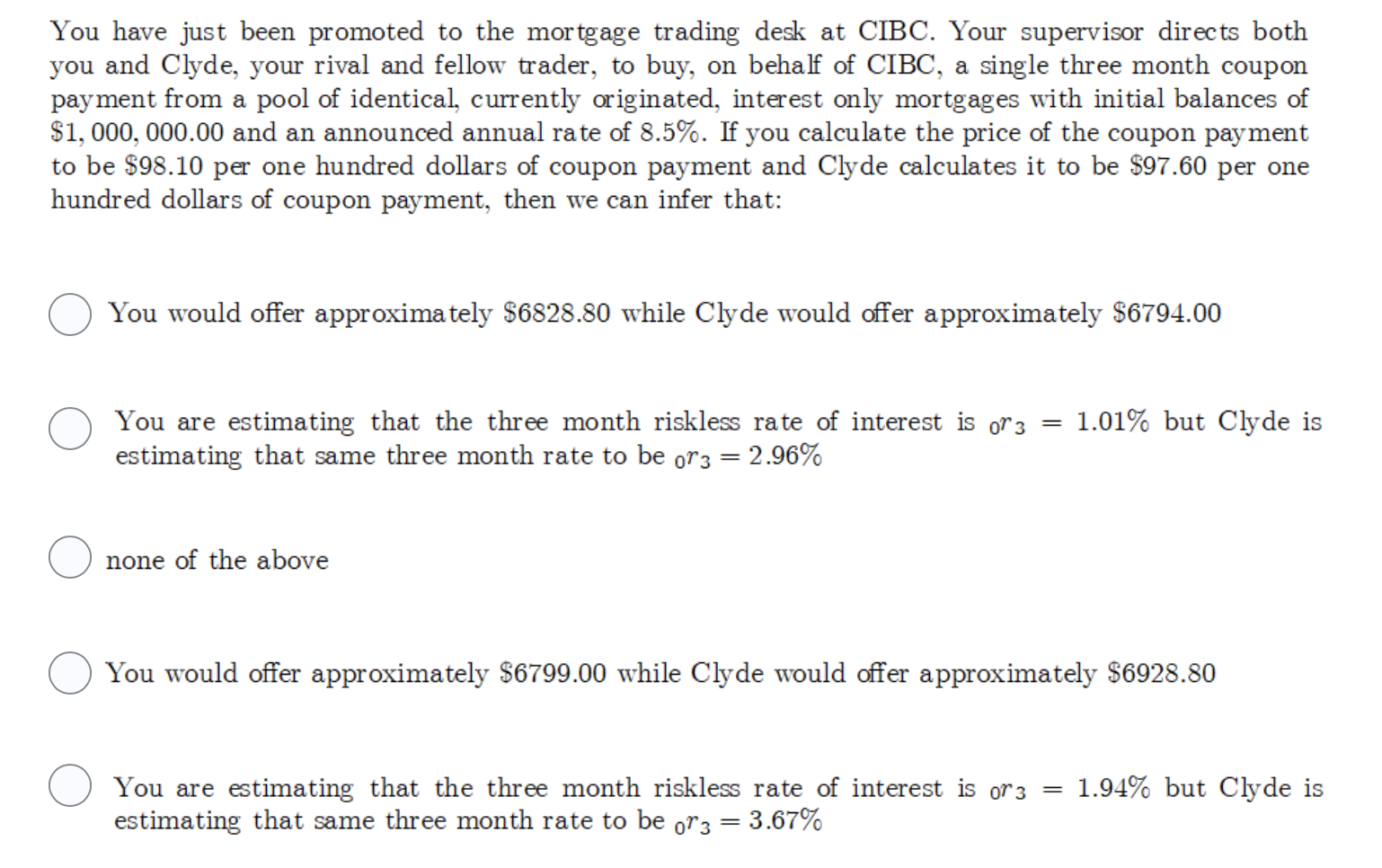

You have just been promoted to the mortgage trading desk at CIBC. Your supervisor directs both you and Clyde, your rival and fellow trader, to buy, on behalf of CIBC, a single three month coupon payment from a pool of identical, currently originated, interest only mortgages with initial balances of $1,000,000.00 and an announced annual rate of 8.5%. If you calculate the price of the coupon payment to be $98.10 per one hundred dollars of coupon payment and Clyde calculates it to be $97.60 per one hundred dollars of coupon payment, then we can infer that: You would offer approximately $6828.80 while Clyde would offer approximately $6794.00 1.01% but Clyde is You are estimating that the three month riskless rate of interest is or 3 = estimating that same three month rate to be or 3 = 2.96% none of the above You would offer approximately $6799.00 while Clyde would offer approximately $6928.80 1.94% but Clyde is You are estimating that the three month riskless rate of interest is or 3 = estimating that same three month rate to be of 3 = 3.67% You have just been promoted to the mortgage trading desk at CIBC. Your supervisor directs both you and Clyde, your rival and fellow trader, to buy, on behalf of CIBC, a single three month coupon payment from a pool of identical, currently originated, interest only mortgages with initial balances of $1,000,000.00 and an announced annual rate of 8.5%. If you calculate the price of the coupon payment to be $98.10 per one hundred dollars of coupon payment and Clyde calculates it to be $97.60 per one hundred dollars of coupon payment, then we can infer that: You would offer approximately $6828.80 while Clyde would offer approximately $6794.00 1.01% but Clyde is You are estimating that the three month riskless rate of interest is or 3 = estimating that same three month rate to be or 3 = 2.96% none of the above You would offer approximately $6799.00 while Clyde would offer approximately $6928.80 1.94% but Clyde is You are estimating that the three month riskless rate of interest is or 3 = estimating that same three month rate to be of 3 = 3.67%