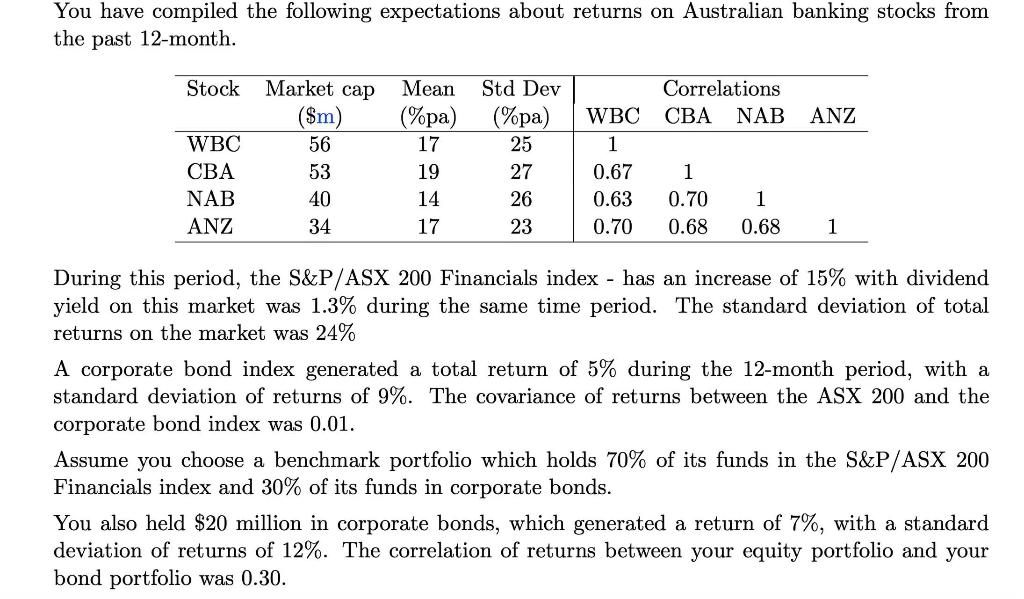

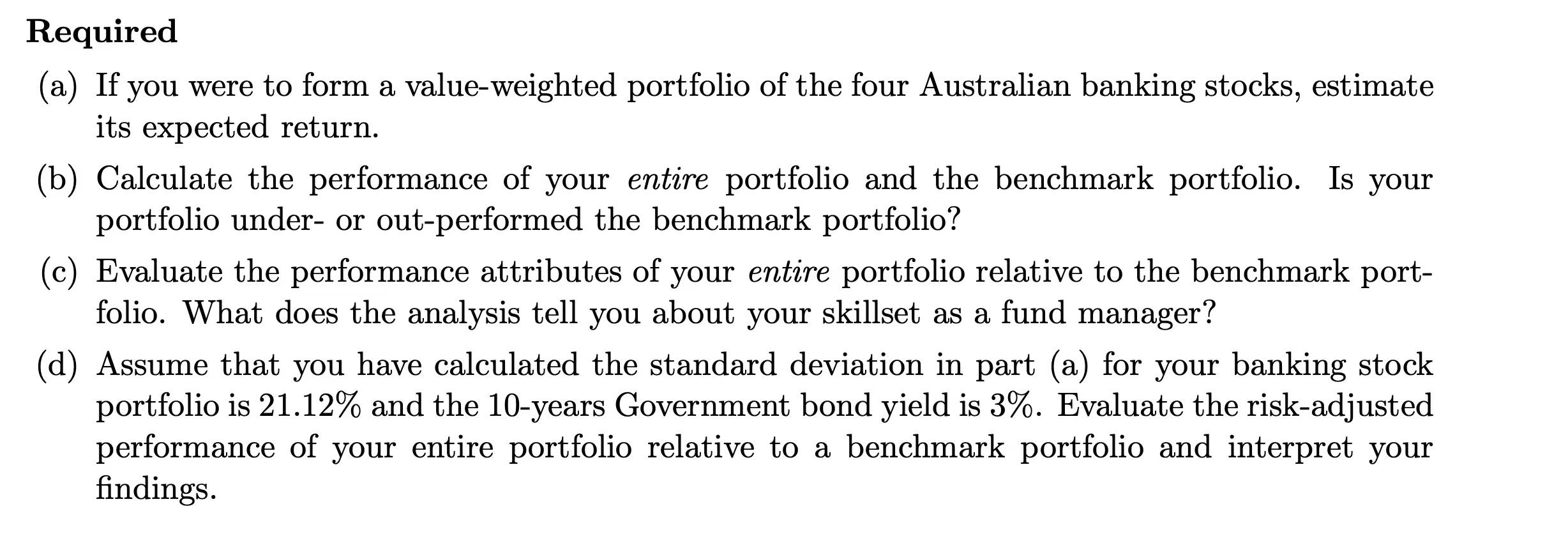

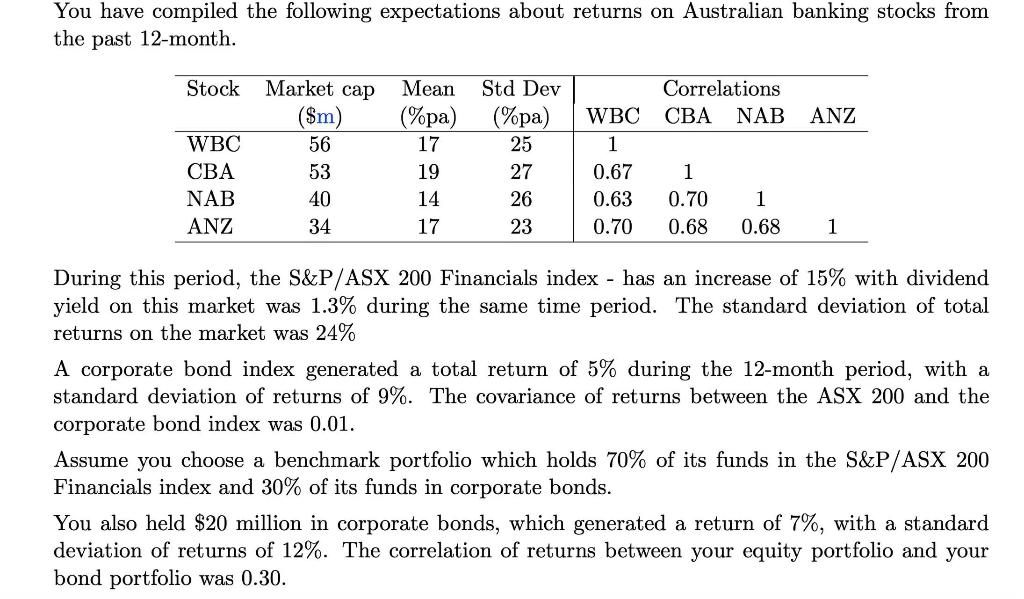

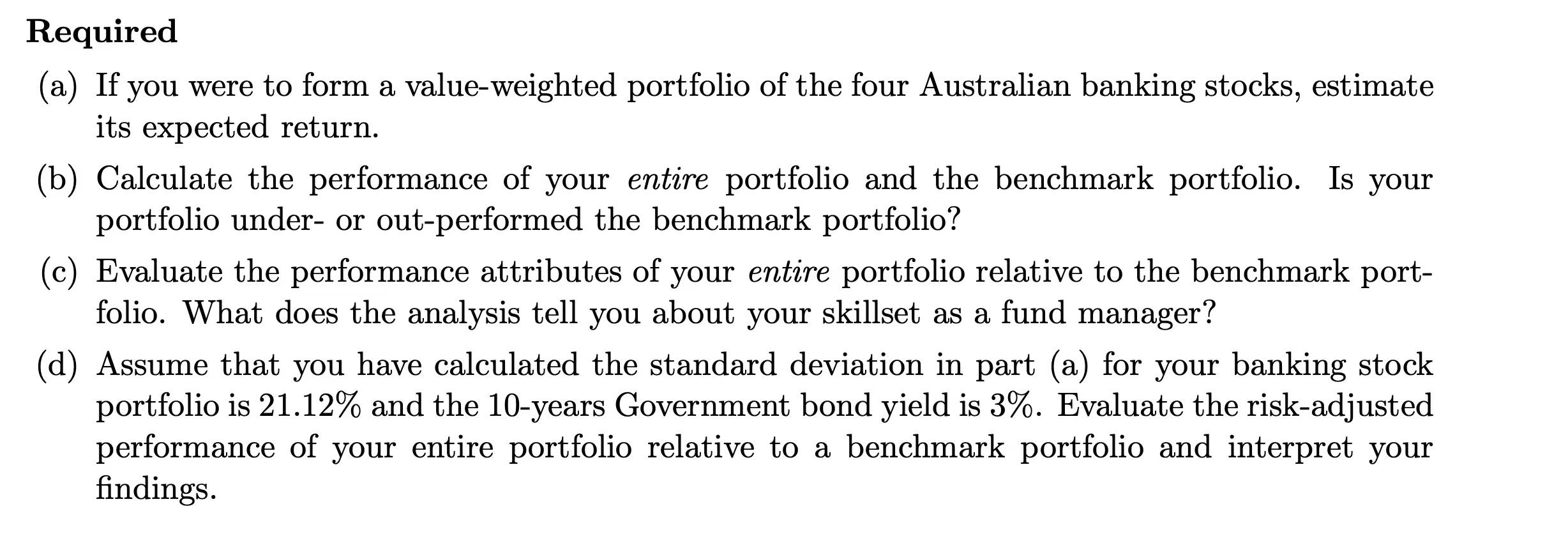

You have compiled the following expectations about returns on Australian banking stocks from the past 12-month. Stock Market cap Correlations CBA NAB ANZ WBC CBA NAB ANZ ($m) 56 53 40 34 Mean (%pa) 17 19 14 17 Std Dev (%pa) 25 27 26 23 WBC 1 0.67 0.63 0.70 1 0.70 0.68 1 0.68 1 During this period, the S&P/ASX 200 Financials index - has an increase of 15% with dividend yield on this market was 1.3% during the same time period. The standard deviation of total returns on the market was 24% A corporate bond index generated a total return of 5% during the 12-month period, with a standard deviation of returns of 9%. The covariance of returns between the ASX 200 and the corporate bond index was 0.01. Assume you choose a benchmark portfolio which holds 70% of its funds in the S&P/ASX 200 Financials index and 30% of its funds in corporate bonds. You also held $20 million in corporate bonds, which generated a return of 7%, with a standard deviation of returns of 12%. The correlation of returns between your equity portfolio and your bond portfolio was 0.30. Required (a) If you were to form a value-weighted portfolio of the four Australian banking stocks, estimate its expected return. (b) Calculate the performance of your entire portfolio and the benchmark portfolio. Is your portfolio under- or out-performed the benchmark portfolio? (c) Evaluate the performance attributes of your entire portfolio relative to the benchmark port- folio. What does the analysis tell you about your skillset as a fund manager? (d) Assume that you have calculated the standard deviation in part (a) for your banking stock portfolio is 21.12% and the 10-years Government bond yield is 3%. Evaluate the risk-adjusted performance of your entire portfolio relative to a benchmark portfolio and interpret your findings. You have compiled the following expectations about returns on Australian banking stocks from the past 12-month. Stock Market cap Correlations CBA NAB ANZ WBC CBA NAB ANZ ($m) 56 53 40 34 Mean (%pa) 17 19 14 17 Std Dev (%pa) 25 27 26 23 WBC 1 0.67 0.63 0.70 1 0.70 0.68 1 0.68 1 During this period, the S&P/ASX 200 Financials index - has an increase of 15% with dividend yield on this market was 1.3% during the same time period. The standard deviation of total returns on the market was 24% A corporate bond index generated a total return of 5% during the 12-month period, with a standard deviation of returns of 9%. The covariance of returns between the ASX 200 and the corporate bond index was 0.01. Assume you choose a benchmark portfolio which holds 70% of its funds in the S&P/ASX 200 Financials index and 30% of its funds in corporate bonds. You also held $20 million in corporate bonds, which generated a return of 7%, with a standard deviation of returns of 12%. The correlation of returns between your equity portfolio and your bond portfolio was 0.30. Required (a) If you were to form a value-weighted portfolio of the four Australian banking stocks, estimate its expected return. (b) Calculate the performance of your entire portfolio and the benchmark portfolio. Is your portfolio under- or out-performed the benchmark portfolio? (c) Evaluate the performance attributes of your entire portfolio relative to the benchmark port- folio. What does the analysis tell you about your skillset as a fund manager? (d) Assume that you have calculated the standard deviation in part (a) for your banking stock portfolio is 21.12% and the 10-years Government bond yield is 3%. Evaluate the risk-adjusted performance of your entire portfolio relative to a benchmark portfolio and interpret your findings