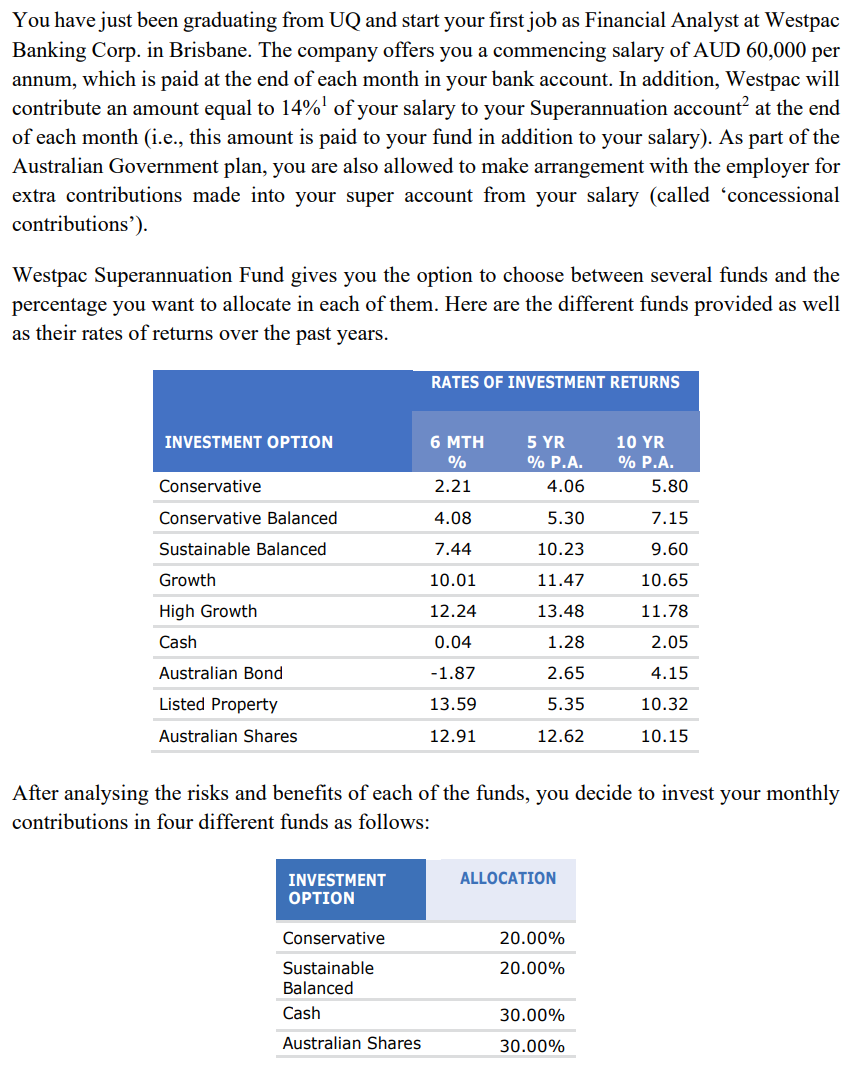

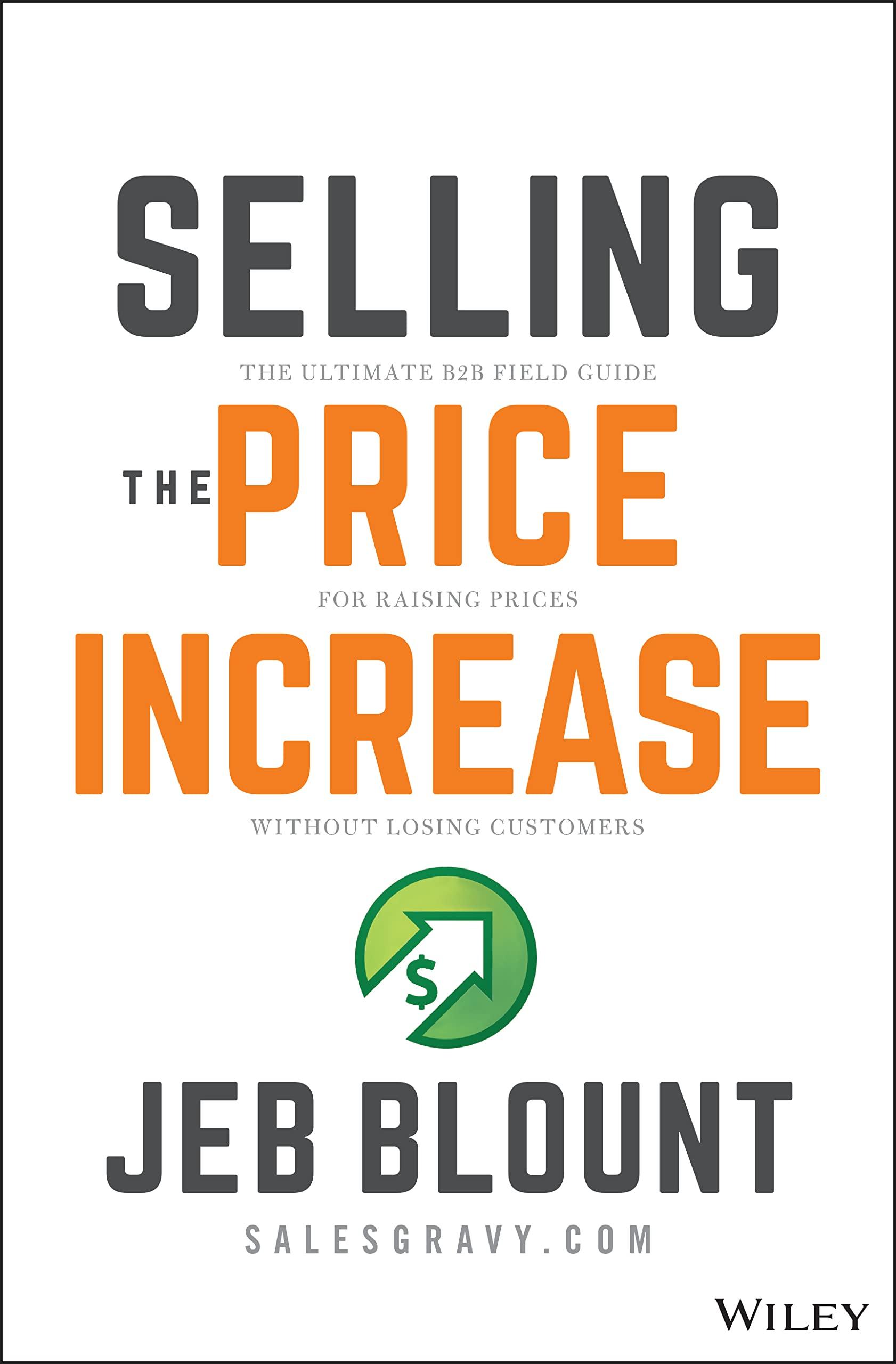

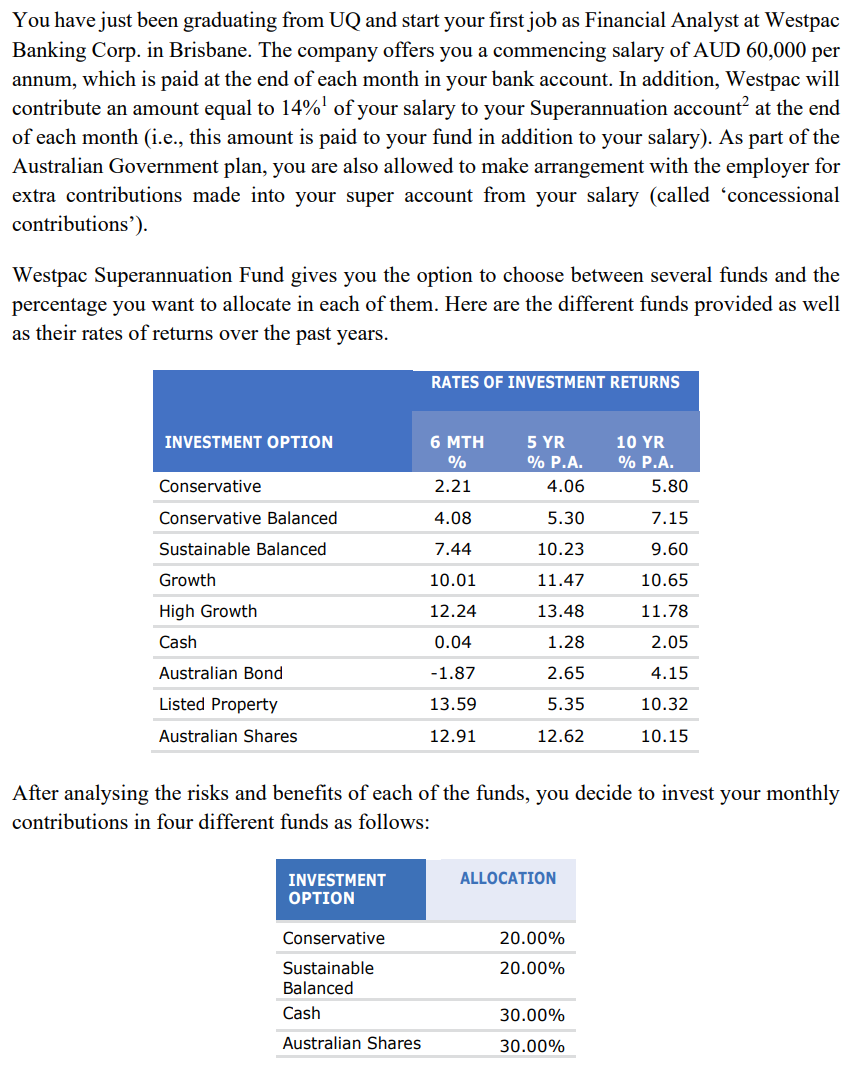

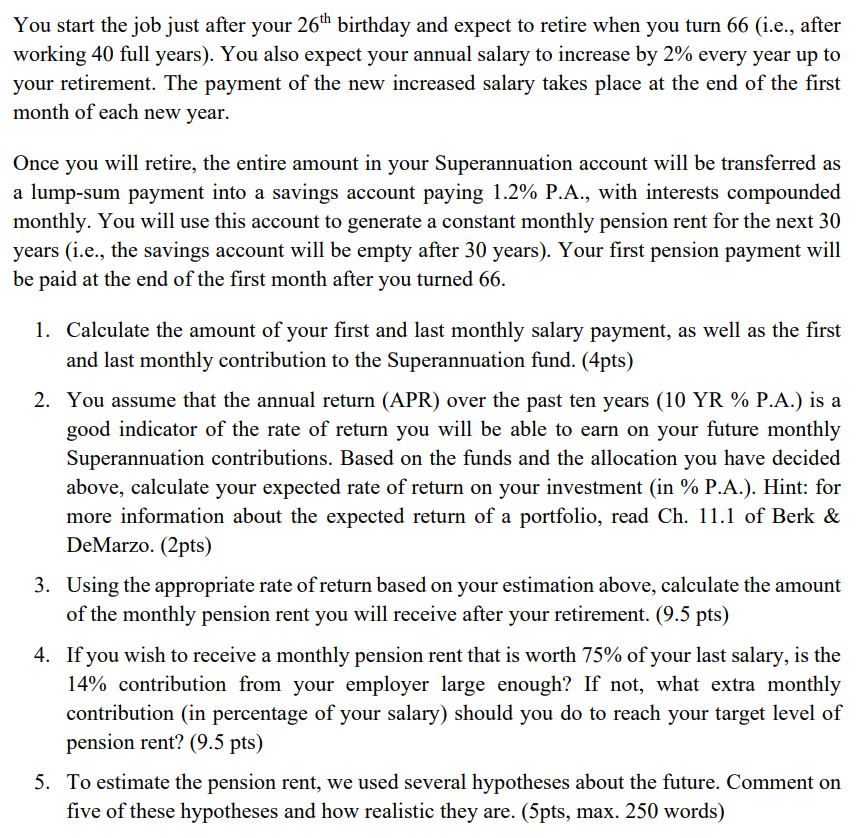

You have just been graduating from UQ and start your first job as Financial Analyst at Westpac Banking Corp. in Brisbane. The company offers you a commencing salary of AUD 60,000 per annum, which is paid at the end of each month in your bank account. In addition, Westpac will contribute an amount equal to 14% of your salary to your Superannuation account at the end of each month (i.e., this amount is paid to your fund in addition to your salary). As part of the Australian Government plan, you are also allowed to make arrangement with the employer for extra contributions made into your super account from your salary (called 'concessional contributions). Westpac Superannuation Fund gives you the option to choose between several funds and the percentage you want to allocate in each of them. Here are the different funds provided as well as their rates of returns over the past years. RATES OF INVESTMENT RETURNS INVESTMENT OPTION 6 MTH % 2.21 5 YR % P.A. 4.06 10 YR % P.A. 5.80 Conservative Conservative Balanced 4.08 5.30 7.15 Sustainable Balanced 7.44 10.23 9.60 10.01 11.47 10.65 Growth High Growth Cash 12.24 13.48 11.78 0.04 1.28 2.05 Australian Bond -1.87 2.65 4.15 Listed Property 13.59 5.35 10.32 Australian Shares 12.91 12.62 10.15 After analysing the risks and benefits of each of the funds, you decide to invest your monthly contributions in four different funds as follows: ALLOCATION INVESTMENT OPTION 20.00% Conservative Sustainable Balanced Cash 20.00% 30.00% Australian Shares 30.00% You start the job just after your 26th birthday and expect to retire when you turn 66 (i.e., after working 40 full years). You also expect your annual salary to increase by 2% every year up to your retirement. The payment of the new increased salary takes place at the end of the first month of each new year. Once you will retire, the entire amount in your Superannuation account will be transferred as a lump-sum payment into a savings account paying 1.2% P.A., with interests compounded monthly. You will use this account to generate a constant monthly pension rent for the next 30 years (i.e., the savings account will be empty after 30 years). Your first pension payment will be paid at the end of the first month after you turned 66. 1. Calculate the amount of your first and last monthly salary payment, as well as the first and last monthly contribution to the Superannuation fund. (4pts) 2. You assume that the annual return (APR) over the past ten years (10 YR % P.A.) is a good indicator of the rate of return you will be able to earn on your future monthly Superannuation contributions. Based on the funds and the allocation you have decided above, calculate your expected rate of return on your investment (in % P.A.). Hint: for more information about the expected return of a portfolio, read Ch. 11.1 of Berk & DeMarzo. (2pts) 3. Using the appropriate rate of return based on your estimation above, calculate the amount of the monthly pension rent you will receive after your retirement. (9.5 pts) 4. If you wish to receive a monthly pension rent that is worth 75% of your last salary, is the 14% contribution from your employer large enough? If not, what extra monthly contribution (in percentage of your salary) should you do to reach your target level of pension rent? (9.5 pts) 5. To estimate the pension rent, we used several hypotheses about the future. Comment on five of these hypotheses and how realistic they are. (5pts, max. 250 words) You have just been graduating from UQ and start your first job as Financial Analyst at Westpac Banking Corp. in Brisbane. The company offers you a commencing salary of AUD 60,000 per annum, which is paid at the end of each month in your bank account. In addition, Westpac will contribute an amount equal to 14% of your salary to your Superannuation account at the end of each month (i.e., this amount is paid to your fund in addition to your salary). As part of the Australian Government plan, you are also allowed to make arrangement with the employer for extra contributions made into your super account from your salary (called 'concessional contributions). Westpac Superannuation Fund gives you the option to choose between several funds and the percentage you want to allocate in each of them. Here are the different funds provided as well as their rates of returns over the past years. RATES OF INVESTMENT RETURNS INVESTMENT OPTION 6 MTH % 2.21 5 YR % P.A. 4.06 10 YR % P.A. 5.80 Conservative Conservative Balanced 4.08 5.30 7.15 Sustainable Balanced 7.44 10.23 9.60 10.01 11.47 10.65 Growth High Growth Cash 12.24 13.48 11.78 0.04 1.28 2.05 Australian Bond -1.87 2.65 4.15 Listed Property 13.59 5.35 10.32 Australian Shares 12.91 12.62 10.15 After analysing the risks and benefits of each of the funds, you decide to invest your monthly contributions in four different funds as follows: ALLOCATION INVESTMENT OPTION 20.00% Conservative Sustainable Balanced Cash 20.00% 30.00% Australian Shares 30.00% You start the job just after your 26th birthday and expect to retire when you turn 66 (i.e., after working 40 full years). You also expect your annual salary to increase by 2% every year up to your retirement. The payment of the new increased salary takes place at the end of the first month of each new year. Once you will retire, the entire amount in your Superannuation account will be transferred as a lump-sum payment into a savings account paying 1.2% P.A., with interests compounded monthly. You will use this account to generate a constant monthly pension rent for the next 30 years (i.e., the savings account will be empty after 30 years). Your first pension payment will be paid at the end of the first month after you turned 66. 1. Calculate the amount of your first and last monthly salary payment, as well as the first and last monthly contribution to the Superannuation fund. (4pts) 2. You assume that the annual return (APR) over the past ten years (10 YR % P.A.) is a good indicator of the rate of return you will be able to earn on your future monthly Superannuation contributions. Based on the funds and the allocation you have decided above, calculate your expected rate of return on your investment (in % P.A.). Hint: for more information about the expected return of a portfolio, read Ch. 11.1 of Berk & DeMarzo. (2pts) 3. Using the appropriate rate of return based on your estimation above, calculate the amount of the monthly pension rent you will receive after your retirement. (9.5 pts) 4. If you wish to receive a monthly pension rent that is worth 75% of your last salary, is the 14% contribution from your employer large enough? If not, what extra monthly contribution (in percentage of your salary) should you do to reach your target level of pension rent? (9.5 pts) 5. To estimate the pension rent, we used several hypotheses about the future. Comment on five of these hypotheses and how realistic they are. (5pts, max. 250 words)