Answered step by step

Verified Expert Solution

Question

1 Approved Answer

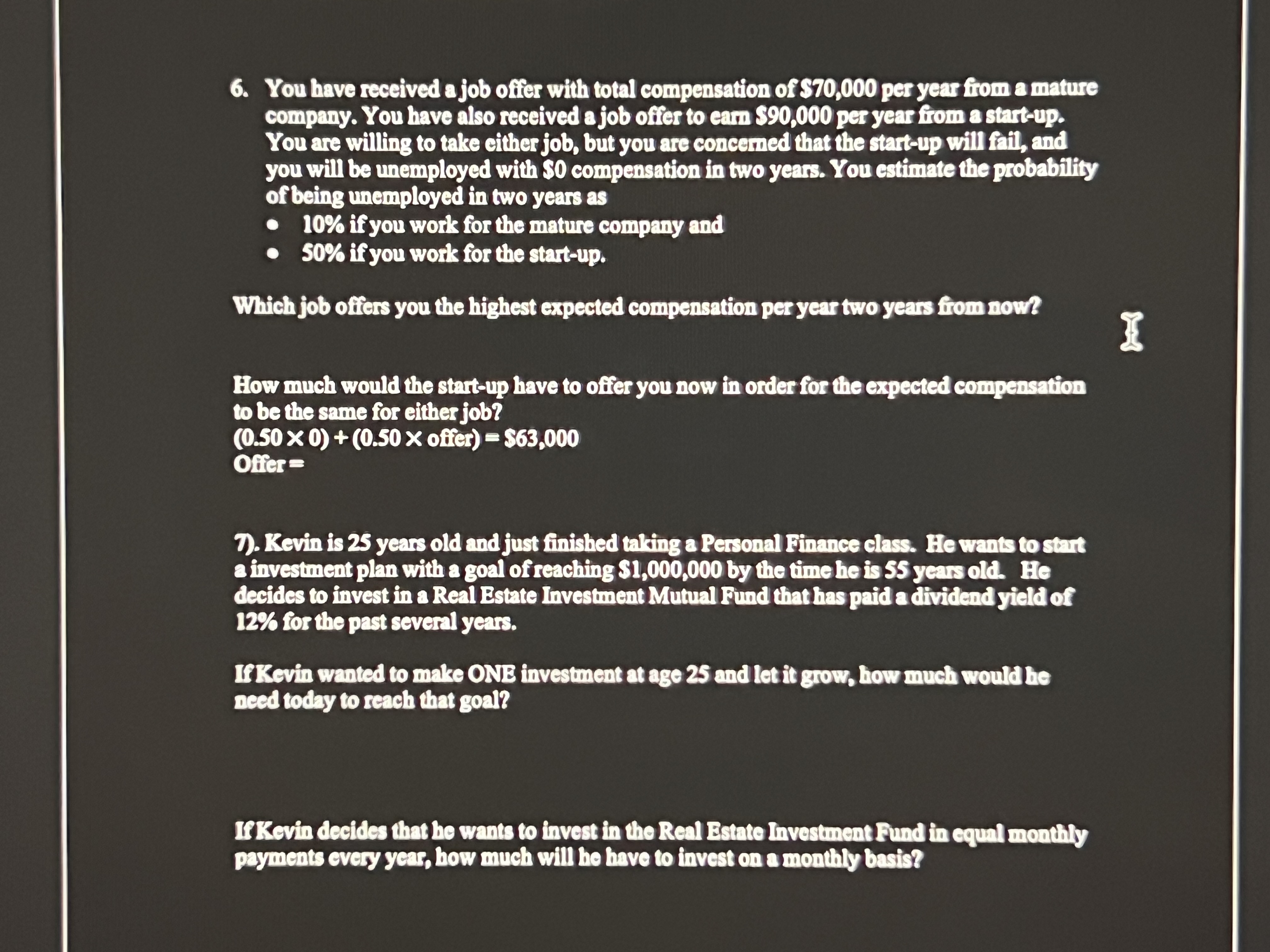

You have received a job offer with total compensation of 5 7 0 , 0 0 0 per year from a mature company. You have

You have received a job offer with total compensation of per year from a mature

company. You have also received a job offer to eam per year from a start up

You are willing to take either job, but you are concemed that the startup will fill, and

you will be unemployed with compensation in two years. You estimate the probability

of being unemployed in two years as

if you work for the mature company and

if you work for the startup

Which job offers you the highest expected compensation per year two years from now?

How much would the startup have to offer you now in order for the expected compensation

to be the same for either job?

fres

Offer

Revin is years old and just finished taking a Personal Finance class. He wants to sthrt

a investment plan with a goal of reaching $ by the time he is years old. He

decides to invest in a Real Bstate Investment Mutual Pund that has paid a dividend yield of

for the past several years.

Ifkevin wanted to make ONB investment at age and let it grow, how much would be

need today to reach that goal?

IfKevin decides that ho wants to invest in the Real Estato Investment Fund in equal monthly

payments every year, how much will ho have to invest on a monthly basis?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started