Question

You have spent the few weeks analyzing the operations of the client. A detailed improvement roadmap has been developed and the client is now considering

You have spent the few weeks analyzing the operations of the client. A detailed improvement roadmap has been developed and the client is now considering whether or not to retain you as a longer term partner to help implement the improvements.

Example improvements include:

- Improved equipment maintenance

- Better material management which will reduce time wasted waiting for parts

- Improved sourcing practices and supplier negotiation to deliver lower cost of parts

- Improved equipment settings (e.g., the dials and standard procedures) to increase speed of the machines

- Installed operational performance dashboards

In the final meeting the client CEO looks to you and asks What is this improvement worth to my bottom line? If you can justify me paying $6.5M in consulting fees, Ill sign up for your work. Whats my project ROI?

Excel Modeling Exercise

Use the information in this packet to develop an Excel based model of financial impact resulting from your work. A good model submission will be:

- Concise

- Easy to follow and understand

- Use reasonable assumptions

- Show results monthly

- Show a graphical representation of the project benefits (over the client baseline) forecast curve by month

The financial model should show the current 2022 baseline client forecast (monthly), and the expected forecast with you improvements of:

- 10% throughput improvement

- 10% reduction in material spend (in total dollars spent)

Please calculate the overall financial benefit for the client CEO by partnering with you. What is

the incremental 2022 P&L EBITDA? Based on this, what is the ROI for hiring you for this

Engagement?

Assumptions

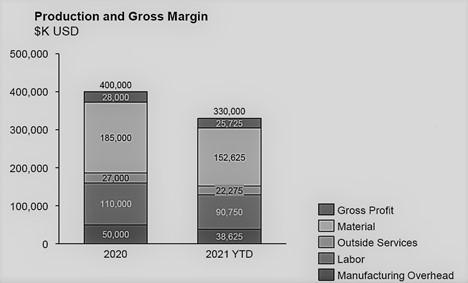

- The client 2021 YTD revenue through end of September is $330M, and expects that volume will continue at its current pace through year end

- Furthermore, the client has forecast 2022 production, without Implementation Engineers involvement, to increase 5% over 2021 volumes

- The business is not seasonal and sales tend to be evenly distributed throughout the year

- Implementation Engineers improvement project begins March 1, 2022

- All improvements will take six (6) months to implement, and ramp up to 100% benefit realization straight line over the first four (4) months of the project (i.e., month one of the project we will realize 25% of the 10% production improvement, in month two we will realize 50%, etc.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started