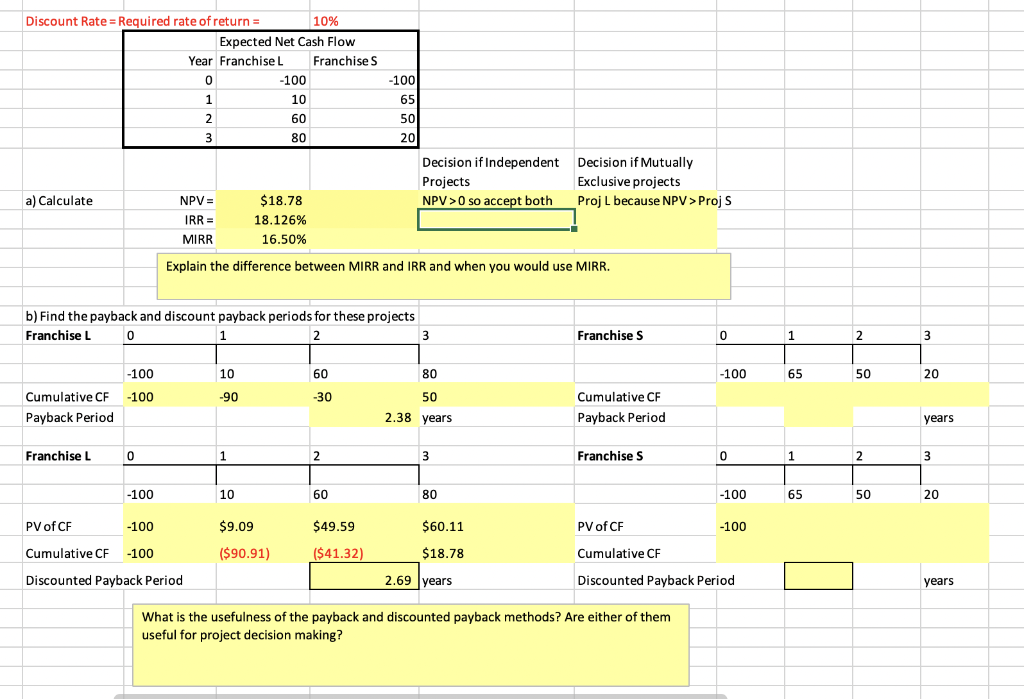

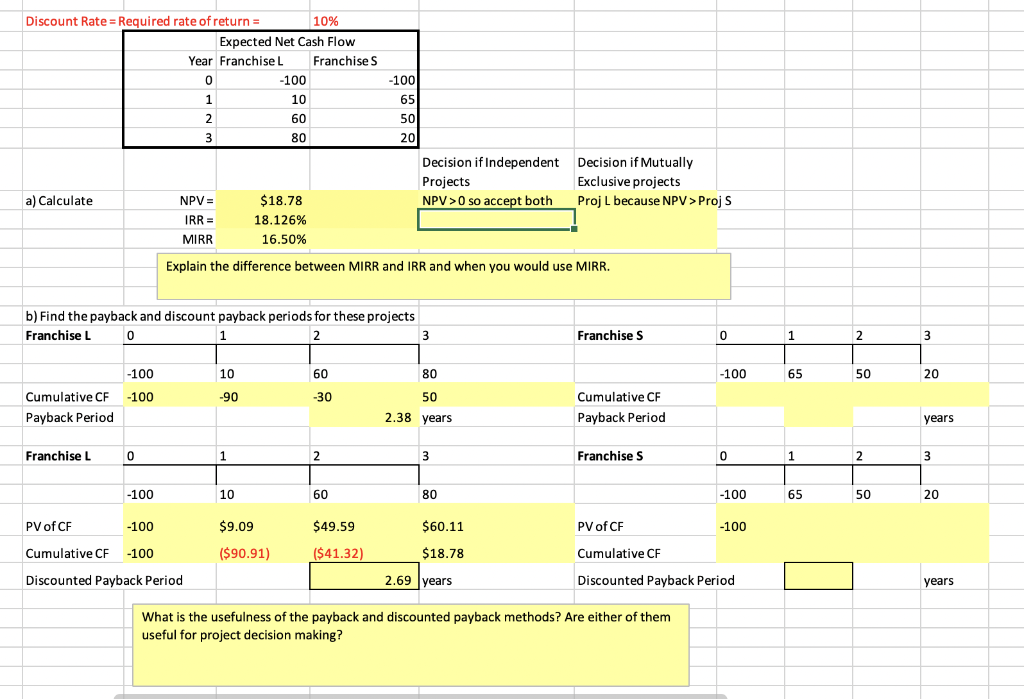

You have just graduated with a business degree from a large university, and one of your favourite courses was "Today's Entrepreneurs." In fact, you enjoyed it so much you have decided you want to "be your own boss." While you were studying, your grandfather died and left you $1 million to do with as you please. You are not an inventor, and you do not have a trade skill that you can market; however, you have decided that you would like to purchase at least one established franchise in the fast-food area, maybe two (if profitable). The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 3 years. After 3 years you will go on to something else. You have narrowed your selection down to two choices: (1) Franchise L, Lisa's Soups, Salads, & Stuff, and (2) Franchise S, Sam's Fabulous Fried Chicken. The net cash flows shown below include the price you would receive for selling the franchise in Year 3 and the forecast of how each franchise will do over the 3-year period. Franchise L's cash flows will start off slowly but will increase rather quickly as people become more health conscious, while Franchise S's cash flows will start off high but will trail off as other chicken competitors enter the marketplace and as people become more health conscious and avoid fried foods. Franchise L serves breakfast and lunch, while Franchise S serves only dinner, so it is possible for you to invest in both franchises. You see these franchises as perfect complements to each other: You could attract both the lunch and dinner crowds and the health-conscious and not so health-conscious crowds without the franchises directly competing against each other. Discount Rate = Required rate of return = 10% Expected Net Cash Flow Year Franchise Franchise S 0 0 -100 1 10 2 60 3 80 -100 65 50 20 Decision if Independent Decision if Mutually Projects Exclusive projects NPV >0 so accept both Proj L because NPV > Projs a) Calculate NPV = IRR = MIRR $18.78 18.126% 16.50% Explain the difference between MIRR and IRR and when you would use MIRR. b) Find the payback and discount payback periods for these projects Franchise L 0 1 2 3 3 Franchise S 0 1 2 3 -100 10 60 80 -100 65 50 20 -100 -90 -30 50 Cumulative CF Payback Period Cumulative CF Payback Period 2.38 years years Franchise L 0 1 2 3 Franchise s 0 1 2 2 3 -100 10 60 80 -100 65 50 20 PV of CF -100 $9.09 $49.59 $60.11 PV of CF -100 Cumulative CF -100 ($90.91) ($41.32) $18.78 Cumulative CF Discounted Payback Period 2.69 years Discounted Payback Period years What is the usefulness of the payback and discounted payback methods? Are either of them useful for project decision making