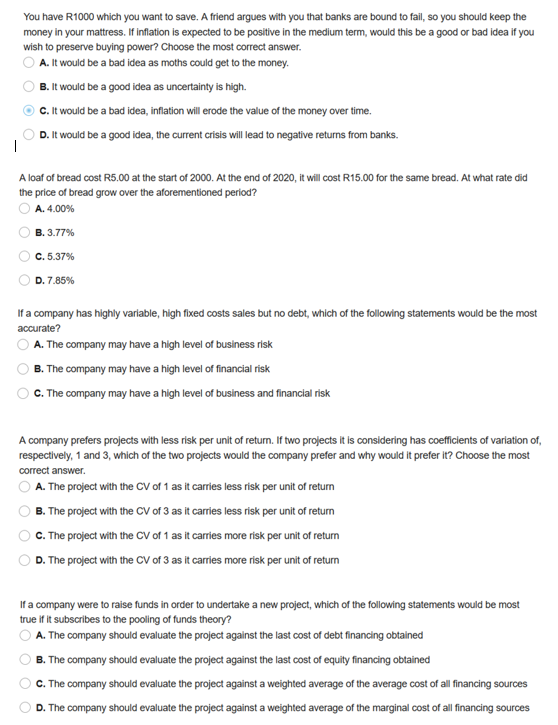

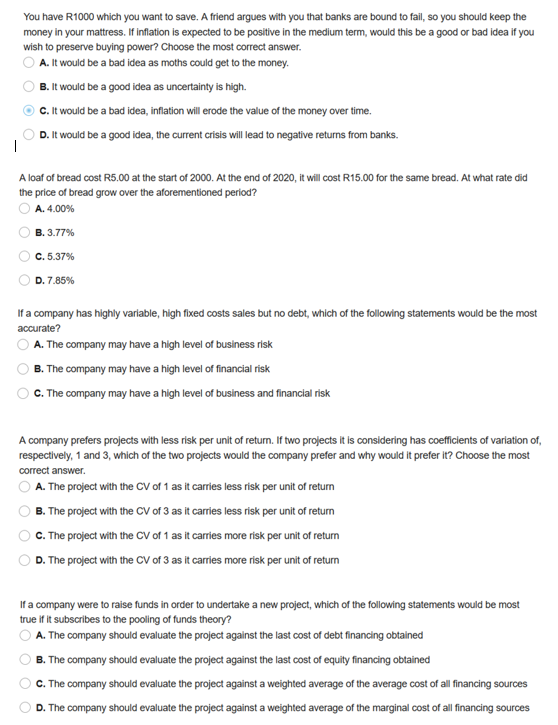

You have R1000 which you want to save. A friend argues with you that banks are bound to fail, so you should keep the money in your mattress. If inflation is expected to be positive in the medium term, would this be a good or bad idea if you wish to preserve buying power? Choose the most correct answer. A. It would be a bad idea as moths could get to the money. O B. It would be a good idea as uncertainty is high. C. It would be a bad idea, inflation will erode the value of the money over time. O D . It would be a good idea, the current crisis will lead to negative returns from banks. A loaf of bread cost R5.00 at the start of 2000. At the end of 2020, it will cost R15.00 for the same bread. At what rate did the price of bread grow over the aforementioned period? O A. 4.00% OB.3.77% C.5.37% OD. 7.85% If a company has highly variable, high fixed costs sales but no debt, which of the following statements would be the most accurate? O A. The company may have a high level of business risk O B. The company may have a high level of financial risk C. The company may have a high level of business and financial risk A company prefers projects with less risk per unit of return. If two projects it is considering has coefficients of variation of respectively, 1 and 3, which of the two projects would the company prefer and why would it prefer it? Choose the most correct answer. O A. The project with the CV of 1 as it carries less risk per unit of return O B. The project with the CV of 3 as it carries less risk per unit of return C. The project with the CV of 1 as it carries more risk per unit of return O D. The project with the CV of 3 as it carries more risk per unit of return If a company were to raise funds in order to undertake a new project, which of the following statements would be most true if it subscribes to the pooling of funds theory? O A. The company should evaluate the project against the last cost of debt financing obtained O B. The company should evaluate the project against the last cost of equity financing obtained C. The company should evaluate the project against a weighted average of the average cost of all financing sources D. The company should evaluate the project against a weighted average of the marginal cost of all financing sources