Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have started a new job as an analyst at Vanguard, one of the world's largest and most respected mutual fund companies. Vanguard allocates its

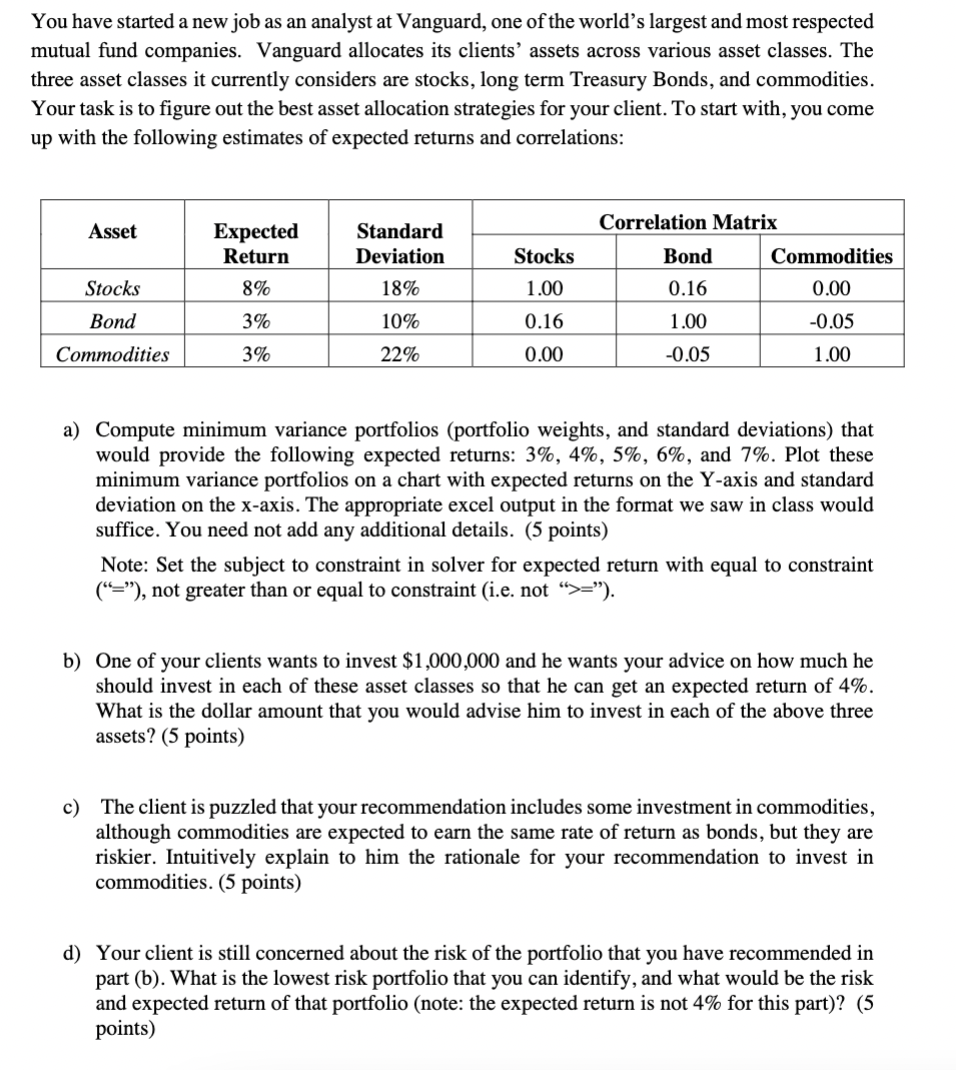

You have started a new job as an analyst at Vanguard, one of the world's largest and most respected mutual fund companies. Vanguard allocates its clients' assets across various asset classes. The three asset classes it currently considers are stocks, long term Treasury Bonds, and commodities. Your task is to figure out the best asset allocation strategies for your client. To start with, you come up with the following estimates of expected returns and correlations: a) Compute minimum variance portfolios (portfolio weights, and standard deviations) that would provide the following expected returns: 3%,4%,5%,6%, and 7%. Plot these minimum variance portfolios on a chart with expected returns on the Y-axis and standard deviation on the x-axis. The appropriate excel output in the format we saw in class would suffice. You need not add any additional details. (5 points) Note: Set the subject to constraint in solver for expected return with equal to constraint ("="), not greater than or equal to constraint (i.e. not ">="). b) One of your clients wants to invest $1,000,000 and he wants your advice on how much he should invest in each of these asset classes so that he can get an expected return of 4%. What is the dollar amount that you would advise him to invest in each of the above three assets? (5 points) c) The client is puzzled that your recommendation includes some investment in commodities, although commodities are expected to earn the same rate of return as bonds, but they are riskier. Intuitively explain to him the rationale for your recommendation to invest in commodities. (5 points) d) Your client is still concerned about the risk of the portfolio that you have recommended in part (b). What is the lowest risk portfolio that you can identify, and what would be the risk and expected return of that portfolio (note: the expected return is not 4% for this part)? (5 points)

You have started a new job as an analyst at Vanguard, one of the world's largest and most respected mutual fund companies. Vanguard allocates its clients' assets across various asset classes. The three asset classes it currently considers are stocks, long term Treasury Bonds, and commodities. Your task is to figure out the best asset allocation strategies for your client. To start with, you come up with the following estimates of expected returns and correlations: a) Compute minimum variance portfolios (portfolio weights, and standard deviations) that would provide the following expected returns: 3%,4%,5%,6%, and 7%. Plot these minimum variance portfolios on a chart with expected returns on the Y-axis and standard deviation on the x-axis. The appropriate excel output in the format we saw in class would suffice. You need not add any additional details. (5 points) Note: Set the subject to constraint in solver for expected return with equal to constraint ("="), not greater than or equal to constraint (i.e. not ">="). b) One of your clients wants to invest $1,000,000 and he wants your advice on how much he should invest in each of these asset classes so that he can get an expected return of 4%. What is the dollar amount that you would advise him to invest in each of the above three assets? (5 points) c) The client is puzzled that your recommendation includes some investment in commodities, although commodities are expected to earn the same rate of return as bonds, but they are riskier. Intuitively explain to him the rationale for your recommendation to invest in commodities. (5 points) d) Your client is still concerned about the risk of the portfolio that you have recommended in part (b). What is the lowest risk portfolio that you can identify, and what would be the risk and expected return of that portfolio (note: the expected return is not 4% for this part)? (5 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started