Question

You have made a very preliminary analysis of three common stocks with the information set forth below. All three stocks have the same investment grade

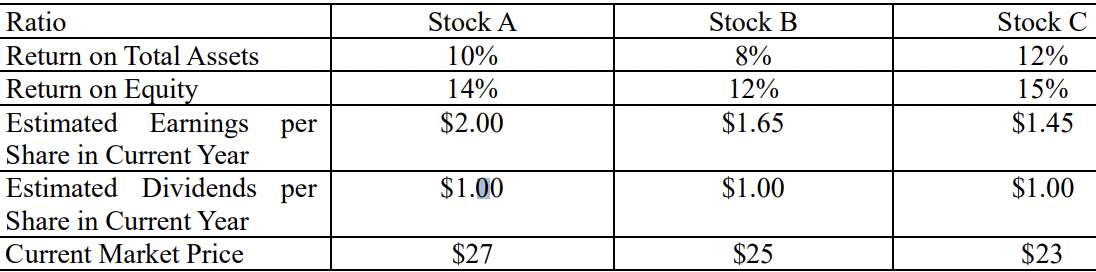

You have made a very preliminary analysis of three common stocks with the information set forth below. All three stocks have the same investment grade or quality. Assume that the same important numerical financial ratios and relationships which currently exist (such as price-earnings ratio, payout ratio, dividend yield, etc) will extend into the future. For the investments being considered, you require a rate of return of 10% a year. Based solely on the information given in the table below, which, if any, of the following stocks meet your requirements? Show your calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started