Answered step by step

Verified Expert Solution

Question

1 Approved Answer

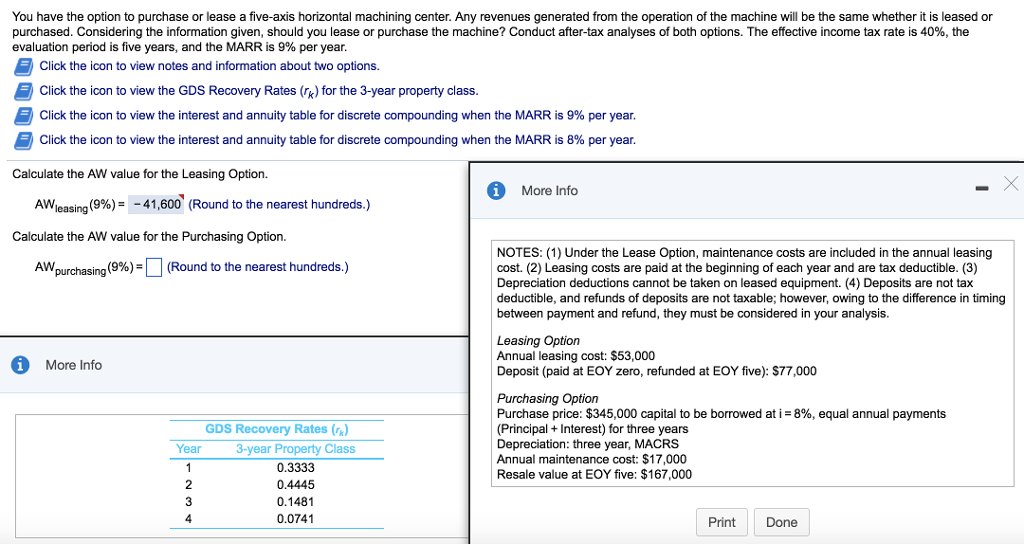

You have the option to purchase or lease a? five-axis horizontal machining center. Any revenues generated from the operation of the machine will be the

You have the option to purchase or lease a? five-axis horizontal machining center. Any revenues generated from the operation of the machine will be the same whether it is leased or purchased. Considering the information? given, should you lease or purchase the? machine? Conduct? after-tax analyses of both options. The effective income tax rate is 40?%, the evaluation period is five? years, and the MARR is 99?% per year. Please find the annual worth of purchasing at 9%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started