You have just been hired into a management position which requires the application of your budgeting skills. You have contacted various areas on the organization and have accumulated the information below to assist you in preparing a comprehensive budget.

Please see requirement below.

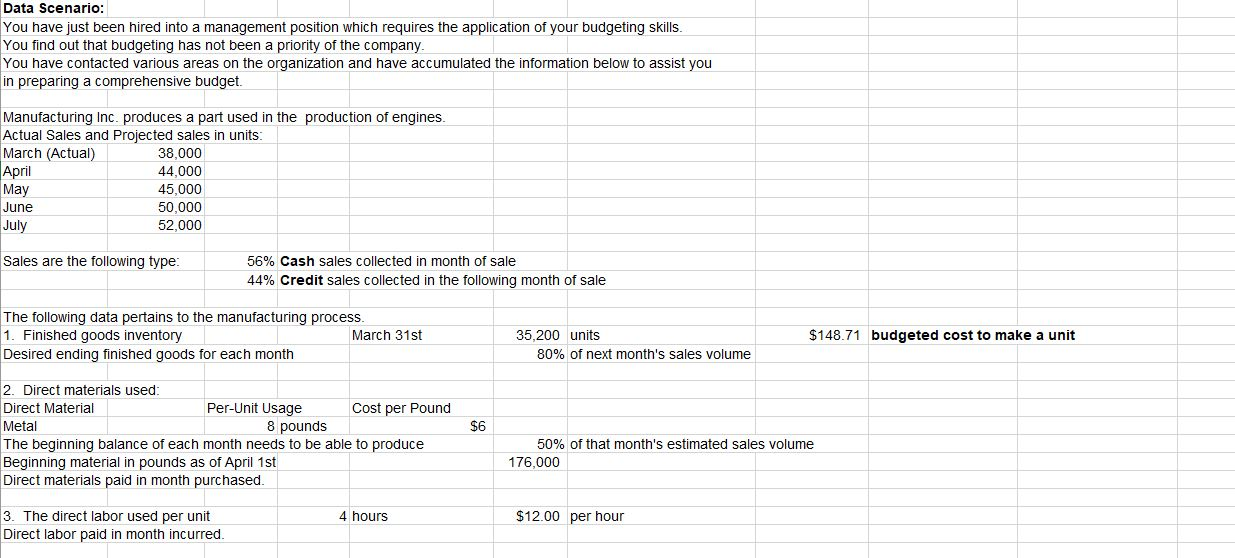

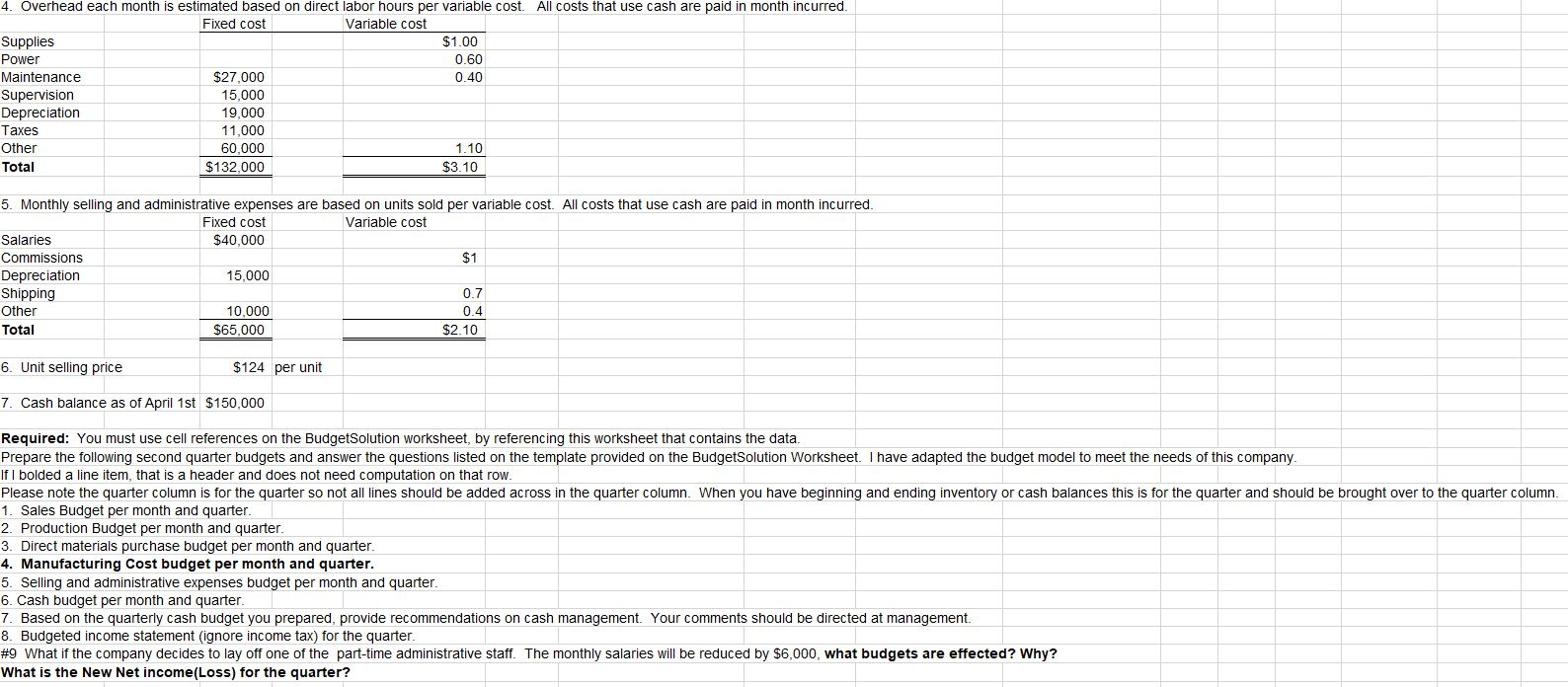

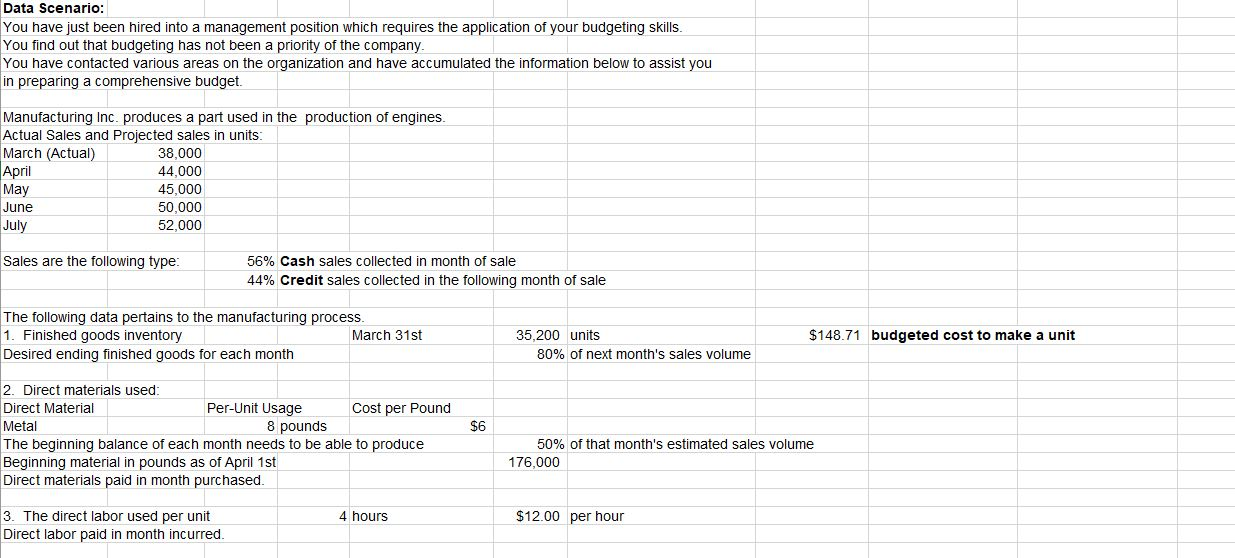

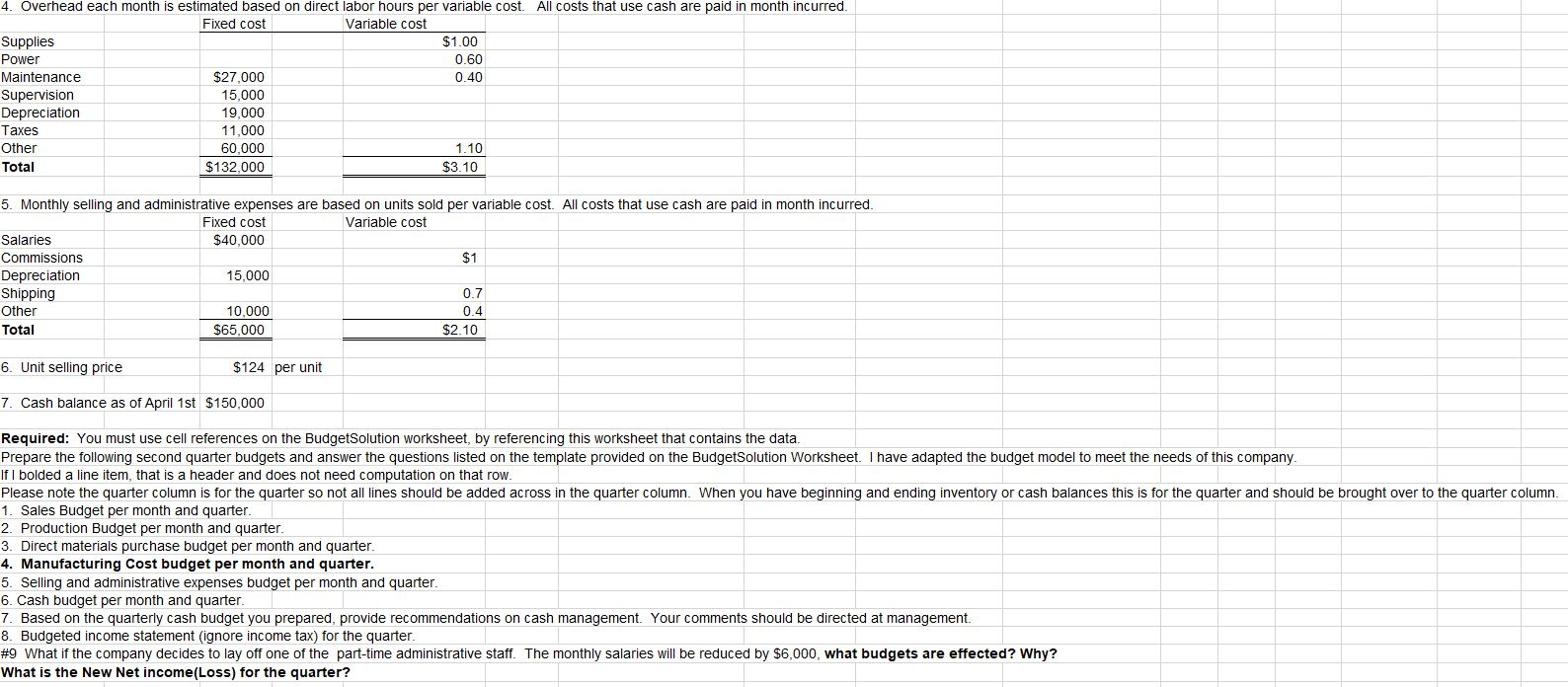

Data Scenario: You have just been hired into a management position which requires the application of your budgeting skills. You find out that budgeting has not been a priority of the company. You have contacted various areas on the organization and have accumulated the information below to assist you in preparing a comprehensive budget. Manufacturing Inc. produces a part used in the production of engines. Actual Sales and Projected sales in units: March (Actual) 38,000 April 44,000 May 45,000 June 50,000 July 52,000 Sales are the following type: 56% Cash sales collected in month of sale 44% Credit sales collected in the following month of sale The following data pertains to the manufacturing process. 1. Finished goods inventory March 31st Desired ending finished goods for each month $148.71 budgeted cost to make a unit 35,200 units 80% of next month's sales volume $6 2. Direct materials used: Direct Material Per-Unit Usage Cost per Pound Metal 8 pounds The beginning balance of each month needs to be able to produce Beginning material in pounds as of April 1st Direct materials paid in month purchased. 50% of that month's estimated sales volume 176,000 4 hours $12.00 per hour 3. The direct labor used per unit Direct labor paid in month incurred. 4. Overhead each month is estimated based on direct labor hours per variable cost. All costs that use cash are paid in month incurred. Fixed cost Variable cost Supplies $1.00 Power 0.60 Maintenance $27,000 0.40 Supervision 15,000 Depreciation 19,000 Taxes 11,000 Other 60,000 1.10 $132,000 $3.10 Total $1 5. Monthly selling and administrative expenses are based on units sold per variable cost. All costs that use cash are paid in month incurred. Fixed cost Variable cost Salaries $40,000 Commissions Depreciation 15,000 Shipping 0.7 Other 10.000 Total $65,000 $2.10 0.4 6. Unit selling price $124 per unit 7. Cash balance as of April 1st $150,000 Required: You must use cell references on the BudgetSolution worksheet, by referencing this worksheet that contains the data. Prepare the following second quarter budgets and answer the questions listed on the template provided on the BudgetSolution Worksheet. I have adapted the budget model to meet the needs of this company. If I bolded a line item, that is a header and does not need computation on that row. Please note the quarter column is for the quarter so not all lines should be added across in the quarter column. When you have beginning and ending inventory or cash balances this is for the quarter and should be brought over to the quarter column. 1. Sales Budget per month and quarter. 2. Production Budget per month and quarter. 3. Direct materials purchase budget per month and quarter. 4. Manufacturing Cost budget per month and quarter. 5. Selling and administrative expenses budget per month and quarter. 6. Cash budget per month and quarter. 7. Based on the quarterly cash budget you prepared, provide recommendations on cash management. Your comments should be directed at management. 8. Budgeted income statement (ignore income tax) for the quarter. #9 What if the company decides to lay off one of the part-time administrative staff. The monthly salaries will be reduced by $6,000, what budgets are effected? Why? What is the New Net income(Loss) for the quarter