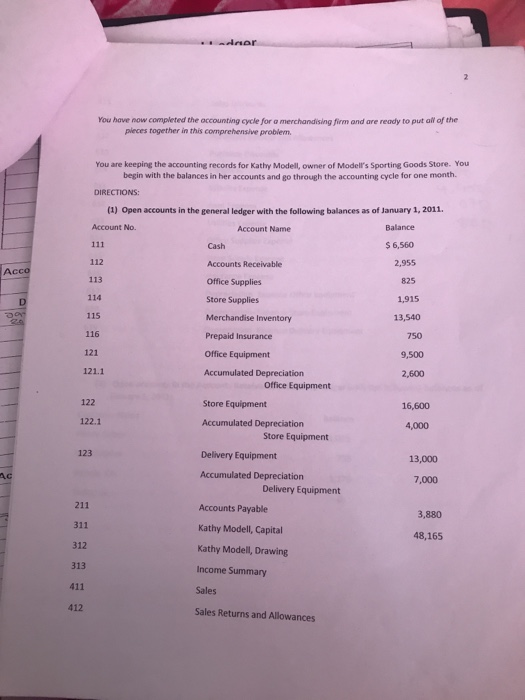

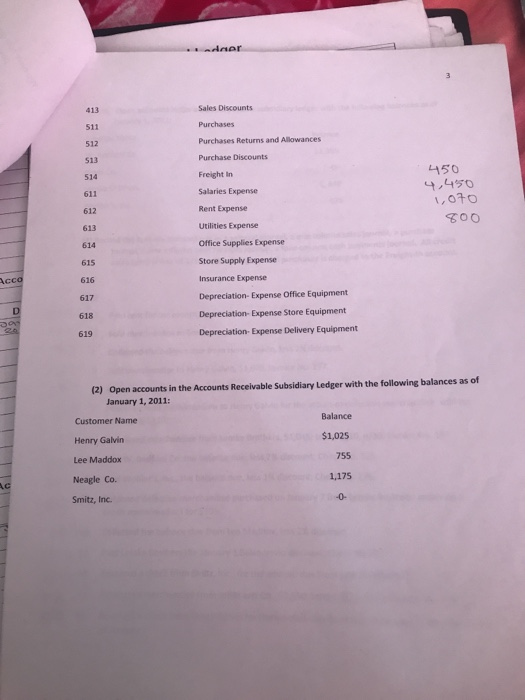

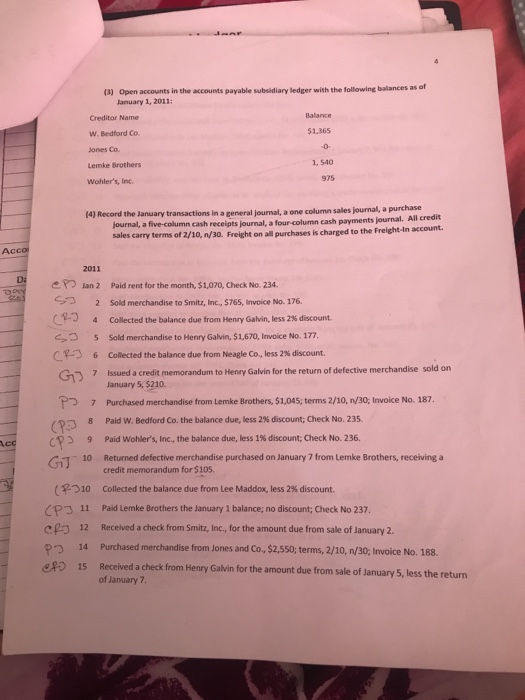

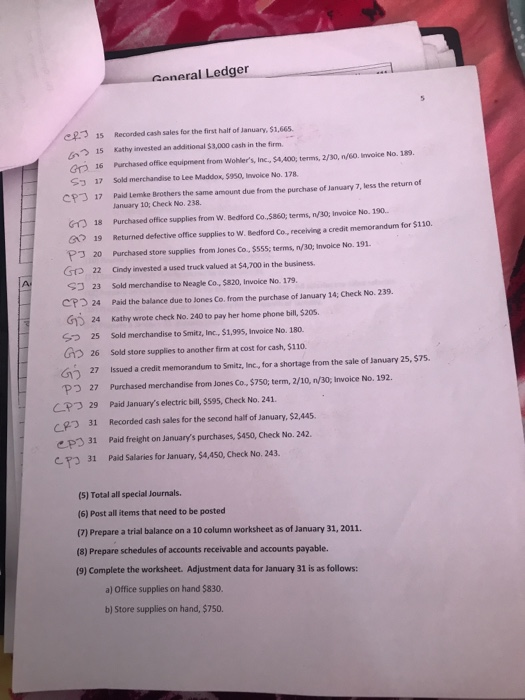

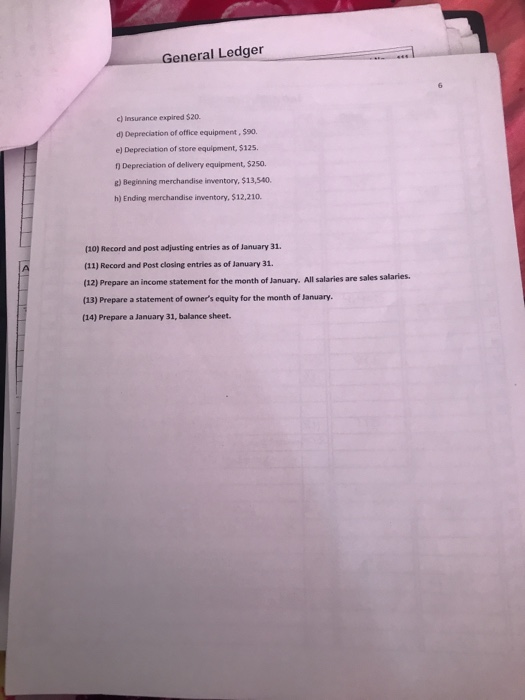

You have now completed the occounting cycle for a merchandising firm and are ready to put all of the pieces together in this comprehensive probiem. You are keeping the accounting records for Kathy Modell, owner of Modell's Sporting Goods Store. You begin with the balances in her accounts and go through the accounting cycle for one month. DIRECTIONS: (1) Open accounts in the general ledger with the following balances as of January 1, 2011. Account No. Account Name Cash Accounts Receivable Office Supplies Store Supplies Merchandise Inventory Prepaid Insurance Office Equipment Accumulated Depreciation 6,560 2,955 825 1,915 112 113 114 115 116 121 121.1 Acco 750 9,500 2,600 Office Equipment 122 Store Equipment 122.1 Accumulated Depreciation 4,000 Store Equipment 123 Delivery Equipment 13,000 Accumulated Depreciation 7,000 Delivery Equipment 211 311 312 313 411 412 Accounts Payable Kathy Modell, Capital Kathy Modell, Drawing Income Summary Sales Sales Returns and Allowances 3,880 48,165 413 Sales Discounts Purchases Purchases Returns and Allowances Purchase Discounts Freight in Salaries Expense Rent Expense Utilities Expense Office Supplies Expense Store Supply Expense Insurance Expense Depreciation- Expense Office Equipment Depreciation- Expense Store Equipment Depreciation- Expense Delivery Equipment 511 512 513 514 611 612 613 614 450 4,4 1,070 T00 615 AcC 616 617 618 619 accounts in the Accounts Receivable Subsidiary Ledger with the following balances as of January 1, 2011: Customer Name Henry Galvin Lee Maddox Neagle Co. Smitz, Inc Balance $1,025 755 1,175 Open accounts in the accounts payable subsidiary ledger with the following balances as of January 1, 2011 (3) Creditor Name W. Bedford Co. Jones Co. Lemke Brothers Wohlers, Inc. $1,365 1, 540 975 journal, a purchase (4) Record the January transactions in a general journal, a one column sales journal, a five-column cash receipts journal, a four column cash payments journal. All credit sales carry terms of 2/10, n/30. Freight on all purchases is charged to the Freight-In account. Acc 2011 e Plan2 Paid rent for the month, $1,070, Check No. 234. 2 Sold merchandise to Smitz, Inc, $765, lnvoice No. 176 , C . 4 Collected the balance due from, Henry Galvin, less 2% discount. 5 Sold merchandise to Henry Galvin, SL670, Invoice No. 177. 6 collected the balance due from Neagle Co. less 2% discount. 7 Issued a credit memorandum to Henry Galvin for the return of defective merchandise sold on January S, $210. Purchased merchandise from Lemke Brothers, S,045; terms 2/10, n/30, Invoice No. 187 Paid w. Bedford Co. the balance due, less 2% discount; Check No. 235. p 7 (P3 CP Gi 8 9 10 Paid Wohlers, Inc., the balance due, less 1% discount, Check No. 236. Returned defective merchandise purchased on January 7 from Lemke Brothers, receiving a credit memorandum for $105 collected the balance due from Lee Maddox, less 2% discount. 10 (P3 1 c p 12 14 15 Paid Lemke Brothers the January 1 balance; no discount, Check No 237. Received a check from Smita, Inc., for the amount due from sale of January 2. Purchased merchandise from Jones and Co, $2,550; terms, 2/10, n/30 Invoice No. 188. Received a check from Henry Galvin for the amount due from sale of January 5, less the return of January 7. eA General Ledger e is Recorded cash sales for the first halt of January, $1,665 15 Kathy invested an additional $3,000 cash in the firm. Parchased office equipment from Wohler's, Inc, $4,400, terms, 2/30, n/60. Inwoice No. 18 Sold merchandise to Lee Maddox, S950. Invoice No. 178. Gro 16 17 S Paid Lemke Brothers the same amount due from the purchase of January 7, less the return of January 10; Check No. 238. CP 17 G 18 Purchased office supplies from W. Bedford Co. $860, terms, n/30; Invoice No. 190 G 19 Returned defective office supplies to w. Bedford Co, receiving a credit memorandum for $110. PJ 20 Purchased store supplies from Jones Co, $555; terms, n/30; Invoice No. 191 Gro 22 Cindy invested a used truck valued at $4,700 in the business. 23 Sold merchandise to Neagle Co, $820, Invoice No. 179. cp 24 Paid the balance due to Jones Co. from the purchase of January 14, Check No. 239. G24 Kathy wrote check No. 240 to pay her home phone bill, $205 S25 Sold merchandise to Smit, Inc., S. 995, invoice No. aa Gp 26 Sold store supplies to another firm at cost for cash, $110 27 ssued a credit memorandum to Smitz, Inc, for a shortage from the sale of January 25, 575. P27 Purchased merchandise from Jones Co, s 750, term, 2/10, np. invoice No. 192. CP 29 Paid January's electric bill, $595, Check No. 241 CP 31 Recorded cash sales for the second half of January, $2,445 ep31 Paid freight on January's purchases, Saso, check No. 242. CPO 31 Paid Salaries for January, $4,450, Check No. 243. (S) Total all special Journals. (6) Post all items that need to be posted (7) Prepare a trial balance on a 10 column worksheet as of January 31, 2011. (8) Prepare schedules of accounts receivable and accounts payable. (9) Complete the worksheet. Adjustment data for January 31 is as follows: a) Office supplies on hand $830. b) Store supplies on hand, $75o General Ledger ) Insurance expired $20 d) Depreciation of office equipment, 590. e) Depreciation of store equipment, $125 Depreciation of delivery equipment, S250. g) Beginning merchandise inventory. $13,540. h) Ending merchandise inventory, $12,210. (10) Record and post adjusting entries as of January 31. (11) Record and Post closing entries as of January 31. (12) Prepare an income statement for the month of January. All salaries are sales (13) Prepare a statement of owners equity for the month of lanuary (14) Prepare a January 31, balance sheet