Question

You have shorted a put option on Ford stock with a strike price of $12. When you sold (wrote) the put, you received $5.

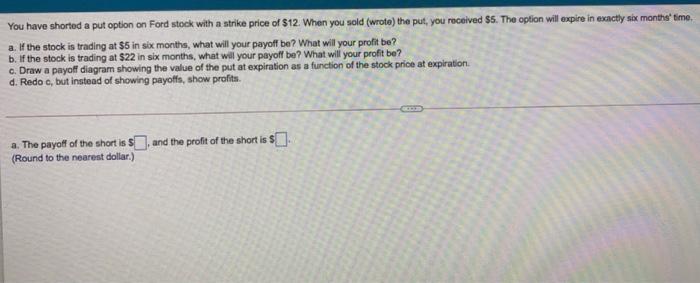

You have shorted a put option on Ford stock with a strike price of $12. When you sold (wrote) the put, you received $5. The option will expire in exactly six months' time. a. If the stock is trading at $5 in six months, what will your payoff be? What will your profit be? b. If the stock is trading at $22 in six months, what will your payoff be? What will your profit be? c. Draw a payoff diagram showing the value of the put at expiration as a function of the stock price at expiration. d. Redo c, but instead of showing payoffs, show profits. a. The payoff of the short is S,and the profit of the short is $ (Round to the nearest dollar.)

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

A B D E F G H K M P Q R T 1 3 Stock pric Owe Profit 4 a 3 5 2 Owe Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Berk, DeMarzo, Harford

2nd edition

132148234, 978-0132148238

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App