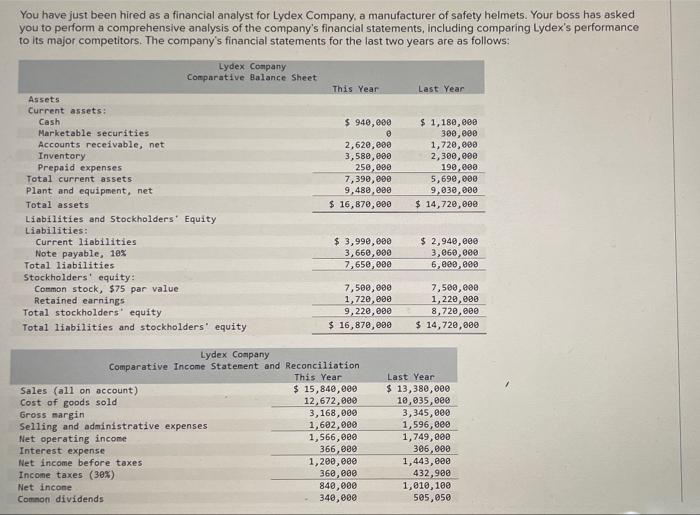

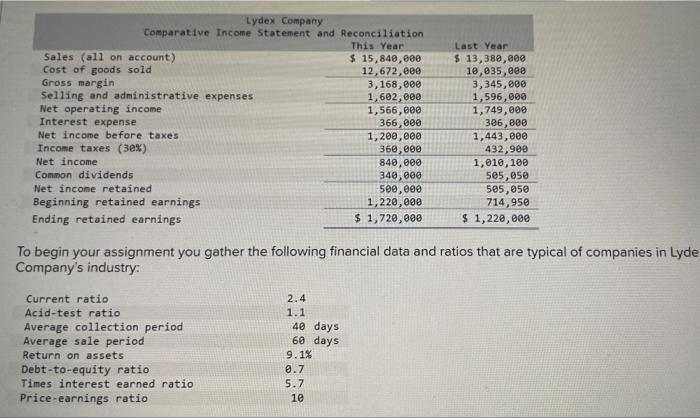

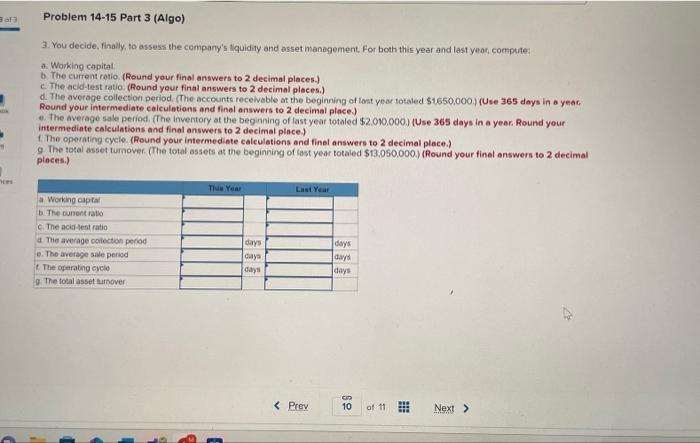

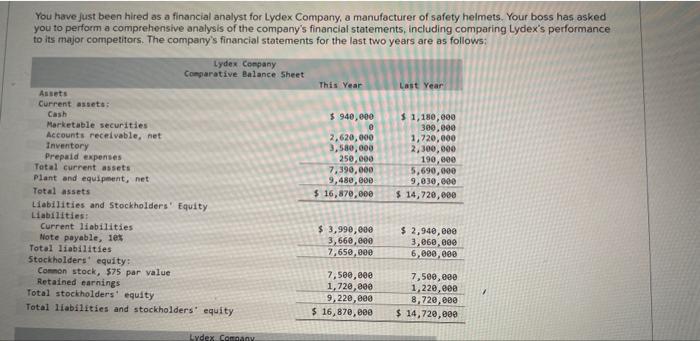

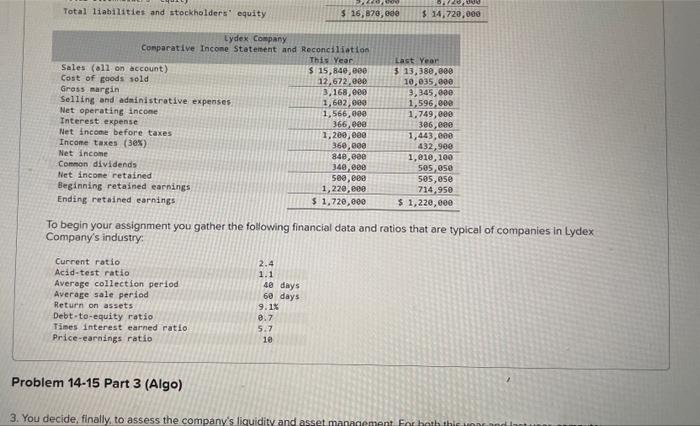

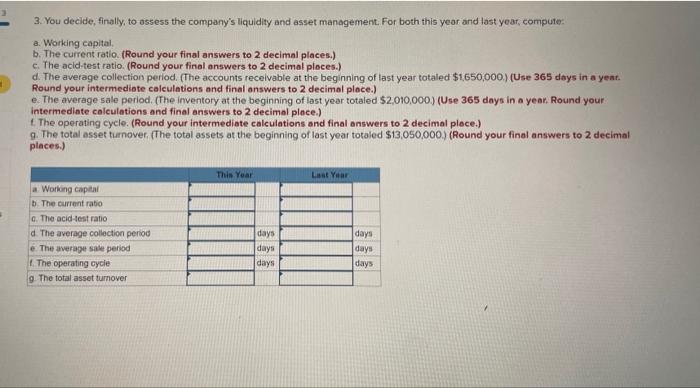

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company's financial statements, Including comparing Lydex's performance to its major competitors. The company's financial statements for the last two years are as follows: To begin your assignment you gather the following financial data and ratios that are typical of companies in Lyde Company's industry: 3. You decide, finally, to assess the company's iquidity and asset manegement for both this year and last yeor, compute: a. Working capital b. The current ratio, (Round your final answers to 2 decimal places.) c. The acid-test ratio. (Round your final answers to 2 decimal ploces.) d. The averoge collection period. (The accounte recelvable at the beginning of lost yeac totaled $1.650,000) (Use 365 doys in a yeac. Round your intermediate calculations and final answers to 2 decimal place. e. The average sale period. (The inventory at the beginning of last year totaled $2,010,000) ) (Use 365 days in a yeer. Round your intermediate colculations and final answers to 2 decimal place.) 1. The operating cycle. (Round your intermedinte calculations and finel answers to 2 decimal place.) 9. The sotal asset tumover. (The total assets at the beginning of last year totaled $13.050.000.) (Round your final answers to 2 decimal ploces.) You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehonsive analysis of the company's financial statements, including comparing Lydex's performance to its major competitors. The company's financial statements for the last two years are as follows: Total 1iabilities and stockholders" equity \begin{tabular}{|l|l|} $16,870,690 & $14,720,000 \\ \hline \end{tabular} To begin your assignment you gather the following financial data and ratios that are typical of companies in Lydex Company's industry: Problem 14-15 Part 3 (Algo) 3. You decide, finally, to assess the company's liquidity and asset management: For both this year and last yoar, compute: a. Working capital. b. The current ratio. (Round your final answers to 2 decimal places.) c. The acld-test ratio. (Round your final answers to 2 decimal ploces.) d. The average collection period. (The accounts receivable at the beginning of last year totaled $1,650,000 ) (Use 365 days in a yent. Round your intermediote calculations and final answers to 2 decimal ploce.) e. The average sale period. (The inventory at the beginning of last year totaled 52,010,000 ) (Use 365 days in a ye ar. Round your intermedinte calculations and final answers to 2 decimal place.) 1. The operating cycle. (Round your intermediate calculations and final answers to 2 decimal place.) 9. The total asset turnover. (The total assets at the beginning of last yoar totaled $13,050,000 ) (Round your final answers to 2 decimal places.)