Answered step by step

Verified Expert Solution

Question

1 Approved Answer

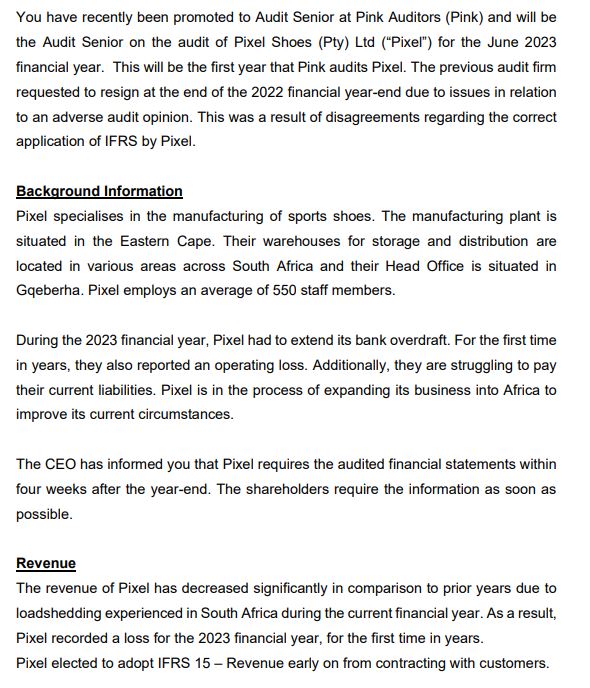

You have recently been promoted to Audit Senior at Pink Auditors (Pink) and will be the Audit Senior on the audit of Pixel Shoes

You have recently been promoted to Audit Senior at Pink Auditors (Pink) and will be the Audit Senior on the audit of Pixel Shoes (Pty) Ltd ("Pixel") for the June 2023 financial year. This will be the first year that Pink audits Pixel. The previous audit firm requested to resign at the end of the 2022 financial year-end due to issues in relation to an adverse audit opinion. This was a result of disagreements regarding the correct application of IFRS by Pixel. Background Information Pixel specialises in the manufacturing of sports shoes. The manufacturing plant is situated in the Eastern Cape. Their warehouses for storage and distribution are located in various areas across South Africa and their Head Office is situated in Gqeberha. Pixel employs an average of 550 staff members. During the 2023 financial year, Pixel had to extend its bank overdraft. For the first time in years, they also reported an operating loss. Additionally, they are struggling to pay their current liabilities. Pixel is in the process of expanding its business into Africa to improve its current circumstances. The CEO has informed you that Pixel requires the audited financial statements within four weeks after the year-end. The shareholders require the information as soon as possible. Revenue The revenue of Pixel has decreased significantly in comparison to prior years due to loadshedding experienced in South Africa during the current financial year. As a result, Pixel recorded a loss for the 2023 financial year, for the first time in years. Pixel elected to adopt IFRS 15 - Revenue early on from contracting with customers. Trade receivables As at 30 June 2023, Pixel had a trade receivables balance of R8.5 million. Pixel's European customers comprised 55% of the balance, while African customers made up 15% and South African customers made up the balance. Both European and African customers are invoiced in their respective currencies. When a sale is made to international customers, Pixel enters into FECS to protect itself against foreign currency fluctuations. Fraud and error The following notes/risk indicators were observed by a First Year Audit Clerk Management receives bonuses driven by profits. Use of financial statements to obtain financing from the bank. Directors/owners are also the Management. Changes in the Companies Act which management does not want to comply with. Expansion into new locations/decentralisation of the entity. New audit client. REQUIRED: 3.1 Describe the risks of material misstatement at the overall financial statement level and assertion level for revenue and trade receivable accounts of Pixel Ltd for the financial year ended 30 June 2023. 3.2 Mark will be allocated: Risks at the overall financial statement level Risks at an assertion level Use the below table to present your answers: Risk indicator (30 marks) With reference to the Fraud and error information provided, identify and describe the risk of material misstatement due to fraud and error at the overall financial statement level based on the risk indicators identified. Description (12 marks) (18 marks) (10 marks)

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

31 Risks of Material Misstatement Risks at the Overall Financial Statement Level 1 Existence and Valuation Given that Pixel recorded an operating loss for the first time and is struggling with payment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started