Question

You have decided to invest in a small commercial office building that has one tenant. The tenant has a lease that calls for annual rent

-

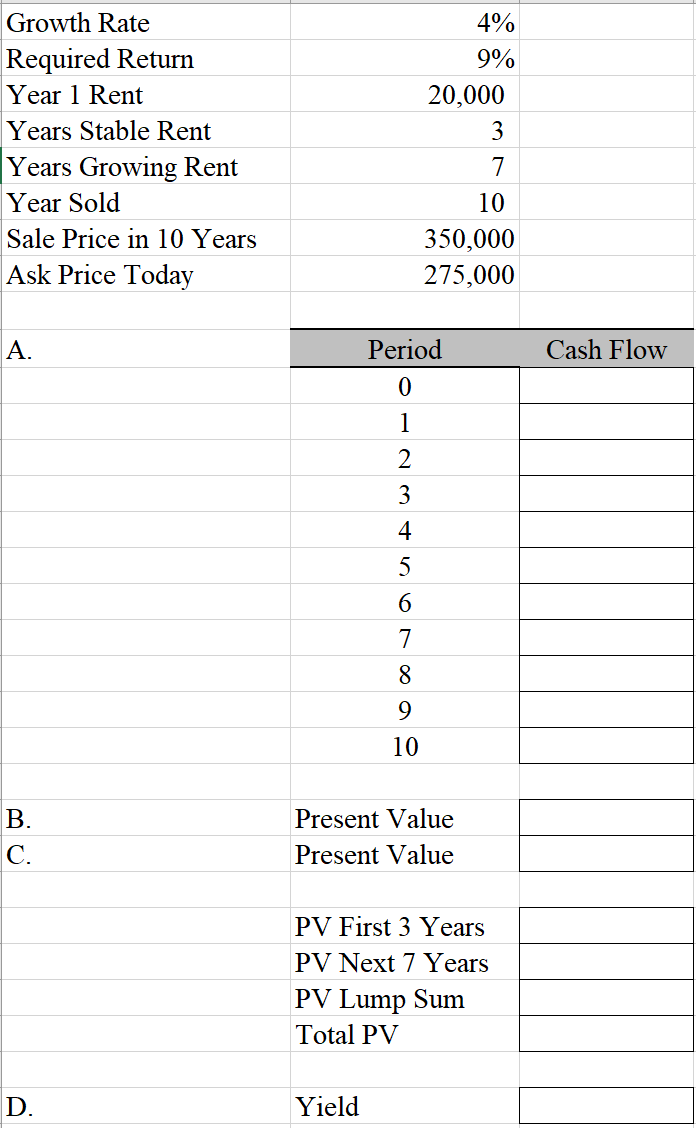

You have decided to invest in a small commercial office building that has one tenant. The tenant has a lease that calls for annual rent payments of $20,000 per year for the next three years. However, after that lease expires you expect to be able to increase the rent by 4% per year for the next seven years. You plan to sell the building for $350,000 ten years from now.

-

Create a table showing the projected cash flows for this investment assuming that the next lease payment will be made in one year.

-

Assuming that you need to earn 9% per year on this investment, what is the maximum price that you would be willing to pay for the building today? Use the Npv function.

-

Notice that the cash flow stream starts out as a three-year regular annuity, but it then changes into a seven-year graduated annuity plus a lump sum in year 10. Use the principle of value additivity to calculate the present value of the cash flows.

-

Suppose that the current owner of the building is asking $275,000 for the building. If you paid this price, what annual rate of return would you earn? Should you buy the building at this price? Show Excel Functions

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started