Answered step by step

Verified Expert Solution

Question

1 Approved Answer

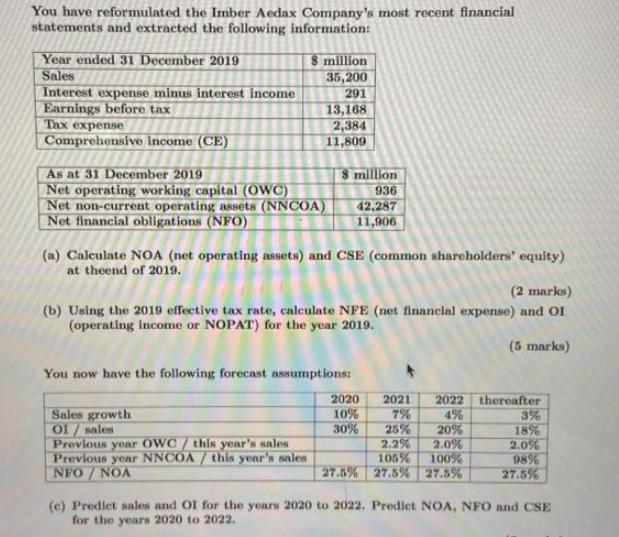

You have reformulated the Imber Aedax Company's most recent financial statements and extracted the following information: Year ended 31 December 2019 Sales Interest expense

You have reformulated the Imber Aedax Company's most recent financial statements and extracted the following information: Year ended 31 December 2019 Sales Interest expense minus interest income Earnings before tax Tax expense Comprehensive income (CE) 8 million 35,200 291 13,168 2,384 11,809 As at 31 December 2019 8 million 936 Net non-current operating assets (NNCOA) Net financial obligations (NFO) 42.287 11,906 Net operating working capital (OWC) (a) Calculate NOA (net operating assets) and CSE (common shareholders' equity) at theend of 2019. (2 marks) (b) Using the 2019 effective tax rate, calculate NFE (net financial expense) and OI (operating income or NOPAT) for the year 2019. You now have the following forecast assumptions: (5 marks) 2020 2021 2022 thereafter Sales growth 10% 7% 4% 3% OI/sales 30% 25% 20% 18% Previous year OWC/ this year's sales Previous year NNCOA/ this year's sales 2.2% 2.0% 2.0% 105% 100% 98% NFO/NOA 27.5% 27.5% 27.5% 27.5% (e) Predict sales and OI for the years 2020 to 2022. Predict NOA, NFO and CSE for the years 2020 to 2022.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Calculating NOA and CSE Net Operating Assets NOA NOA Net OWC Net NonCurrent Operating Assets NNCOA NOA 8 million 42287 million NOA 43223 mill...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started