You have estimated rates as follows: r1 = 5.00%, r2 = 5.40%, r3 = 5.70%, r4 = 5.90%, r5 = 6.00%. where ri is the

You have estimated rates as follows:

r1 = 5.00%, r2 = 5.40%, r3 = 5.70%, r4 = 5.90%, r5 = 6.00%.

where ri is the discount rate for year i.

a. What are the discount factors for each date (that is, the present value of $1 paid in year (i.e. consider cash flow of $1 dollar per year for the next 5 years)? Using these rates, calculate the PV of the following bonds assuming annual coupons and face values of $1,000:

(i) 4% coupon rate, 1-year bond; and

(ii) 8% coupon rate, 5-year bond.

b. Which bond would you purchase if the economic condition has been volatile? why? Critically discuss your answer.

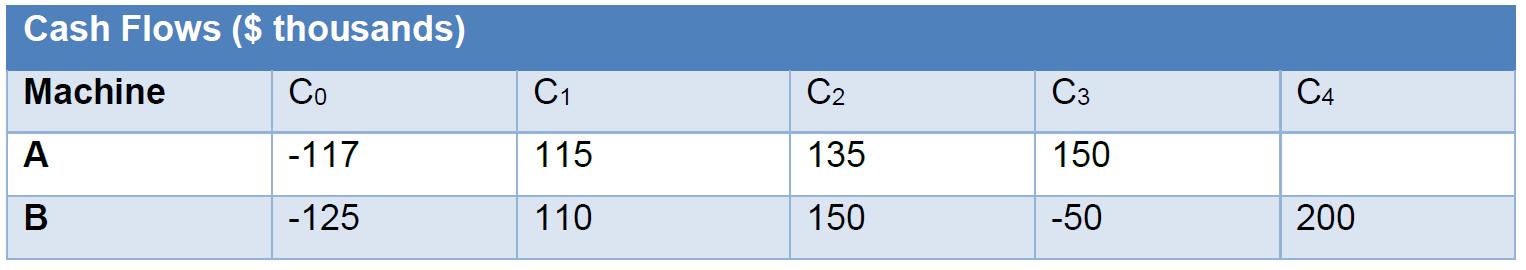

Qus2) Machines A and B are mutually exclusive and are expected to produce the following real cash flows:

The real opportunity cost of capital is 10%.

a) Calculate the NPV of each machine.

b) Calculate the equivalent annual cash flow from each machine.

c) Which machine should you buy? Justify your answer.

d) When appraising mutually exclusive investments in plant and equipment, financial managers calculate the investments' equivalent annual costs and rank the investments on this basis. Critically discuss why this is necessary and why not just compare the investments' NPVs?

Qus3) You can invest in the following 7-year bond with a coupon of 3% and a yield to maturity/discount factor of 4%

a) Calculate the duration using the following table

a) Calculate the duration using the following table

b) What is the modified duration of the bond? Discuss how advisors and investors can use modified duration.

Cash Flows ($ thousands) Machine A B Co -117 -125 C 115 110 C 135 150 C3 150 -50 C4 200

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Qus1 a Discount factors for each date Year 1 1 1 r1 1 1 00500 09524 Year 2 1 1 r22 1 1 005402 09044 Year 3 1 1 r33 1 1 005703 08550 Year 4 1 1 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started