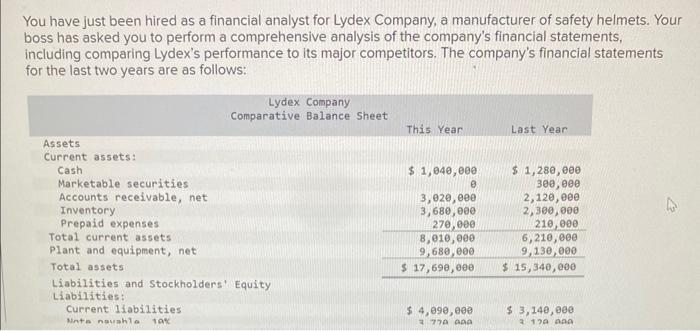

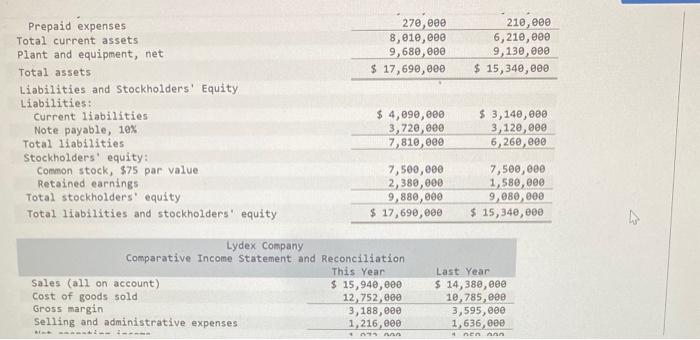

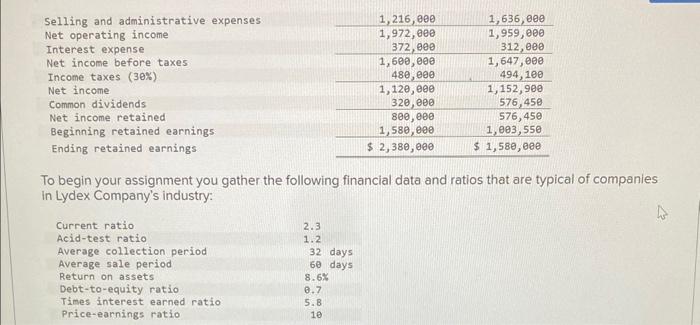

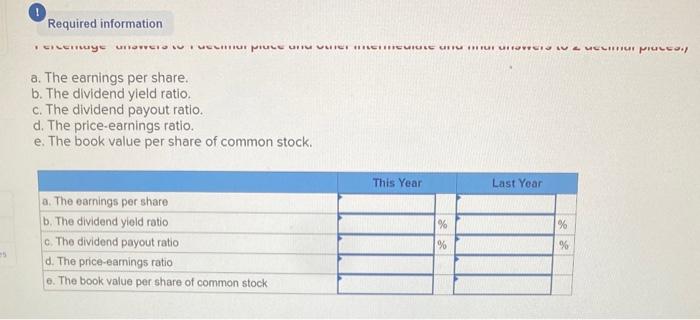

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company's financial statements, including comparing Lydex's performance to its major competitors. The company's financial statements for the last two years are as follows: Prepaid expenses Total current assets Plant and equipment, net Total assets \begin{tabular}{rr} 27,0 & 210,00 \\ \hline 8,01,00 & 6,210,000 \\ 9,680,00 & 9,130,000 \\ \hline$17,690,00 & $15,34,00 \\ \hline \end{tabular} Liabilities and Stockholders' Equity Liabilities: current liabilities Note payable, 10% Total 1iabilities Stockholders' equity: Common stock, $75 par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity To begin your assignment you gather the following financial data and ratios that are typical of companies In Lydex Company's industry: a. The earnings per share. b. The dividend yield ratio. c. The dividend payout ratio. d. The price-earnings ratio. e. The book value per share of common stock. You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company's financial statements, including comparing Lydex's performance to its major competitors. The company's financial statements for the last two years are as follows: Prepaid expenses Total current assets Plant and equipment, net Total assets \begin{tabular}{rr} 27,0 & 210,00 \\ \hline 8,01,00 & 6,210,000 \\ 9,680,00 & 9,130,000 \\ \hline$17,690,00 & $15,34,00 \\ \hline \end{tabular} Liabilities and Stockholders' Equity Liabilities: current liabilities Note payable, 10% Total 1iabilities Stockholders' equity: Common stock, $75 par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity To begin your assignment you gather the following financial data and ratios that are typical of companies In Lydex Company's industry: a. The earnings per share. b. The dividend yield ratio. c. The dividend payout ratio. d. The price-earnings ratio. e. The book value per share of common stock