Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have developed a chain of 10 cyber cafes near university campuses like Wits, UCT, UJ, Rhodes and Stellenbosch. Your business concept is to

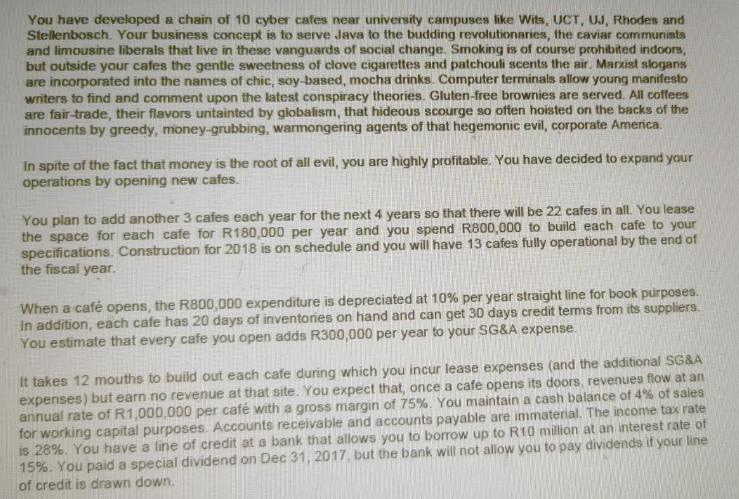

You have developed a chain of 10 cyber cafes near university campuses like Wits, UCT, UJ, Rhodes and Stellenbosch. Your business concept is to serve Java to the budding revolutionaries, the caviar communists and limousine liberals that live in these vanguards of social change. Smoking is of course prohibited indoors, but outside your cafes the gentle sweetness of clove cigarettes and patchouli scents the air. Marxist slogans are incorporated into the names of chic, soy-based, mocha drinks. Computer terminals allow young manifesto writers to find and comment upon the latest conspiracy theories. Gluten-free brownies are served. All coffees are fair-trade, their flavors untainted by globalism, that hideous scourge so often hoisted on the backs of the innocents by greedy, money-grubbing, warmongering agents of that hegemonic evil, corporate America. In spite of the fact that money is the root of all evil, you are highly profitable. You have decided to expand your operations by opening new cafes. You plan to add another 3 cafes each year for the next 4 years so that there will be 22 cafes in all. You lease the space for each cafe for R180,000 per year and you spend R800,000 to build each cafe to your specifications. Construction for 2018 is on schedule and you will have 13 cafes fully operational by the end of the fiscal year. When a caf opens, the R800,000 expenditure is depreciated at 10% per year straight line for book purposes. In addition, each cafe has 20 days of inventories on hand and can get 30 days credit terms from its suppliers. You estimate that every cafe you open adds R300,000 per year to your SG&A expense. It takes 12 mouths to build out each cafe during which you incur lease expenses (and the additional SG&A expenses) but earn no revenue at that site. You expect that, once a cafe opens its doors, revenues flow at an annual rate of R1,000,000 per caf with a gross margin of 75%. You maintain a cash balance of 4% of sales for working capital purposes. Accounts receivable and accounts payable are immaterial. The income tax rate is 28%. You have a line of credit at a bank that allows you to borrow up to R10 million at an interest rate of 15%. You paid a special dividend on Dec 31, 2017, but the bank will not allow you to pay dividends if your line of credit is drawn down. Questions: Draw up a set of proforma financial statements (income statement, balance sheet and cash flow statement) for each of the years 2018 through 2022. 1. How large was the dividend you paid on 31 Dec. 2017? 2. Estimate the amount of financing you will need to meet your expansion plans assuming all your projections are accurate. Assumptions: 1. It takes 12 months to build each cafe and it produces no revenues during the year it is constructed, although rental (R180,000 per cafe) and incremental SG&A (R300,000 per cafe) start when construction starts. 2. Depreciation does not start until the cafe produces revenues. 3. For simplicity, assume that interest charge in year t is based on the balance of the bank loan at the end year f-1. (1.e., if the bank loan for 2016 is R100. then the interest payment in 2017 is R15.) This exercise is designed to familiarise you with the mechanics of financial analysis. After you have built the pro-formas, please do the following: 1. Assume a growth rate of 3% and a discount rate of 25% (Don't worry about where these numbers come from) and calculate the NPV of the revolutionary endeavor. 2. AVC offers you R1 million for a 20% equity stake in your company, discuss the merits of this offer. The most recent balance sheet and income statements are: Balance sheet Share capital Retained earnings Loans Total capital Fixed Assets Cost (original) Acc dep Current assets Debtors Inventory Cash Current Liabilities Creditors Overdraft NCA Net Assets Dec 2016 5,000,000 2,330,000 7,330,000 7,200,000 8,000,000 800,000 430,000 150,000 200,000 80,000 300,000 300,000 50,000 7,330,000 Dec 2017 5,000,000 1,521,096 6,521,096 6,400,000 8,000,000 1,600,000 326,575 109,589 136,986 80,000 205,479 205.479 41,096 6.521.096 Income statement Sales COS GP SG&A Rentals Depreciation PBIT Interest PBT Tax PAT 2017 10,000,000 2,500,000 7,500,000 3,000,000 1,800,000 800,000 1,900,000 1,900,000 532,000 1,368,000

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Proforma Financial Statements 20182022 Income Statement Year Revenue COGS Gross Profit SGA Depreciation EBIT Interest Tax Net Income 2018 10000000 750...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started