Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have bought the exchange-listed convertible bonds of a company today on Jan 2,20X1, immediately after the coupon payment. The bond has the following

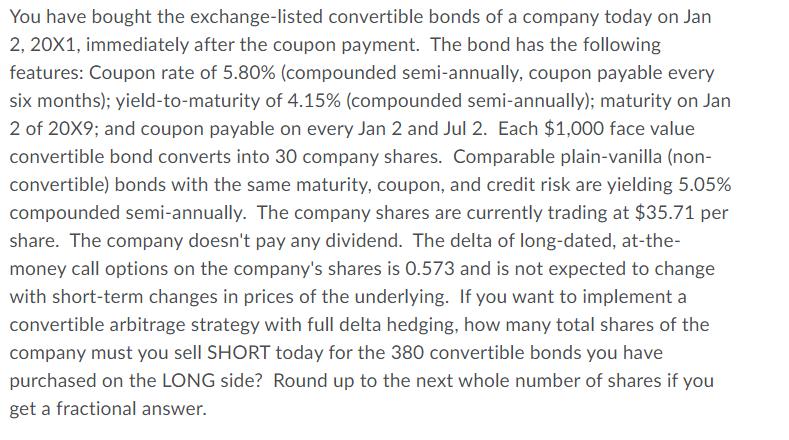

You have bought the exchange-listed convertible bonds of a company today on Jan 2,20X1, immediately after the coupon payment. The bond has the following features: Coupon rate of 5.80% (compounded semi-annually, coupon payable every six months); yield-to-maturity of 4.15% (compounded semi-annually); maturity on Jan 2 of 20X9; and coupon payable on every Jan 2 and Jul 2. Each $1,000 face value convertible bond converts into 30 company shares. Comparable plain-vanilla (non- convertible) bonds with the same maturity, coupon, and credit risk are yielding 5.05% compounded semi-annually. The company shares are currently trading at $35.71 per share. The company doesn't pay any dividend. The delta of long-dated, at-the- money call options on the company's shares is 0.573 and is not expected to change with short-term changes in prices of the underlying. If you want to implement a convertible arbitrage strategy with full delta hedging, how many total shares of the company must you sell SHORT today for the 380 convertible bonds you have purchased on the LONG side? Round up to the next whole number of shares if you get a fractional answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To implement a convertible arbitrage strategy with full delta hedging we need to sell short a certai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started