Question

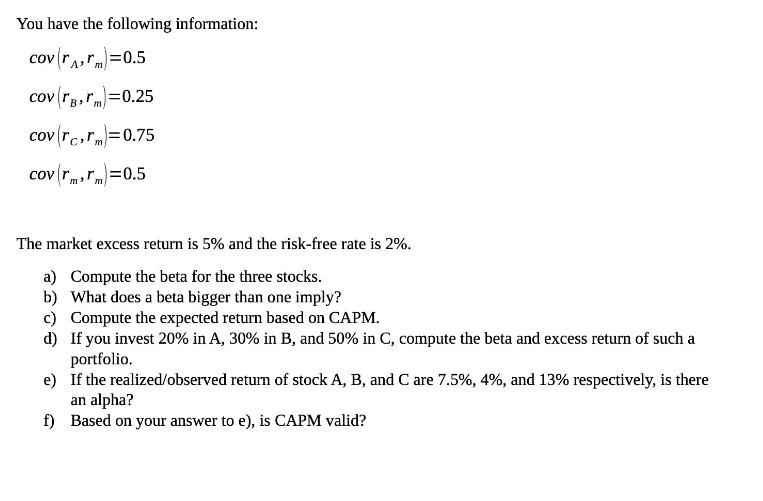

You have the following information: cov (r,m)=0.5 cov (B,M)=0.25 m covrc,r=0.75 cov r,r=0.5 m The market excess return is 5% and the risk-free rate

You have the following information: cov (r,m)=0.5 cov (B,M)=0.25 m covrc,r=0.75 cov r,r=0.5 m The market excess return is 5% and the risk-free rate is 2%. a) Compute the beta for the three stocks. b) What does a beta bigger than one imply? c) Compute the expected return based on CAPM. d) If you invest 20% in A, 30% in B, and 50% in C, compute the beta and excess return of such a portfolio. e) If the realized/observed return of stock A, B, and C are 7.5%, 4%, and 13% respectively, is there an alpha? f) Based on your answer to e), is CAPM valid?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance Principles and Practice

Authors: Denzil Watson, Antony Head

7th edition

1292103035, 978-1292103082, 1292103086, 978-1292103037

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App