Question

You have recently won the super jackpot in the Washington State Lottery. On reading the fine print, you discover that you have the following two

You have recently won the super jackpot in the Washington State Lottery. On reading the fine print, you discover that you have the following two options:

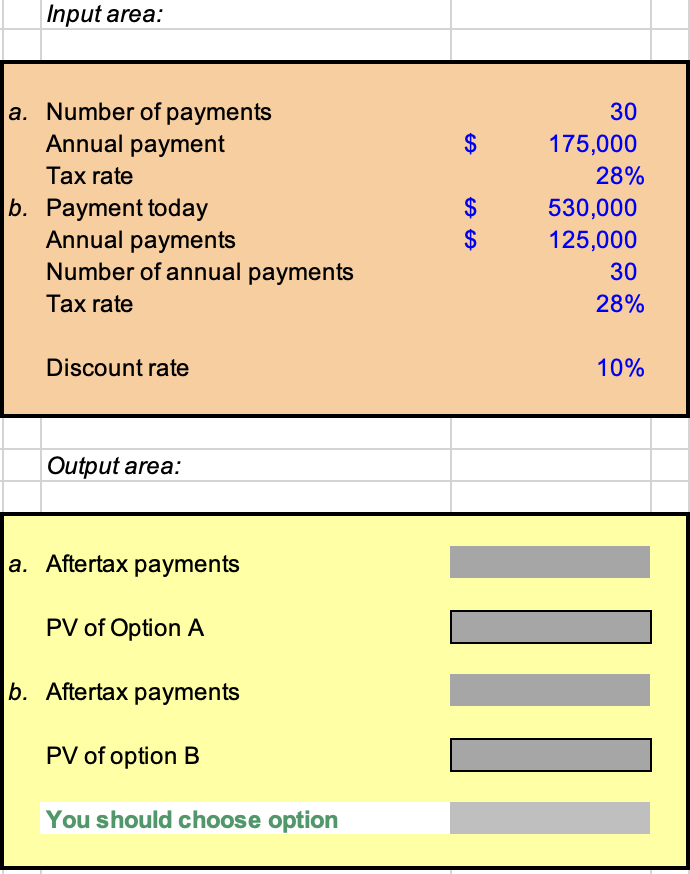

1- You will receive 30 annual payments of $175,000, with the first payment being delivered one year from today. The income will be taxed at a rate of 28 percent. Taxes will be withheld when the checks are issued.

2- You will receive $530,000 now, and you will not have to pay taxes on this amount. In addition, beginning one year from today, you will receive $125,000 each year for 30 years. The cash flows from this annuity will be taxed at 28 percent.

Using a discount rate of 10 percent, which option should you select?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started