Question

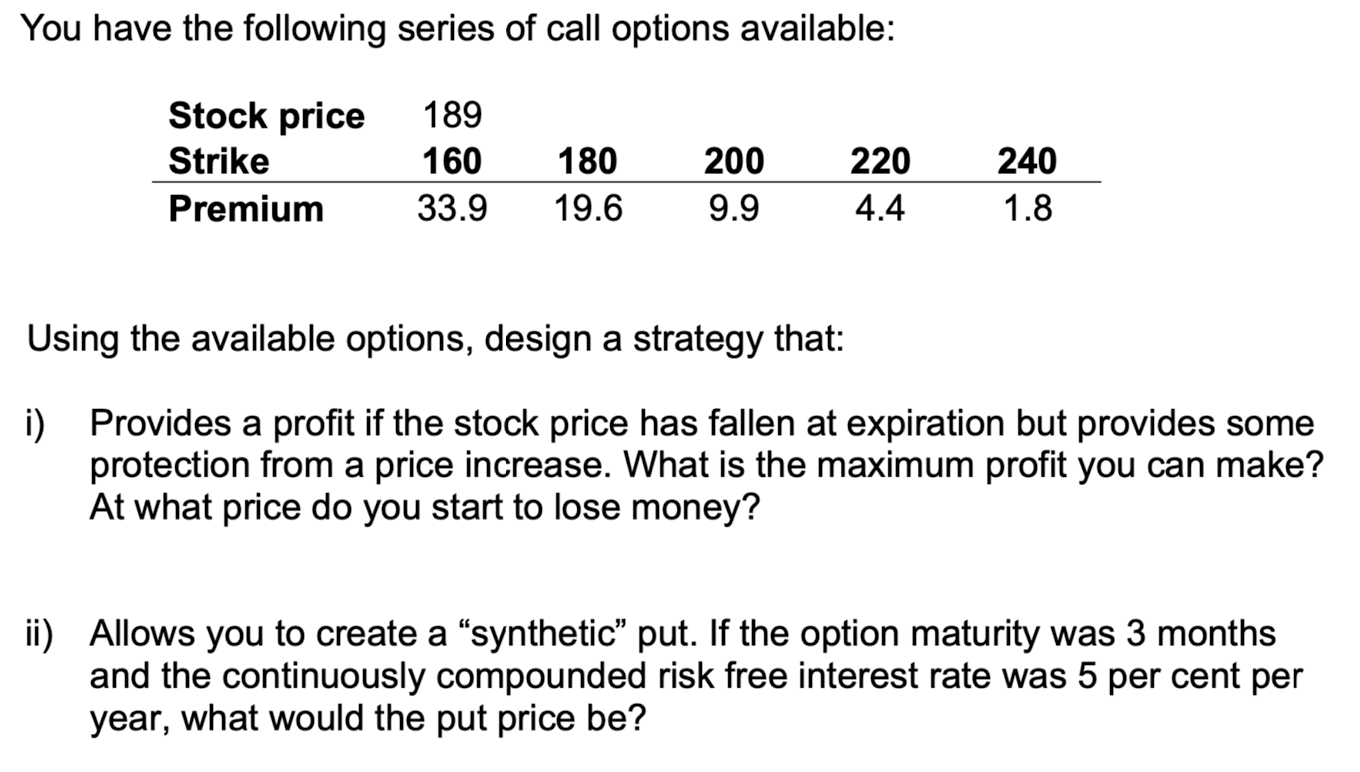

You have the following series of call options available: Stock price 189 Strike 160 Premium 33.9 180 19.6 200 9.9 220 4.4 240 1.8

You have the following series of call options available: Stock price 189 Strike 160 Premium 33.9 180 19.6 200 9.9 220 4.4 240 1.8 Using the available options, design a strategy that: i) Provides a profit if the stock price has fallen at expiration but provides some protection from a price increase. What is the maximum profit you can make? At what price do you start to lose money? ii) Allows you to create a "synthetic" put. If the option maturity was 3 months and the continuously compounded risk free interest rate was 5 per cent per year, what would the put price be?

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Portfolio Strategies for Different Goals i Profit from Falling Stock Price with Limited Upside Risk ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Global Investments

Authors: Bruno Solnik, Dennis McLeavey

6th edition

321527704, 978-0321527707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App