Answered step by step

Verified Expert Solution

Question

1 Approved Answer

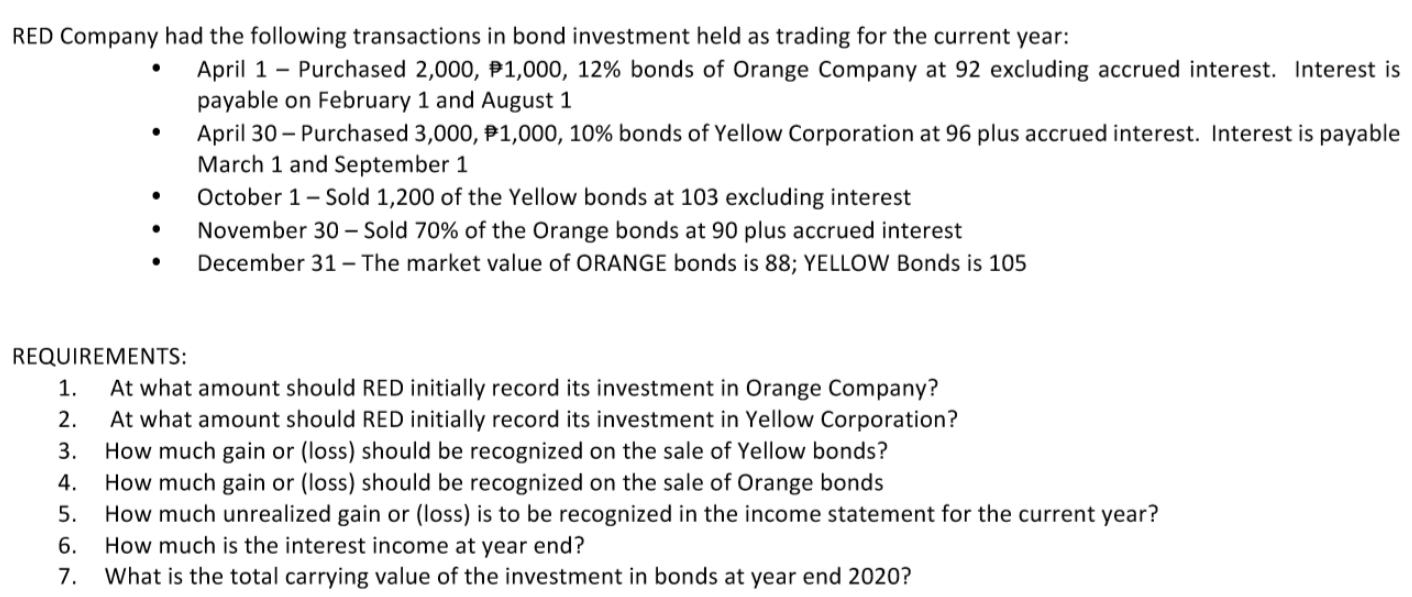

RED Company had the following transactions in bond investment held as trading for the current year: 5. 6. 7. REQUIREMENTS: April 1 Purchased 2,000,

RED Company had the following transactions in bond investment held as trading for the current year: 5. 6. 7. REQUIREMENTS: April 1 Purchased 2,000, #1,000, 12% bonds of Orange Company at 92 excluding accrued interest. Interest is payable on February 1 and August 1 April 30 - Purchased 3,000, #1,000, 10% bonds of Yellow Corporation at 96 plus accrued interest. Interest is payable March 1 and September 1 October 1- Sold 1,200 of the Yellow bonds at 103 excluding interest November 30- Sold 70% of the Orange bonds at 90 plus accrued interest December 31 - The market value of ORANGE bonds is 88; YELLOW Bonds is 105 1. At what amount should RED initially record its investment in Orange Company? 2. At what amount should RED initially record its investment in Yellow Corporation? 3. How much gain or (loss) should be recognized on the sale of Yellow bonds? 4. How much gain or (loss) should be recognized on the sale of Orange bonds How much unrealized gain or (loss) is to be recognized in the income statement for the current year? How much is the interest income at year end? What is the total carrying value of the investment in bonds at year end 2020?

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Initial Recording of Investment in Orange Company Answer The initial investment in Orange Company should be recorded at the cost of the bonds plus t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started