Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been recently promoted to be the group accountant for Horus Berhad and the following information were found in the minutes of meeting: Horus

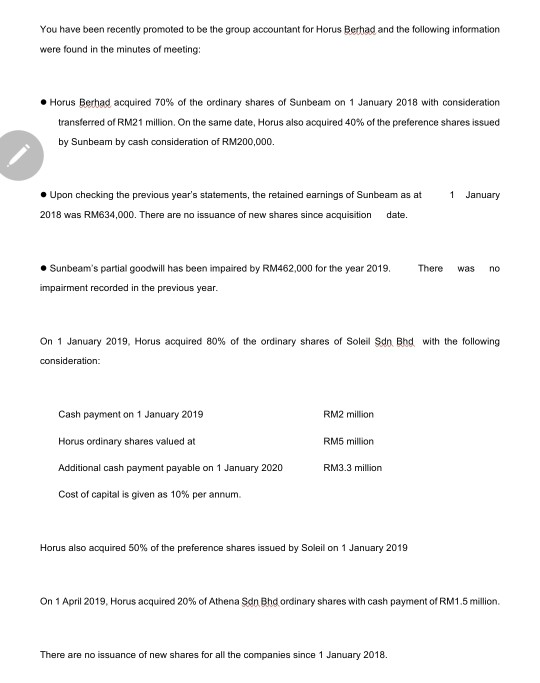

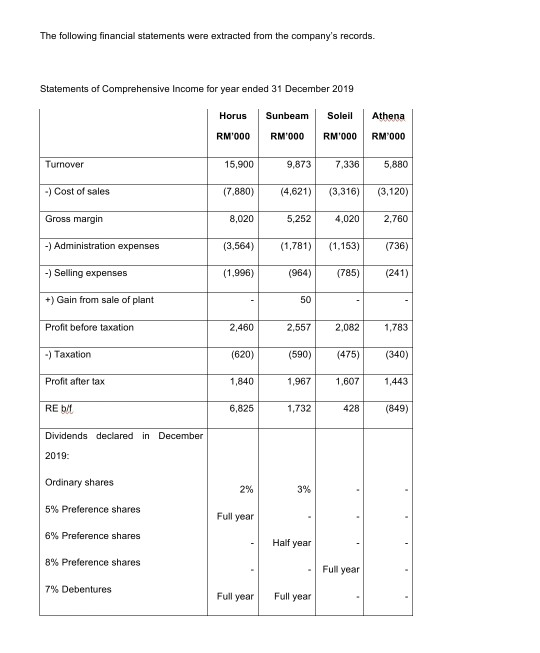

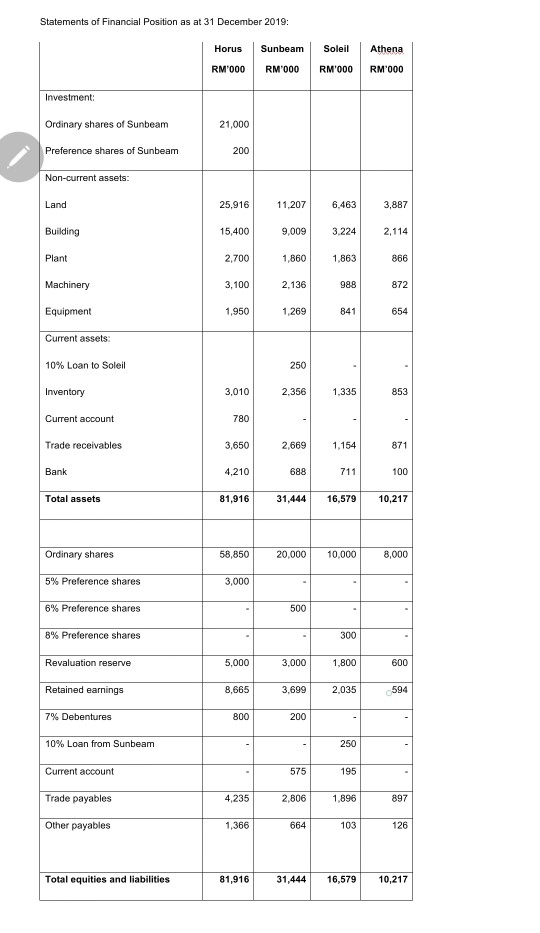

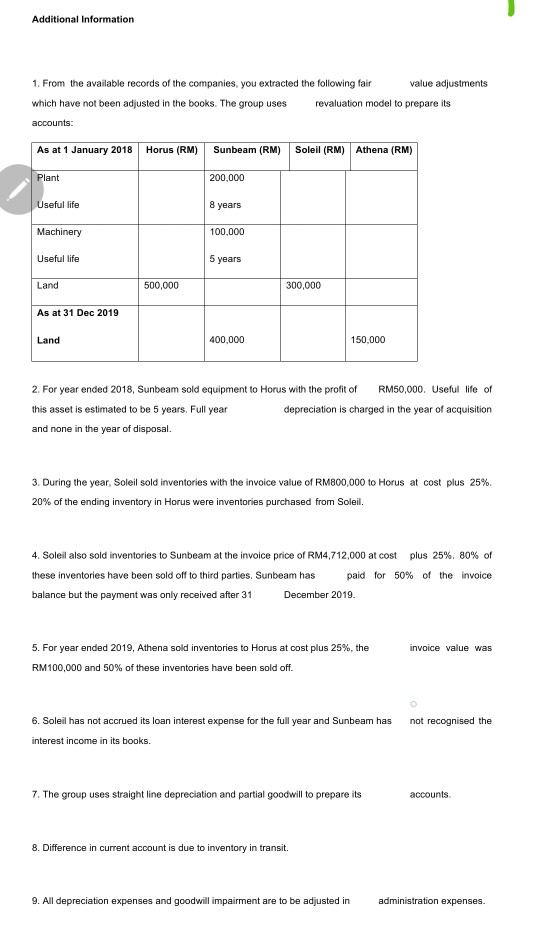

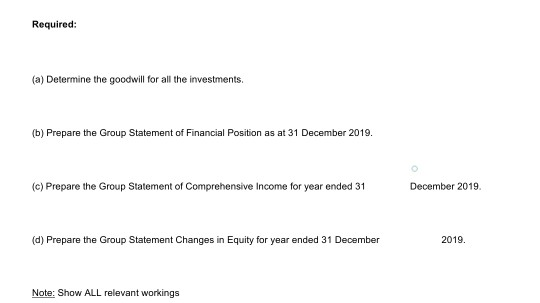

You have been recently promoted to be the group accountant for Horus Berhad and the following information were found in the minutes of meeting: Horus Berhad acquired 70% of the ordinary shares of Sunbeam on 1 January 2018 with consideration transferred of RM21 million. On the same date, Horus also acquired 40% of the preference shares issued by Sunbeam by cash consideration of RM200,000. 1 January Upon checking the previous year's statements, the retained earnings of Sunbeam as at 2018 was RM634,000. There are no issuance of new shares since acquisition date. There was no Sunbeam's partial goodwill has been impaired by RM462,000 for the year 2019. impairment recorded in the previous year. On 1 January 2019, Horus acquired 80% of the ordinary shares of Soleil Sdn Bhd with the following consideration: Cash payment on 1 January 2019 RM2 million Horus ordinary shares valued at RM5 million RM3.3 million Additional cash payment payable on 1 January 2020 Cost of capital is given as 10% per annum Horus also acquired 50% of the preference shares issued by Soleil on 1 January 2019 On 1 April 2019, Horus acquired 20% of Athena Sdn Bhd ordinary shares with cash payment of RM1.5 million. There are no issuance of new shares for all the companies since 1 January 2018. The following financial statements were extracted from the company's records. Statements of Comprehensive Income for year ended 31 December 2019 Horus Sunbeam Soleil Athena RM'000 RM1000 RM'000 RM 000 Turnover 15,900 9,873 7,336 5,880 -) Cost of sales (7.880) (4,621) (3,316) (3,120) Gross margin 8,020 5,252 4,020 2,760 -) Administration expenses (3,564) (1,781) (1,153) (736) -) Selling expenses (1.996) (964) (785) (241) +) Gain from sale of plant - 50 Profit before taxation 2,460 2,557 2,082 1,783 -) Taxation (620) (590) (475) (340) Profit after tax 1,840 1,967 1,607 1,443 RE/ 6,825 1,732 428 (849) Dividends declared in December 2019 Ordinary shares 2% 3% 5% Preference shares Full year 6% Preference shares Half year 8% Preference shares Full year 7% Debentures Full year Full year Statements of Financial Position as at 31 December 2019: Horus Soleil Athena Sunbeam RM'000 RM'000 RM'000 RM'000 Investment: Ordinary shares of Sunbeam 21,000 Preference shares of Sunbeam 200 Non-current assets: Land 25,916 11,207 6,463 3,887 Building 15,400 9,009 3,224 2,114 Plant 2,700 1,860 1,863 866 Machinery 3,100 2.136 988 872 Equipment 1,950 1,269 841 654 Current assets: 10% Loan to Soleil 250 Inventory 3,010 2.356 1,335 853 Current account 780 Trade receivables 3,650 2,669 1.154 871 Bank 4,210 688 711 100 Total assets 81,916 31,444 16,579 10,217 Ordinary shares 58,850 20,000 10,000 8,000 5% Preference shares 3,000 6% Preference shares 500 8% Preference shares 300 Revaluation reserve 5,000 3.000 1,800 600 Retained earnings 8,665 3,699 2,035 594 7% Debentures 800 200 10% Loan from Sunbeam 250 Current account 575 195 Trade payables 4,235 2,806 1,896 897 Other payables 1,366 664 103 126 Total equities and liabilities 81,916 31,444 16,579 10,217 Additional Information 1. From the available records of the companies, you extracted the following fair value adjustments which have not been adjusted in the books. The group uses revaluation model to prepare its accounts: As at 1 January 2018 Horus (RM) Sunbeam (RM) Soleil (RM) Athena (RM) Plant 200,000 Useful life 8 years Machinery 100.000 Useful life 5 years Land 500,000 300,000 As at 31 Dec 2019 Land 400,000 150.000 2. For year ended 2018, Sunbeam sold equipment to Horus with the profit of RM50,000. Useful life of this asset is estimated to be 5 years. Full year depreciation is charged in the year of acquisition and none in the year of disposal. 3. During the year, Soleil sold inventories with the invoice value of RM800,000 to Horus at cost plus 25%. 20% of the ending inventory in Horus were inventories purchased from Soleil. 4. Soleil also sold inventories to Sunbeam at the invoice price of RM4,712,000 at cost plus 25%, 80% of these inventories have been sold off to third parties. Sunbeam has paid for 50% of the invoice balance but the payment was only received after 31 December 2019. invoice value was 5. For year ended 2019, Athena sold inventories to Horus at cost plus 25%, the RM100,000 and 50% of these inventories have been sold off. not recognised the 6. Soleil has not accrued its loan interest expense for the full year and Sunbeam has interest income in its books. 7. The group uses straight line depreciation and partial goodwill to prepare its accounts 8. Difference in current account is due to inventory in transit. 9. All depreciation expenses and goodwill impairment are to be adjusted in administration expenses. Required: (a) Determine the goodwill for all the investments. (b) Prepare the Group Statement of Financial Position as at 31 December 2019. (c) Prepare the Group Statement of Comprehensive Income for year ended 31 December 2019 (d) Prepare the Group Statement Changes in Equity for year ended 31 December 2019. Note: Show ALL relevant workings You have been recently promoted to be the group accountant for Horus Berhad and the following information were found in the minutes of meeting: Horus Berhad acquired 70% of the ordinary shares of Sunbeam on 1 January 2018 with consideration transferred of RM21 million. On the same date, Horus also acquired 40% of the preference shares issued by Sunbeam by cash consideration of RM200,000. 1 January Upon checking the previous year's statements, the retained earnings of Sunbeam as at 2018 was RM634,000. There are no issuance of new shares since acquisition date. There was no Sunbeam's partial goodwill has been impaired by RM462,000 for the year 2019. impairment recorded in the previous year. On 1 January 2019, Horus acquired 80% of the ordinary shares of Soleil Sdn Bhd with the following consideration: Cash payment on 1 January 2019 RM2 million Horus ordinary shares valued at RM5 million RM3.3 million Additional cash payment payable on 1 January 2020 Cost of capital is given as 10% per annum Horus also acquired 50% of the preference shares issued by Soleil on 1 January 2019 On 1 April 2019, Horus acquired 20% of Athena Sdn Bhd ordinary shares with cash payment of RM1.5 million. There are no issuance of new shares for all the companies since 1 January 2018. The following financial statements were extracted from the company's records. Statements of Comprehensive Income for year ended 31 December 2019 Horus Sunbeam Soleil Athena RM'000 RM1000 RM'000 RM 000 Turnover 15,900 9,873 7,336 5,880 -) Cost of sales (7.880) (4,621) (3,316) (3,120) Gross margin 8,020 5,252 4,020 2,760 -) Administration expenses (3,564) (1,781) (1,153) (736) -) Selling expenses (1.996) (964) (785) (241) +) Gain from sale of plant - 50 Profit before taxation 2,460 2,557 2,082 1,783 -) Taxation (620) (590) (475) (340) Profit after tax 1,840 1,967 1,607 1,443 RE/ 6,825 1,732 428 (849) Dividends declared in December 2019 Ordinary shares 2% 3% 5% Preference shares Full year 6% Preference shares Half year 8% Preference shares Full year 7% Debentures Full year Full year Statements of Financial Position as at 31 December 2019: Horus Soleil Athena Sunbeam RM'000 RM'000 RM'000 RM'000 Investment: Ordinary shares of Sunbeam 21,000 Preference shares of Sunbeam 200 Non-current assets: Land 25,916 11,207 6,463 3,887 Building 15,400 9,009 3,224 2,114 Plant 2,700 1,860 1,863 866 Machinery 3,100 2.136 988 872 Equipment 1,950 1,269 841 654 Current assets: 10% Loan to Soleil 250 Inventory 3,010 2.356 1,335 853 Current account 780 Trade receivables 3,650 2,669 1.154 871 Bank 4,210 688 711 100 Total assets 81,916 31,444 16,579 10,217 Ordinary shares 58,850 20,000 10,000 8,000 5% Preference shares 3,000 6% Preference shares 500 8% Preference shares 300 Revaluation reserve 5,000 3.000 1,800 600 Retained earnings 8,665 3,699 2,035 594 7% Debentures 800 200 10% Loan from Sunbeam 250 Current account 575 195 Trade payables 4,235 2,806 1,896 897 Other payables 1,366 664 103 126 Total equities and liabilities 81,916 31,444 16,579 10,217 Additional Information 1. From the available records of the companies, you extracted the following fair value adjustments which have not been adjusted in the books. The group uses revaluation model to prepare its accounts: As at 1 January 2018 Horus (RM) Sunbeam (RM) Soleil (RM) Athena (RM) Plant 200,000 Useful life 8 years Machinery 100.000 Useful life 5 years Land 500,000 300,000 As at 31 Dec 2019 Land 400,000 150.000 2. For year ended 2018, Sunbeam sold equipment to Horus with the profit of RM50,000. Useful life of this asset is estimated to be 5 years. Full year depreciation is charged in the year of acquisition and none in the year of disposal. 3. During the year, Soleil sold inventories with the invoice value of RM800,000 to Horus at cost plus 25%. 20% of the ending inventory in Horus were inventories purchased from Soleil. 4. Soleil also sold inventories to Sunbeam at the invoice price of RM4,712,000 at cost plus 25%, 80% of these inventories have been sold off to third parties. Sunbeam has paid for 50% of the invoice balance but the payment was only received after 31 December 2019. invoice value was 5. For year ended 2019, Athena sold inventories to Horus at cost plus 25%, the RM100,000 and 50% of these inventories have been sold off. not recognised the 6. Soleil has not accrued its loan interest expense for the full year and Sunbeam has interest income in its books. 7. The group uses straight line depreciation and partial goodwill to prepare its accounts 8. Difference in current account is due to inventory in transit. 9. All depreciation expenses and goodwill impairment are to be adjusted in administration expenses. Required: (a) Determine the goodwill for all the investments. (b) Prepare the Group Statement of Financial Position as at 31 December 2019. (c) Prepare the Group Statement of Comprehensive Income for year ended 31 December 2019 (d) Prepare the Group Statement Changes in Equity for year ended 31 December 2019. Note: Show ALL relevant workings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started