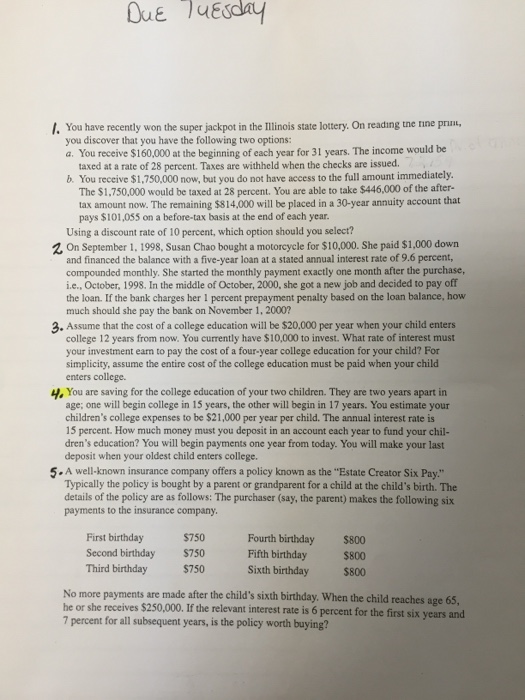

You have recently won the super jackpot in the Illinois state lottery- On reading the line print, you discover that you have the following two options: You receive $160,000 at the beginning of each year for 31 years. The income would be taxed at a rate of 28 percent. Taxes are withheld when the checks are issued. You receive $1, 750,000 now, but you do not have access to the full amount immediately. The $1, 750,000 would be taxed at 28 percent. You are able to take $446,000 of the after-tax amount now. The remaining $814,000 will be placed in a 30-year annuity account that pays $101, 055 on a before-tax basis at the end of each year. Using a discount rate of 10 percent, which option should you select? On September 1, 1998, Susan Chao bought a motorcycle for $10,000. She paid $1,000 down and financed the balance with a five-year loan at a stated annual interest rate of 9.6 percent, compounded monthly. She started the monthly payment exactly one month after the purchase, i.e., October. 1998. In the middle of October, 2000, she got a new job and decided to pay off the loan. If the bank charges her 1 percent prepayment penalty based on the loan balance, how much should she pay the bank on November 1, 2000? Assume that the cost of a college education will be $20,000 per year when your child enters college 12 years from now. You currently have $10,000 to invest. What rate of interest must your investment earn to pay the cost of a four-year college education for your child? For simplicity, assume the entire cost of the college education must be paid when your child enters college. You are saving for the college education of your two children. They are two years apart in age: one will begin college in 15 years, the other will begin in 17 years. You estimate your children's college expenses to be $21,000 per year per child. The annual interest rate is 15 percent. How much money must you deposit in an account each year to fund your children's education? You will begin payments one year from today. You will make your last deposit when your oldest child enters college. A well-known insurance company offers a policy known as the "Estate Creator Six Pay." Typically the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say. the parent) makes the following six payments to the insurance company. No more payments are made after the child's sixth birthday. When the child reaches age 65, he or she receives $250,000. If the relevant interest rate is 6 percent for the first six years and 7 percent for all subsequent years, is the policy worth buying