Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have recently started your own accounting firm and have been engaged by Wheelie Cool Bicycles (WCB), which is a new business that commenced

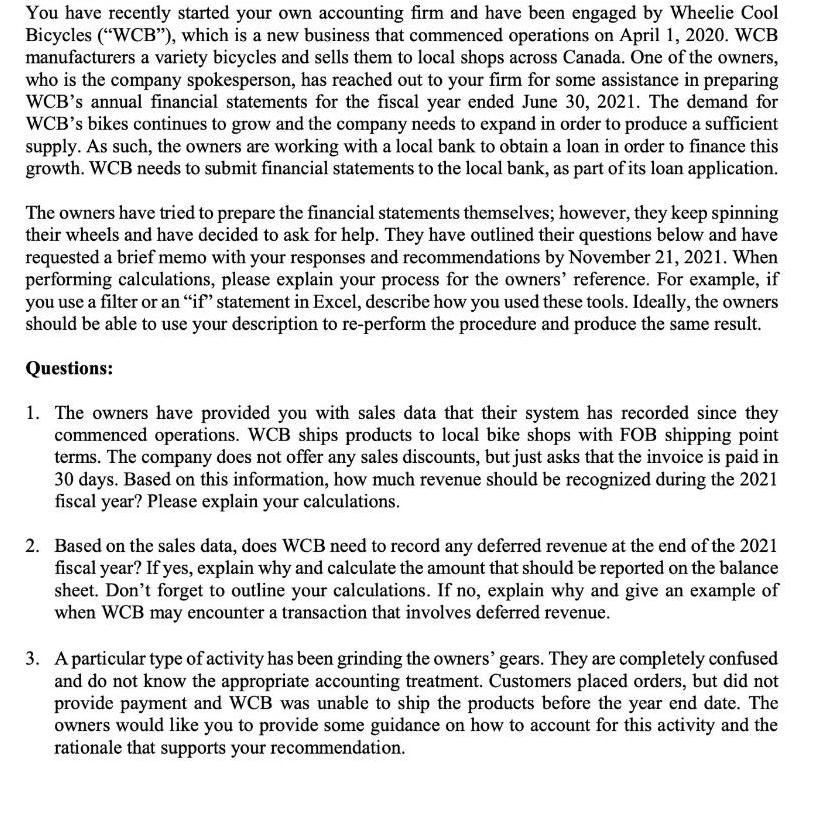

You have recently started your own accounting firm and have been engaged by Wheelie Cool Bicycles ("WCB"), which is a new business that commenced operations on April 1, 2020. WCB manufacturers a variety bicycles and sells them to local shops across Canada. One of the owners, who is the company spokesperson, has reached out to your firm for some assistance in preparing WCB's annual financial statements for the fiscal year ended June 30, 2021. The demand for WCB's bikes continues to grow and the company needs to expand in order to produce a sufficient supply. As such, the owners are working with a local bank to obtain a loan in order to finance this growth. WCB needs to submit financial statements to the local bank, as part of its loan application. The owners have tried to prepare the financial statements themselves; however, they keep spinning their wheels and have decided to ask for help. They have outlined their questions below and have requested a brief memo with your responses and recommendations by November 21, 2021. When performing calculations, please explain your process for the owners' reference. For example, if you use a filter or an "if" statement in Excel, describe how you used these tools. Ideally, the owners should be able to use your description to re-perform the procedure and produce the same result. Questions: 1. The owners have provided you with sales data that their system has recorded since they commenced operations. WCB ships products to local bike shops with FOB shipping point terms. The company does not offer any sales discounts, but just asks that the invoice is paid in 30 days. Based on this information, how much revenue should be recognized during the 2021 fiscal year? Please explain your calculations. 2. Based on the sales data, does WCB need to record any deferred revenue at the end of the 2021 fiscal year? If yes, explain why and calculate the amount that should be reported on the balance sheet. Don't forget to outline your calculations. If no, explain why and give an example of when WCB may encounter a transaction that involves deferred revenue. 3. A particular type of activity has been grinding the owners' gears. They are completely confused and do not know the appropriate accounting treatment. Customers placed orders, but did not provide payment and WCB was unable to ship the products before the year end date. The owners would like you to provide some guidance on how to account for this activity and the rationale that supports your recommendation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The company should recognize 120000 of revenue during the 2021 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started