Answered step by step

Verified Expert Solution

Question

1 Approved Answer

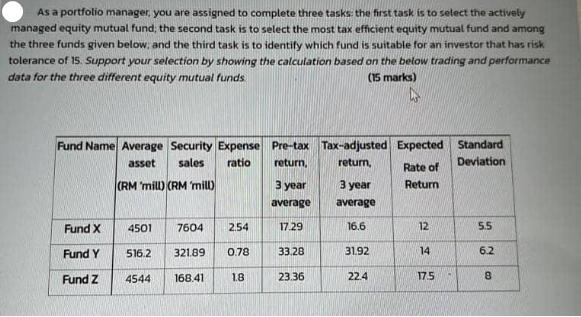

As a portfolio manager, you are assigned to complete three tasks: the first task is to select the actively managed equity mutual fund, the

As a portfolio manager, you are assigned to complete three tasks: the first task is to select the actively managed equity mutual fund, the second task is to select the most tax efficient equity mutual fund and among the three funds given below, and the third task is to identify which fund is suitable for an investor that has risk tolerance of 15. Support your selection by showing the calculation based on the below trading and performance data for the three different equity mutual funds (15 marks) Fund Name Average Security Expense Pre-tax Tax-adjusted Expected asset sales ratio return, return, (RM 'mill) (RM 'mill) Fund X Fund Y Fund Z 4501 7604 2.54 321.89 0.78 168.41 516.2 4544 1.8 3 year average 17.29 33.28 23.36 3 year average 16.6 31.92 22.4 Rate of Return 12 14 17.5 Standard Deviation 5.5 6.2 8

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION The above data can be best supported as explained below Please note that in case of multipl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started