Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have the following transaction during the year of 2020 as related to Steve company: 1. On the 1st of October, the company accepted

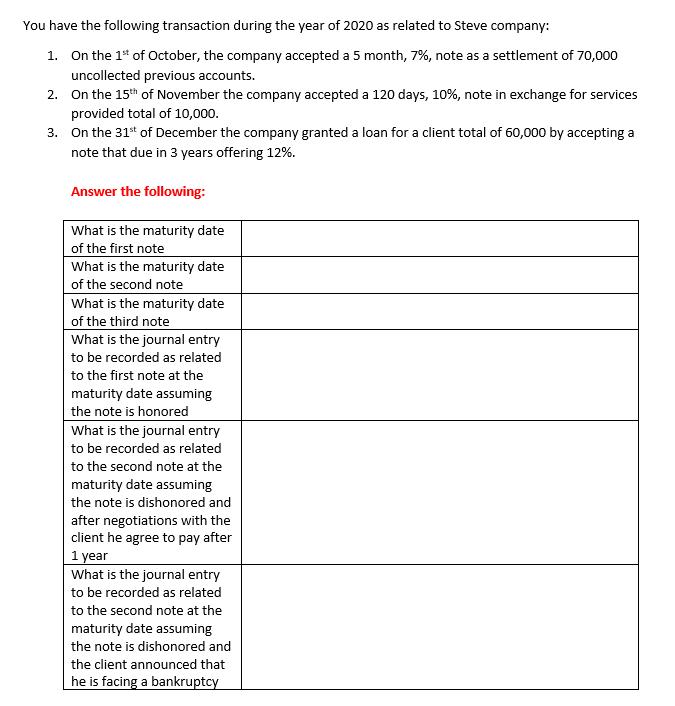

You have the following transaction during the year of 2020 as related to Steve company: 1. On the 1st of October, the company accepted a 5 month, 7%, note as a settlement of 70,000 uncollected previous accounts. 2. On the 15th of November the company accepted a 120 days, 10%, note in exchange for services provided total of 10,000. 3. On the 31st of December the company granted a loan for a client total of 60,000 by accepting a note that due in 3 years offering 12%. Answer the following: What is the maturity date of the first note What is the maturity date of the second note What is the maturity date of the third note What is the journal entry to be recorded as related to the first note at the maturity date assuming the note is honored What is the journal entry to be recorded as related to the second note at the maturity date assuming the note is dishonored and after negotiations with the client he agree to pay after 1 year What is the journal entry to be recorded as related to the second note at the maturity date assuming the note is dishonored and the client announced that he is facing a bankruptcy

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The maturity date of the first note is February 1 2021 5 months after October 1 2020 The matu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started