Question

***You have more than 1 Drifter scenario. Each scenario has many overlapping facts but also contains new items and each scenario should be treated as

***You have more than 1 Drifter scenario. Each scenario has many overlapping facts but also contains new items and each scenario should be treated as stand-alone.***

Drifter is a manufacturing company that builds high-end custom furniture. Drifter uses a job-cost system when accumulating product cost. The company applies overhead at the end of each month as part of its regular adjusting entries & when doing so uses a predetermined overhead rate calculated using a cost driver of pounds of direct materials. Although Drifter applies overhead each month, the disposal entry (for over/under applied MOH) is only made once per year in December.

For 2019, Drifter will purchase all of its Raw Materials on account from a single vendor at a pre-established purchase cost of $25 per pound. Drifter's workforce is highly specialized and with a factory labor rate of $60 per hour Drifter pays well to reflect this expertise! As you would expect, Drifter went through an extensive budgeting process in late 2018 and estimated the company's total manufacturing overhead for 2019 of $625,000. Based on the budget, Drifter expects to use 31,250 pounds of material in 2019.

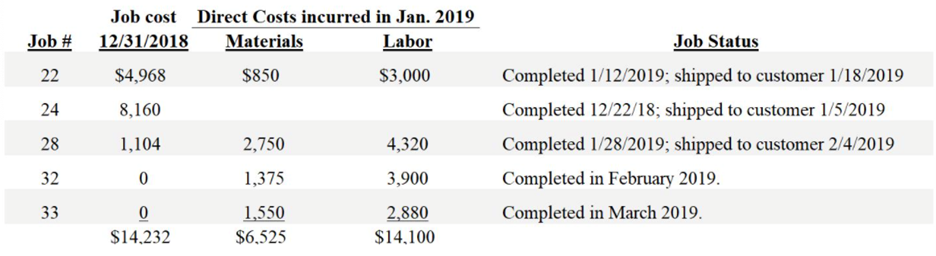

Drifter is trying to finalize the company's Jan 31, 2019 financial statements and needs your assistance. Drifter provides the following summary regarding the January factory activity:

What value will Drifter report on the January 31, 2019 income statement as cost of goods sold?

| A. | None of the answer choices provided are correct. | |

| B. | $16,978 | |

| C. | $12,690 | |

| D. | $17,658 | |

| E. | $17,820 |

Job # Job cost Direct Costs incurred in Jan. 2019 12/31/2018 Materials Labor $4,968 $850 $3,000 8,160 22 24 Job Status Completed 1/12/2019; shipped to customer 1/18/2019 Completed 12/22/18; shipped to customer 1/5/2019 Completed 1/28/2019; shipped to customer 2/4/2019 Completed in February 2019. Completed in March 2019. 28 1,104 4,320 2,750 1,375 32 0 3,900 33 0 $14.232 1,550 $6,525 2,880 $14,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started