Question

You have the privilege of serving on the board of directors for a local not-for-profit that works to prevent homelessness. As a board member, it

You have the privilege of serving on the board of directors for a local not-for-profit that works to prevent homelessness. As a board member, it is your fiduciary duty to ensure the sustainability of the organization; poor judgment on your part could spell misfortunate for the residents. The not-for-profit owns and manages seven locations throughout your city which are used to house those less fortunate. Each location is its own entity for accounting purposesthat is, it generates its own revenue (per 8 housing vouchers and resident rent payment) and records its own expenditures. Each entity also undergoes its own audit. There is a central accounting office, and consolidated financial statements are compiled annually after all seven entity and parent audits are completed.

At a recent board meeting, the executive director presented the board with an opportunity to expand the organizations reach. Essentially, to acquire a building already zoned and used for affordable housing. The building would increase the number of clients the not-for-profit accommodates (this is great news as the boards annual goal is to increase the number of residents).

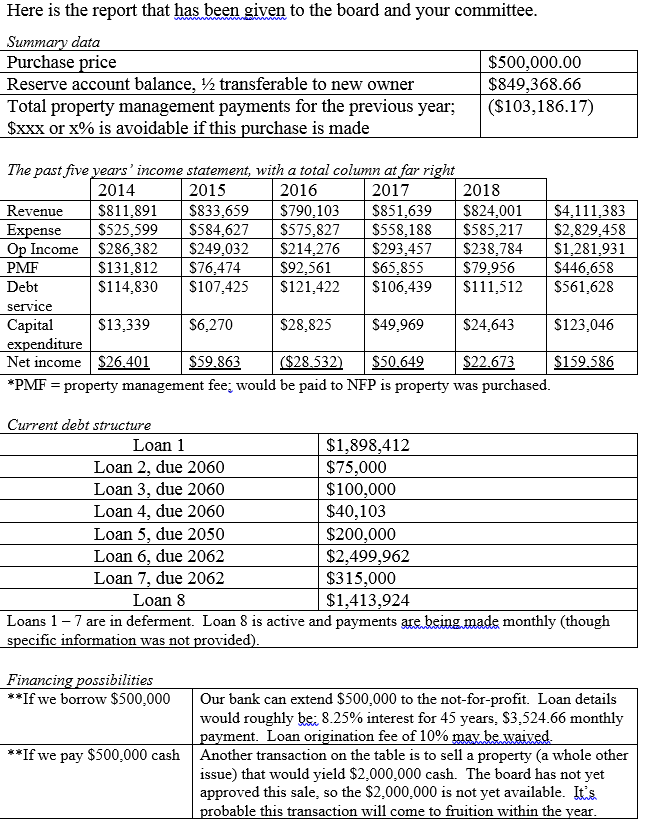

In order for the board to make a decision, the executive director and controller compiled relevant financial data (presented on page two) to the best of their ability. The real trick to the decision is deciding which piece of financial data is relevant (if its relevant at all) and also discerning when the data is/will be relevant. Because of the substantial purchase price, due diligence should be exercised to a fault. The board chair has decided to establish a special committee to take a deep dive into the financial data, and give a recommendation to the entire board at their next meeting. As an accounting professional, youve been volunteered to take part in the committee.

As a committee member, it will be your duty to peruse the above data and convert it to useable information (to the best of your ability). Remember, not everyone on the board, and that will read your memo, is accounting-savvy. And, dont necessarily worry about every piece of datathat is, keep your eyes on the forest, not the trees.

Part I

Your deliverable for the next board meeting is a memo outlining your committees findings. In particular (and anything else you believe is necessary):

Here is the report that has been given to the board and your committee Summary data Purchase price Reserve account balance, / transferable to new owner Total property management payments for the previous year; $xxx or x% is avoidable if this purchase is made $500,000.00 $849,368.66 ($103,186.17) The past five years' income statement, with a total column at far right 2018 2014 2015 2016 2017 $833,659 $584,627 $249,032 S76,474 $107,425 $811,891 $525,599 Op Income $286,382 $131,812 $114,830 Revenue $790,103 S575,827 $214,276 S851,639 $558,188 $293,457 $65,855 $106,439 $824,001 $585,217 $238,784 S4,111,383 S2,829,458 S1,281,931 $446,658 $561,628 Expense PMF S92,561 $121,422 $79,956 $111,512 Debt service $13,339 $6,270 $49,969 Capital expenditure Net income $26.401 $28,825 $24,643 $123,046 ($28.532) $50.649 $22,673 $59.863 $159.586 purchased PMF property management fee; would be paid to NFP is property was Current debt structure Loan 1 $1,898,412 $75,000 $100,000 $40,103 $200,000 $2,499,962 $315,000 $1,413,924 Loan 2, due 2060 Loan 3, due 2060 Loan 4, due 2060 Loan 5, due 2050 Loan 6, due 2062 Loan 7, due 2062 Loan 8 Loans 17 are in deferment. Loan 8 is active and payments are being made monthly (though specific information was not provided) Financing possibilities *If we borrow $500,000 Our bank can extend $500,000 to the not-for-profit. Loan details would roughly bs 8.25% interest for 45 years, S3,524.66 monthly payment. Loan origination fee of 10% may be waived *If we pay $500,000 cash Another transaction on the table is to sell a property (a whole other issue) that would yield $2,000,000 cash. The board has not yet approved this sale, so the $2,000,000 is not yet available. Its probable this transaction will come to fruition within the year Here is the report that has been given to the board and your committee Summary data Purchase price Reserve account balance, / transferable to new owner Total property management payments for the previous year; $xxx or x% is avoidable if this purchase is made $500,000.00 $849,368.66 ($103,186.17) The past five years' income statement, with a total column at far right 2018 2014 2015 2016 2017 $833,659 $584,627 $249,032 S76,474 $107,425 $811,891 $525,599 Op Income $286,382 $131,812 $114,830 Revenue $790,103 S575,827 $214,276 S851,639 $558,188 $293,457 $65,855 $106,439 $824,001 $585,217 $238,784 S4,111,383 S2,829,458 S1,281,931 $446,658 $561,628 Expense PMF S92,561 $121,422 $79,956 $111,512 Debt service $13,339 $6,270 $49,969 Capital expenditure Net income $26.401 $28,825 $24,643 $123,046 ($28.532) $50.649 $22,673 $59.863 $159.586 purchased PMF property management fee; would be paid to NFP is property was Current debt structure Loan 1 $1,898,412 $75,000 $100,000 $40,103 $200,000 $2,499,962 $315,000 $1,413,924 Loan 2, due 2060 Loan 3, due 2060 Loan 4, due 2060 Loan 5, due 2050 Loan 6, due 2062 Loan 7, due 2062 Loan 8 Loans 17 are in deferment. Loan 8 is active and payments are being made monthly (though specific information was not provided) Financing possibilities *If we borrow $500,000 Our bank can extend $500,000 to the not-for-profit. Loan details would roughly bs 8.25% interest for 45 years, S3,524.66 monthly payment. Loan origination fee of 10% may be waived *If we pay $500,000 cash Another transaction on the table is to sell a property (a whole other issue) that would yield $2,000,000 cash. The board has not yet approved this sale, so the $2,000,000 is not yet available. Its probable this transaction will come to fruition within the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started