Question

You have recently graduated with a major in finance and landed a financial planner job with Barney Smith Inc., a large financial services corporation. Your

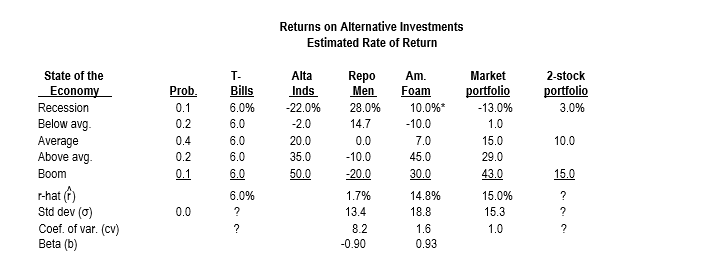

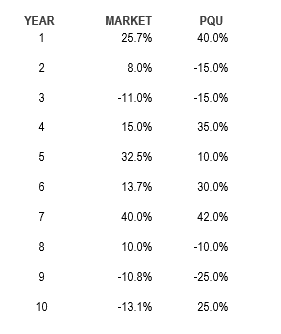

You have recently graduated with a major in finance and landed a financial planner job with Barney Smith Inc., a large financial services corporation. Your first assignment is to invest $100,000 for a client. Because the funds will be invested in a new business the client plans to start at the end of the year, you have been instructed to plan for a 1-year holding period. Further, your boss has restricted you to the investment alternatives shown in Table 1 on the attached resource, "Topic 5 Assignment Graphic Tables." (Disregard for now the items at the bottom of the data; you will fill in the blanks later.) Note that the estimated returns of American Foam (Am. Foam), a bedding company, do not always move in the same direction as the overall economy. For example, when the economy is below average, consumers purchase fewer mattresses than they would if the economy were stronger. However, if the economy is in a flat-out recession, a large number of consumers who were planning to purchase a more expensive inner-spring mattress may purchase a cheaper foam mattress instead. Under these circumstances, we would expect American Foams stock price to be higher if there is a recession than if the economy was just below average. Barney Smiths economic forecasting staff has developed probability estimates for the state of the economy, and its security analysts have developed a sophisticated computer program that was used to estimate the rate of return on each alternative under several state of the economy scenarios. Alta Industries (Alta Inds) is an electronics firm; Repo Men collects past-due debts; and American Foam, as per above, manufactures mattresses and various other foam products. Barney Smith also maintains an "index fund" which owns a market-weighted fraction of all publicly traded stocks; you can invest in that fund, and thus obtain average stock market results. Given the situation as described, answer the following questions. 5. How does the risk of this two-stock portfolio compare with the risk of the individual stocks if those stocks were held in isolation? In what ways do "portfolio effects" impact how investors think about the risk of individual stocks? 6. If you decided to hold a simple one-stock portfolio, and consequently were exposed to more risk than diversified investors, could you expect to be compensated for all of your risk; that is, could you earn a risk premium on that part of your risk that you could have eliminated by diversifying? Explain. 7. Describe how market risk is measured for individual securities. How are beta coefficients calculated? Calculate beta using the following historical returns for the stock market and for another company, P.Q. Unlimited (PQU) as per Table 2 on the attached resource, "Topic 5 Assignment Graphic Tables." Note: Use the Excel formula function to calculate beta and interpret your results.

Table 1

Table 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started