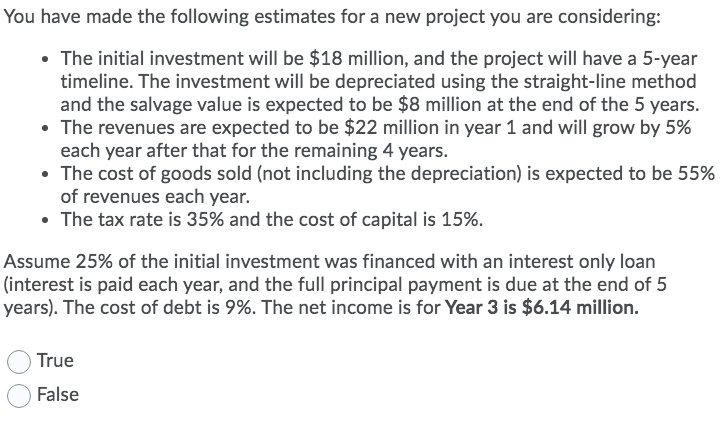

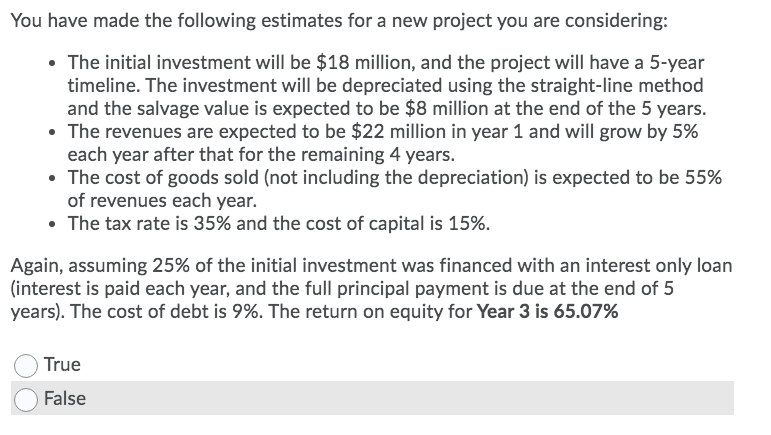

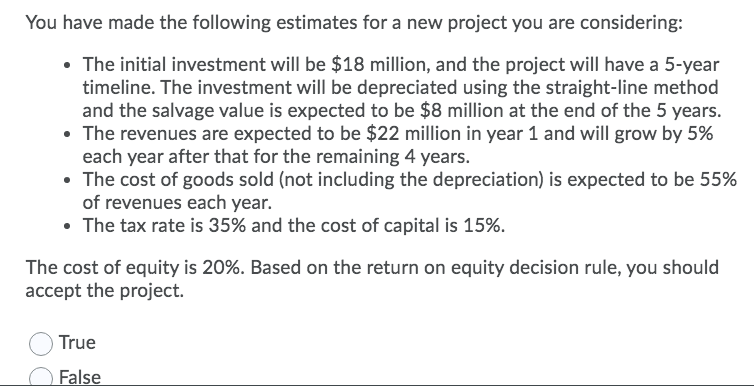

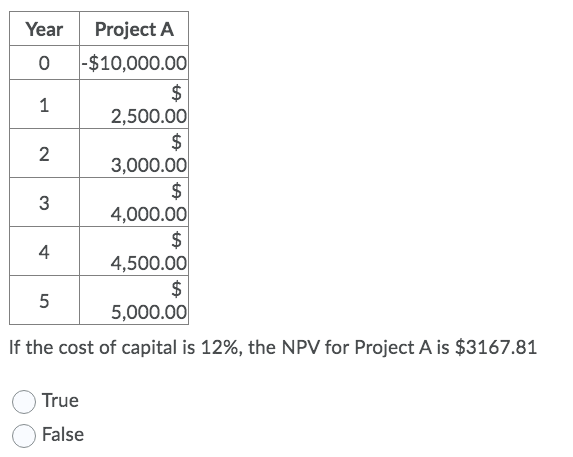

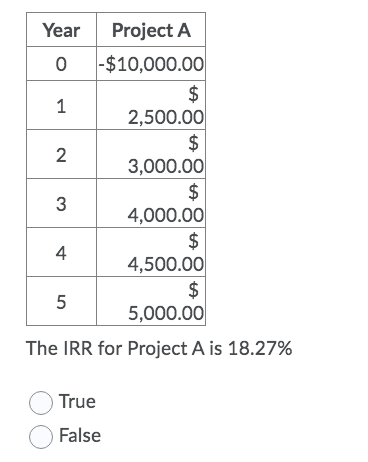

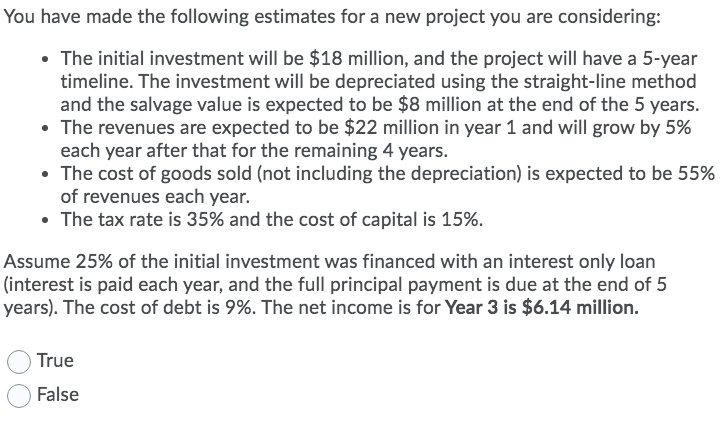

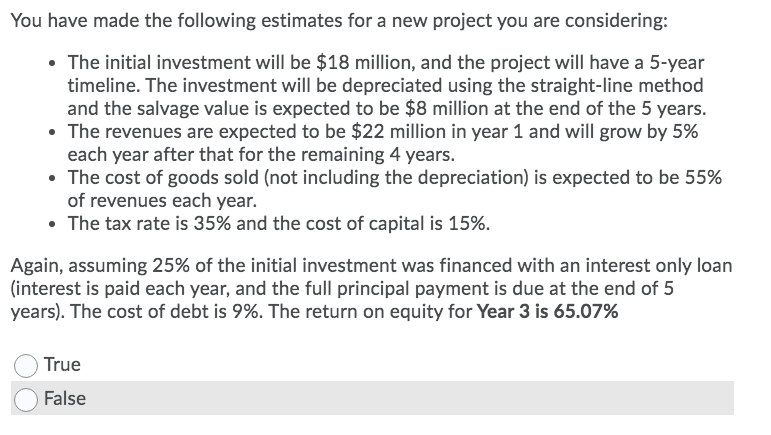

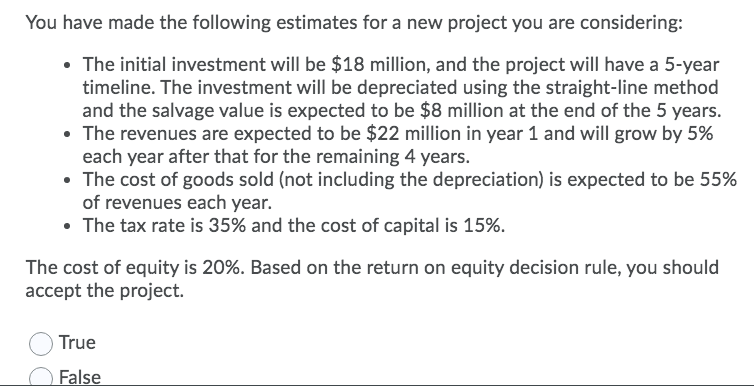

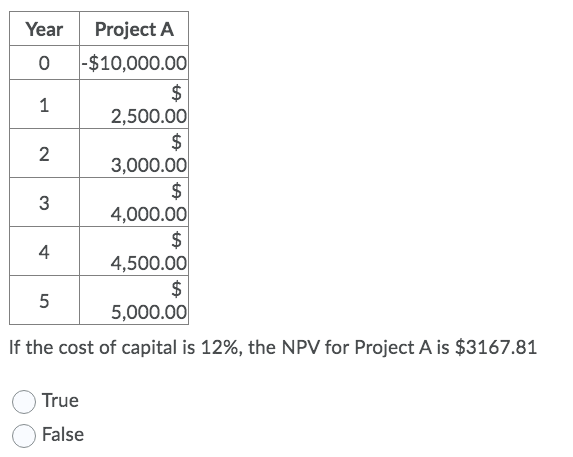

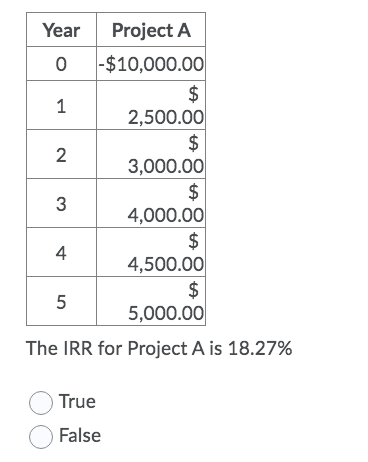

You have made the following estimates for a new project you are considering: The initial investment will be $18 million, and the project will have a 5-year timeline. The investment will be depreciated using the straight-line method and the salvage value is expected to be $8 million at the end of the 5 years. The revenues are expected to be $22 million in year 1 and will grow by 5% each year after that for the remaining 4 years. The cost of goods sold (not including the depreciation) is expected to be 55% of revenues each year. The tax rate is 35% and the cost of capital is 15%. Assume 25% of the initial investment was financed with an interest only loan (interest is paid each year, and the full principal payment is due at the end of 5 years). The cost of debt is 9%. The net income is for Year 3 is $6.14 million. True False You have made the following estimates for a new project you are considering: The initial investment will be $18 million, and the project will have a 5-year timeline. The investment will be depreciated using the straight-line method and the salvage value is expected to be $8 million at the end of the 5 years. The revenues are expected to be $22 million in year 1 and will grow by 5% each year after that for the remaining 4 years. The cost of goods sold (not including the depreciation) is expected to be 55% of revenues each year. The tax rate is 35% and the cost of capital is 15%. Again, assuming 25% of the initial investment was financed with an interest only loan (interest is paid each year, and the full principal payment is due at the end of 5 years). The cost of debt is 9%. The return on equity for Year 3 is 65.07% True False You have made the following estimates for a new project you are considering: The initial investment will be $18 million, and the project will have a 5-year timeline. The investment will be depreciated using the straight-line method and the salvage value is expected to be $8 million at the end of the 5 years. The revenues are expected to be $22 million in year 1 and will grow by 5% each year after that for the remaining 4 years. The cost of goods sold (not including the depreciation) is expected to be 55% of revenues each year. The tax rate is 35% and the cost of capital is 15%. The cost of equity is 20%. Based on the return on equity decision rule, you should accept the project. True False 1 N Year Project A 0 -$10,000.00 $ 1 2,500.00 $ 3,000.00 $ 3 4,000.00 $ 4 4,500.00 $ 5 5,000.00 If the cost of capital is 12%, the NPV for Project A is $3167.81 4 True False Year Project A 0 -$10,000.00 $ 1 2,500.00 $ 2 3,000.00 $ 3 4,000.00 $ 4 4,500.00 $ 5 5,000.00 The IRR for Project A is 18.27% True False