Answered step by step

Verified Expert Solution

Question

1 Approved Answer

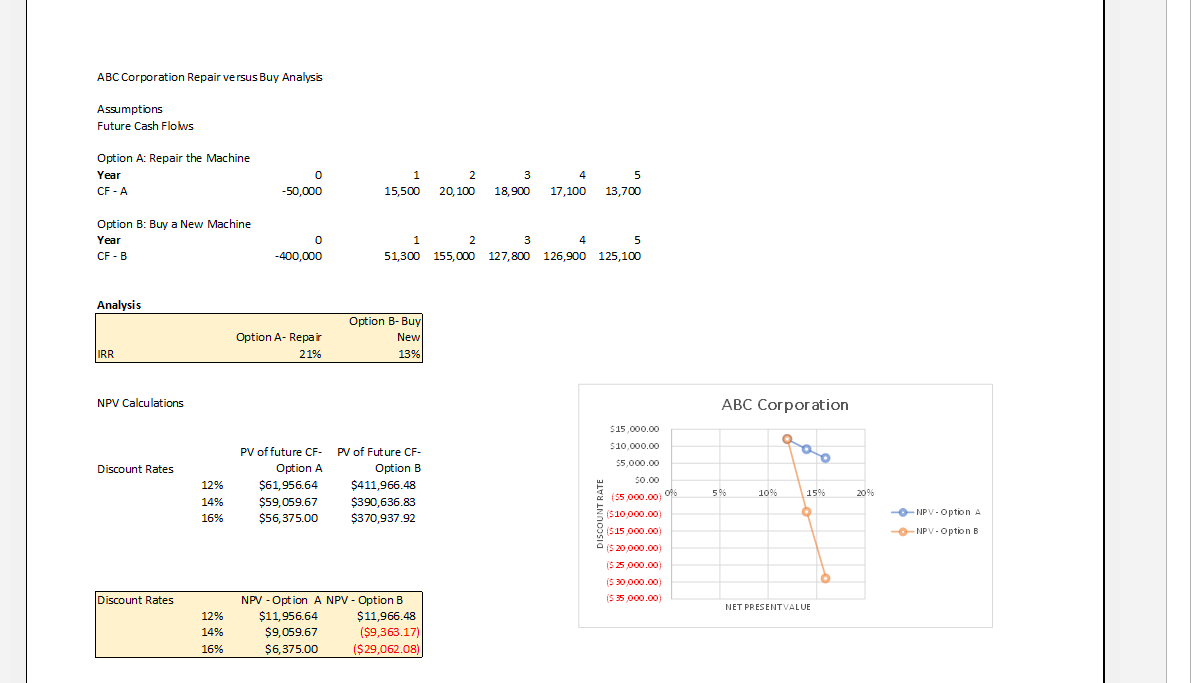

You have recently been hired by ABC Corporation and your first assignment is to help them decide which of these two options should be pursued.

You have recently been hired by ABC Corporation and your first assignment is to help them decide which of these two options should be pursued. Should you buy a new machine or repair the old one? Apply Capital Budgeting and Time Value of Money concepts. Based on the IRR or NPV, evaluate the decision. Identify quantitative information.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started