Question

You have heard that the latest in portfolio diversification is to invest in FANG stocks. FANG being the stocks of Facebook, Amazon, Netflix and Google.

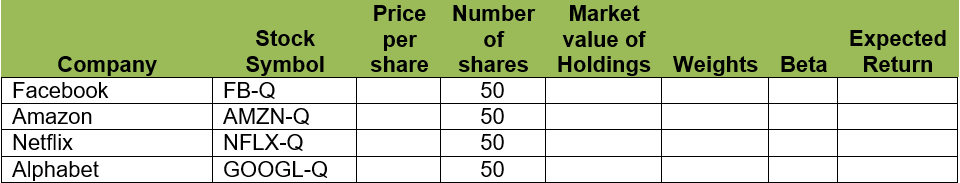

You have heard that the latest in portfolio diversification is to invest in FANG stocks. FANG being the stocks of Facebook, Amazon, Netflix and Google. From www.globeinvestor.com, find the current stock price of each of those four companies, and buy 50 shares of each companies for your portfolio. Calculate the weighting of each company from your portfolio based on the market value in the investment in each of the four FANG. Using a risk-free return of 2% and a stock market return of 6%, calculate the following: a) Weightings of each company on your portfolio (2 marks) b) Find the betas from each company using www.globeinvestor.com (2 marks) c) Expected return from each company based on CAPM (2 marks) d) Weighted Expected return of your portfolio (2 marks) e) Weighted Beta of the portfolio (2 marks) Present your financial data in a table similar to Table 1 on the following page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started