Answered step by step

Verified Expert Solution

Question

1 Approved Answer

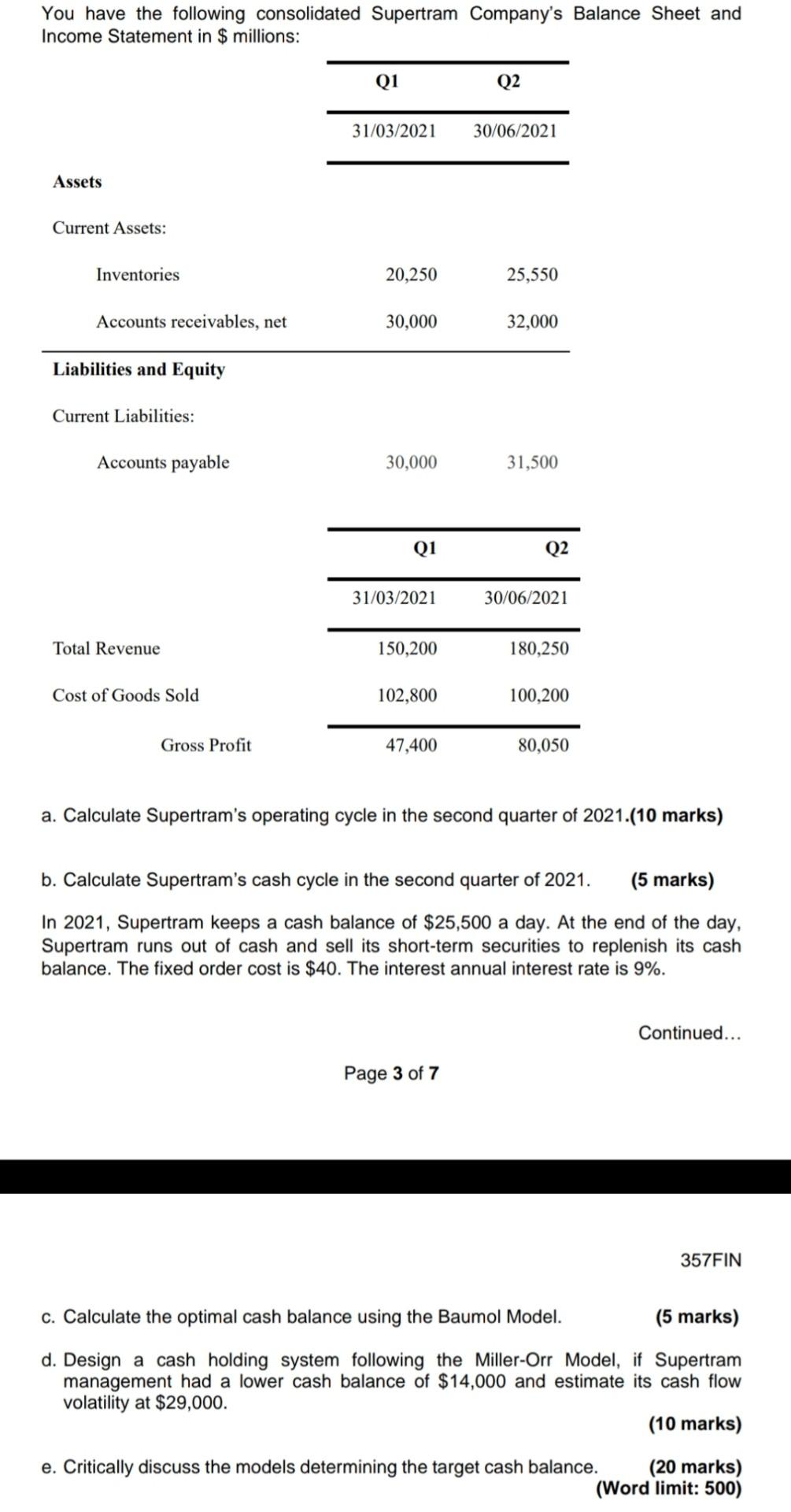

You have the following consolidated Supertram Company's Balance Sheet and Income Statement in $ millions: Q1 Q2 31/03/2021 30/06/2021 Assets Current Assets: Inventories 20,250 25,550

You have the following consolidated Supertram Company's Balance Sheet and Income Statement in $ millions: Q1 Q2 31/03/2021 30/06/2021 Assets Current Assets: Inventories 20,250 25,550 Accounts receivables, net 30,000 32,000 Liabilities and Equity Current Liabilities: Accounts payable 30,000 31,500 Q1 Q2 31/03/2021 30/06/2021 Total Revenue 150,200 180,250 Cost of Goods Sold 102,800 100,200 Gross Profit 47,400 80,050 a. Calculate Supertram's operating cycle in the second quarter of 2021.(10 marks) b. Calculate Supertram's cash cycle in the second quarter of 2021. (5 marks) In 2021, Supertram keeps a cash balance of $25,500 a day. At the end of the day, Supertram runs out of cash and sell its short-term securities to replenish its cash balance. The fixed order cost is $40. The interest annual interest rate is 9%. Continued... Page 3 of 7 357FIN c. Calculate the optimal cash balance using the Baumol Model. (5 marks) d. Design a cash holding system following the Miller-Orr Model, if Supertram management had a lower cash balance of $14,000 and estimate its cash flow volatility at $29,000. (10 marks) e. Critically discuss the models determining the target cash balance. (20 marks) (Word limit: 500)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started