Answered step by step

Verified Expert Solution

Question

1 Approved Answer

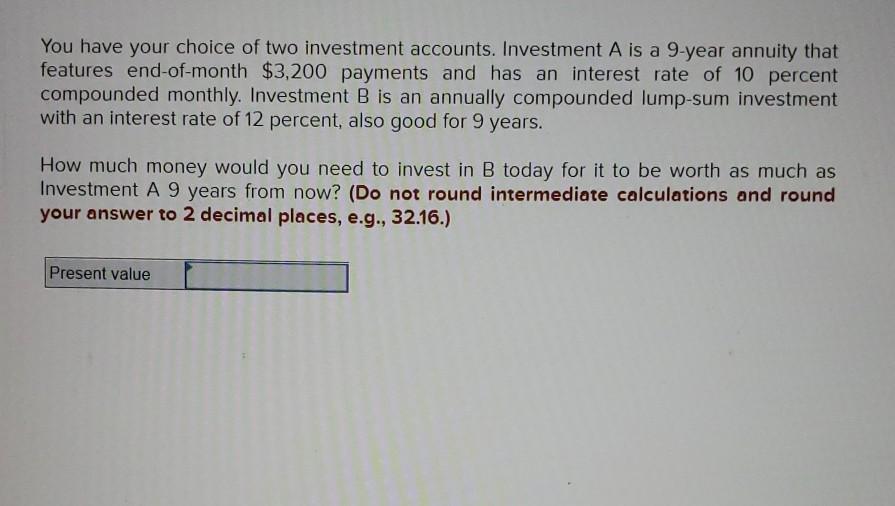

You have your choice of two investment accounts. Investment A is a 9-year annuity that features end-of-month $3,200 payments and has an interest rate of

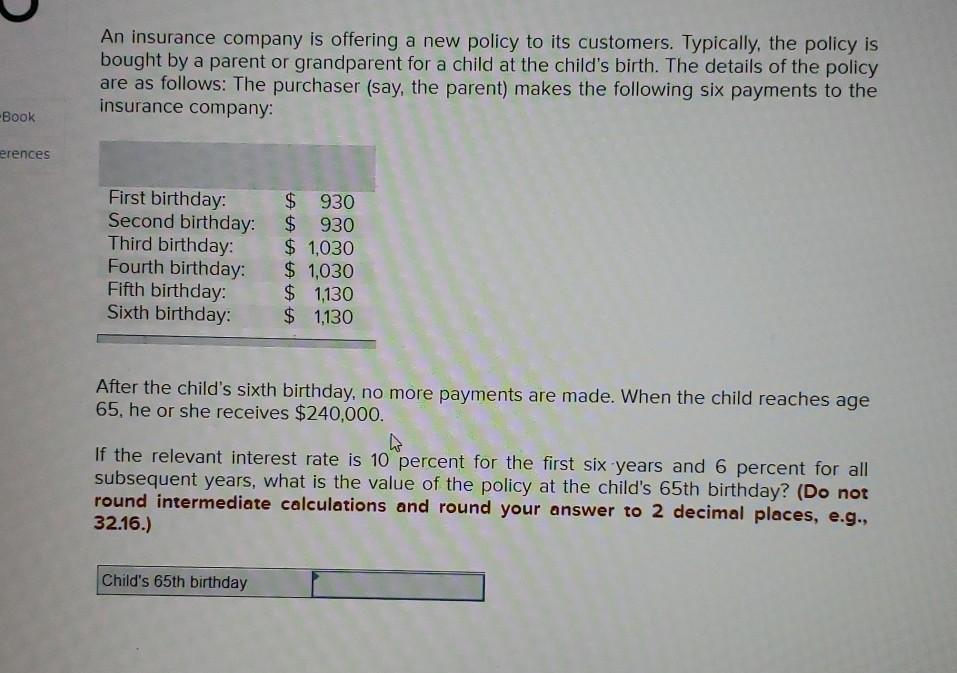

You have your choice of two investment accounts. Investment A is a 9-year annuity that features end-of-month $3,200 payments and has an interest rate of 10 percent compounded monthly. Investment B is an annually compounded lump-sum investment with an interest rate of 12 percent, also good for 9 years. How much money would you need to invest in B today for it to be worth as much as Investment A 9 years from now? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: -Book erences First birthday: $ 930 Second birthday: $ 930 Third birthday: $ 1,030 Fourth birthday: $ 1,030 Fifth birthday: $ 1,130 Sixth birthday $ 1.130 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $240,000. If the relevant interest rate is 10 percent for the first six years and 6 percent for all subsequent years, what is the value of the policy at the child's 65th birthday? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Child's 65th birthday

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started