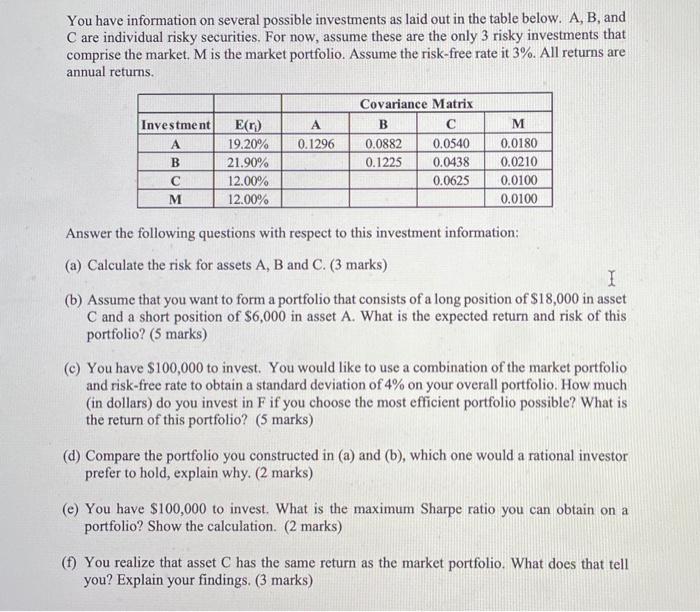

You have information on several possible investments as laid out in the table below. A, B, and C are individual risky securities. For now, assume these are the only 3 risky investments that comprise the market. M is the market portfolio. Assume the risk-free rate it 3%. All returns are annual returns. Covariance Matrix Investment B M E() 19.20% A 0.1296 0.0882 0.0180 0.0210 B 0.1225 0.0540 0.0438 0.0625 21.90% 12.00% 12.00% 0.0100 M 0.0100 Answer the following questions with respect to this investment information: (a) Calculate the risk for assets A, B and C. (3 marks) I (b) Assume that you want to form a portfolio that consists of a long position of $18,000 in asset C and a short position of $6,000 in asset A. What is the expected return and risk of this portfolio? (5 marks) (C) You have $100,000 to invest. You would like to use a combination of the market portfolio and risk-free rate to obtain a standard deviation of 4% on your overall portfolio. How much (in dollars) do you invest in F if you choose the most efficient portfolio possible? What is the return of this portfolio? (5 marks) (d) Compare the portfolio you constructed in (a) and (b), which one would a rational investor prefer to hold, explain why. (2 marks) (e) You have $100,000 to invest. What is the maximum Sharpe ratio you can obtain on a portfolio? Show the calculation. (2 marks) (1) You realize that asset C has the same return as the market portfolio. What does that tell you? Explain your findings. (3 marks) You have information on several possible investments as laid out in the table below. A, B, and C are individual risky securities. For now, assume these are the only 3 risky investments that comprise the market. M is the market portfolio. Assume the risk-free rate it 3%. All returns are annual returns. Covariance Matrix Investment B M E() 19.20% A 0.1296 0.0882 0.0180 0.0210 B 0.1225 0.0540 0.0438 0.0625 21.90% 12.00% 12.00% 0.0100 M 0.0100 Answer the following questions with respect to this investment information: (a) Calculate the risk for assets A, B and C. (3 marks) I (b) Assume that you want to form a portfolio that consists of a long position of $18,000 in asset C and a short position of $6,000 in asset A. What is the expected return and risk of this portfolio? (5 marks) (C) You have $100,000 to invest. You would like to use a combination of the market portfolio and risk-free rate to obtain a standard deviation of 4% on your overall portfolio. How much (in dollars) do you invest in F if you choose the most efficient portfolio possible? What is the return of this portfolio? (5 marks) (d) Compare the portfolio you constructed in (a) and (b), which one would a rational investor prefer to hold, explain why. (2 marks) (e) You have $100,000 to invest. What is the maximum Sharpe ratio you can obtain on a portfolio? Show the calculation. (2 marks) (1) You realize that asset C has the same return as the market portfolio. What does that tell you? Explain your findings