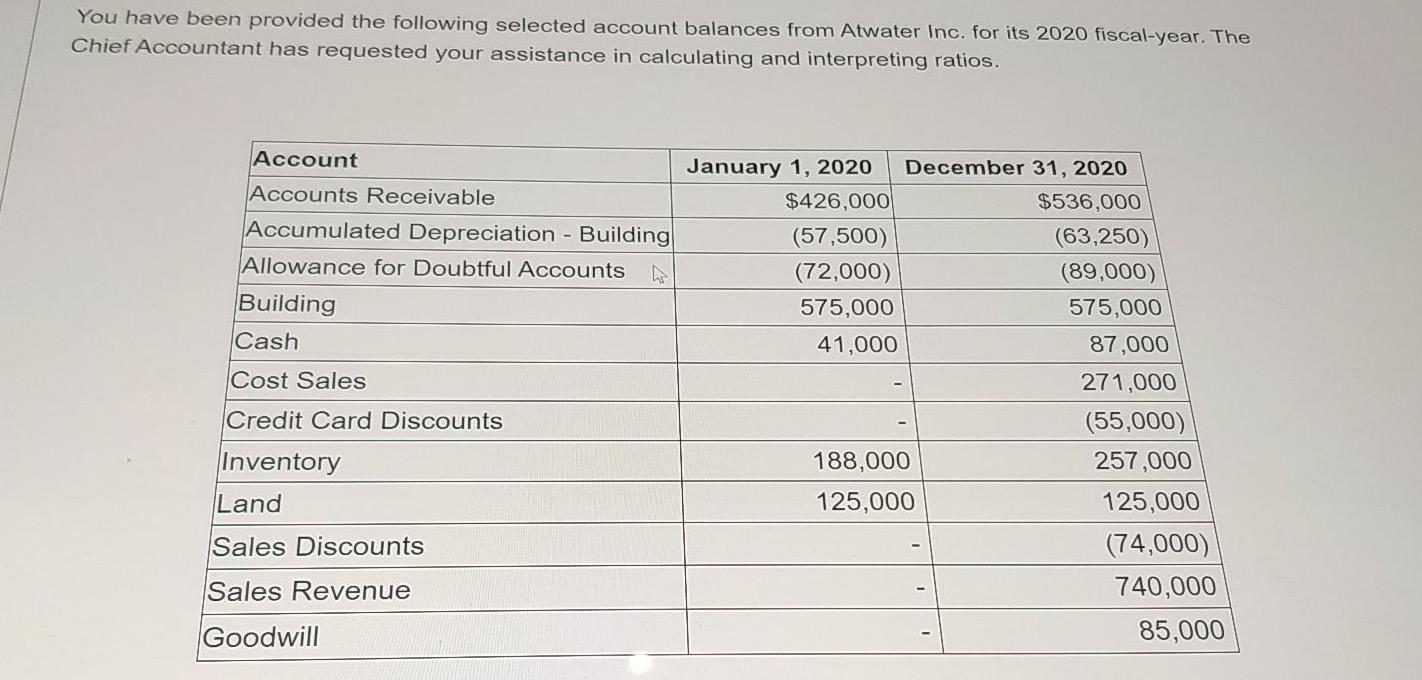

You have been provided the following selected account balances from Atwater Inc. for its 2020 fiscal-year. The Chief Accountant has requested your assistance in calculating

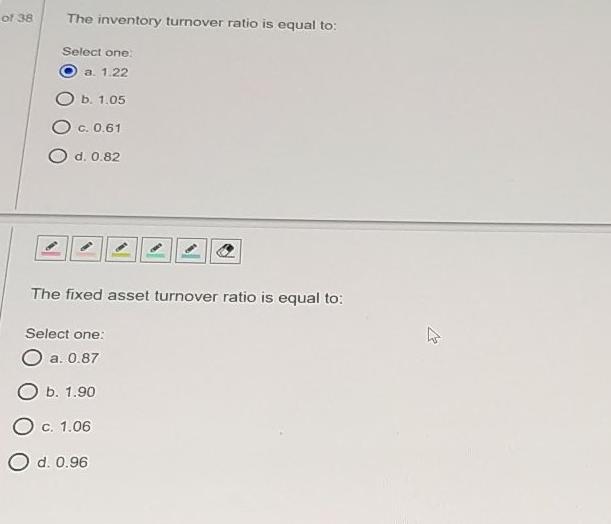

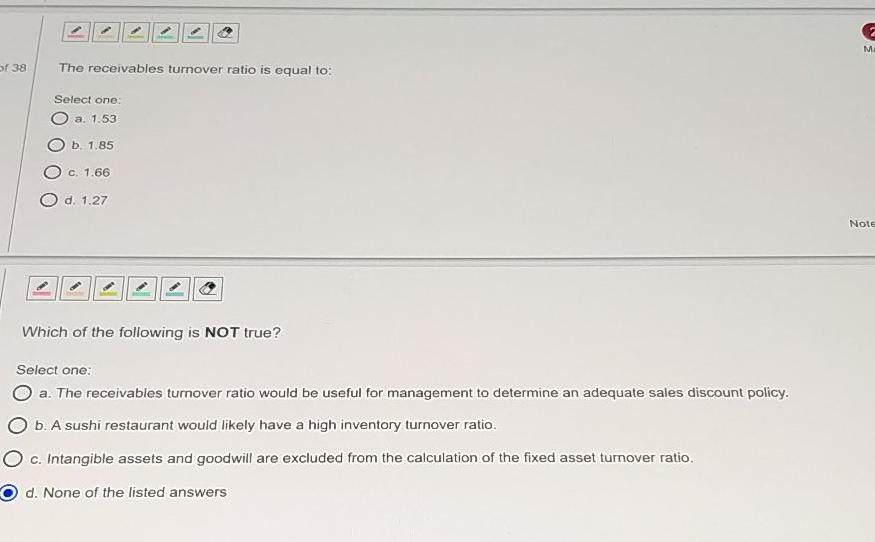

You have been provided the following selected account balances from Atwater Inc. for its 2020 fiscal-year. The Chief Accountant has requested your assistance in calculating and interpreting ratios. Account January 1, 2020 December 31, 2020 Accounts Receivable $426,000 $536,000 Accumulated Depreciation - Building (57,500) (63,250) Allowance for Doubtful Accounts N (72,000) (89,000) Building 575,000 575,000 Cash 41,000 87,000 Cost Sales 271,000 Credit Card Discounts (55,000) Inventory 188,000 257,000 Land 125,000 125,000 Sales Discounts (74,000) Sales Revenue 740,000 Goodwill 85,000 - of 38 The inventory turnover ratio is equal to: Select one a. 1.22 O b. 1.05 O c.0.61 d. 0.82 The fixed asset turnover ratio is equal to: Select one: a. 0.87 b. 1.90 c. 1.06 O d. 0.96 M M of 38 The receivables turnover ratio is equal to: Select one: a. 1.53 O b. 1.85 O c. 1.66 O d. 1.27 Note Which of the following is NOT true? Select one: O a. The receivables turnover ratio would be useful for management to determine an adequate sales discount policy. O b. A sushi restaurant would likely have a high inventory turnover ratio. OC. Intangible assets and goodwill are excluded from the calculation of the fixed asset turnover ratio. O d. None of the listed answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started