Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have dividend per share information provided on the income statement tab. Use this data for this problem. Assume the cost of equity is 10.18%;

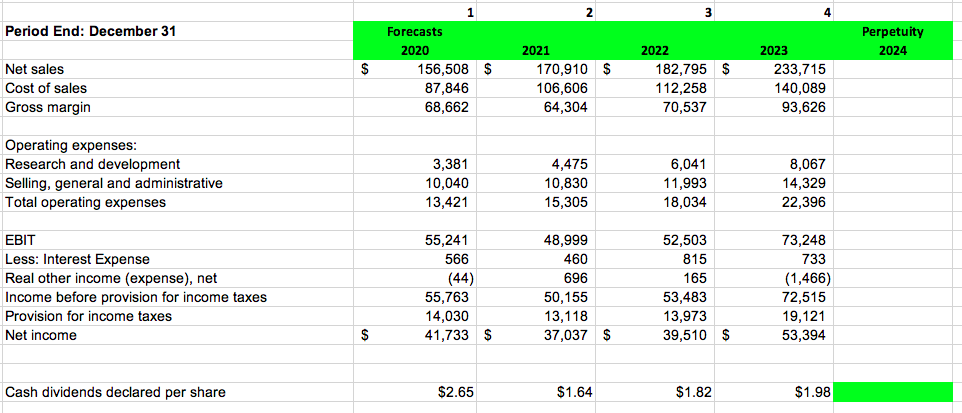

You have dividend per share information provided on the income statement tab. Use this data for this problem. Assume the cost of equity is 10.18%; the dividend growth rate is 3.50% and that WACC is 8.14%. Also assume the forecast for 2024 dividends is $2.14 per share. Use the income approach and value the shares of the subject company using the capitalization of benefits method for the dividend benefit. Round to the nearest whole cent (i.e. $12.9876 would be written as 12.99). State on a per share basis. Use end of period discounting.

Period End: December 31 Perpetuity 2024 $ 1 Forecasts 2020 156,508 $ 87,846 68,662 Net sales Cost of sales Gross margin 2021 170,910 S 106,606 64,304 2022 182,795 $ 112,258 70,537 2023 233,715 140,089 93,626 Operating expenses: Research and development Selling, general and administrative Total operating expenses 3,381 10,040 13,421 4,475 10,830 15,305 6,041 11,993 18,034 8,067 14,329 22,396 EBIT Less: Interest Expense Real other income (expense), net Income before provision for income taxes Provision for income taxes Net income 55,241 566 (44) 55,763 14,030 41,733 $ 48,999 460 696 50,155 13,118 37,037 $ 52,503 815 165 53,483 13,973 39,510 $ 73,248 733 (1,466) 72,515 19,121 53,394 $ Cash dividends declared per share $2.65 $1.64 $1.82 $1.98 Period End: December 31 Perpetuity 2024 $ 1 Forecasts 2020 156,508 $ 87,846 68,662 Net sales Cost of sales Gross margin 2021 170,910 S 106,606 64,304 2022 182,795 $ 112,258 70,537 2023 233,715 140,089 93,626 Operating expenses: Research and development Selling, general and administrative Total operating expenses 3,381 10,040 13,421 4,475 10,830 15,305 6,041 11,993 18,034 8,067 14,329 22,396 EBIT Less: Interest Expense Real other income (expense), net Income before provision for income taxes Provision for income taxes Net income 55,241 566 (44) 55,763 14,030 41,733 $ 48,999 460 696 50,155 13,118 37,037 $ 52,503 815 165 53,483 13,973 39,510 $ 73,248 733 (1,466) 72,515 19,121 53,394 $ Cash dividends declared per share $2.65 $1.64 $1.82 $1.98Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started