Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You identified an error in the Cost of Goods Sold account. Cost of Goods Sold was understated by 37,007.00 in 2020. Calculate Inventory Turnover for

You identified an error in the Cost of Goods Sold account. Cost of Goods Sold was understated by 37,007.00 in 2020. Calculate Inventory Turnover for 2020 using the corrected amount and round your answer to 2 decimal points.

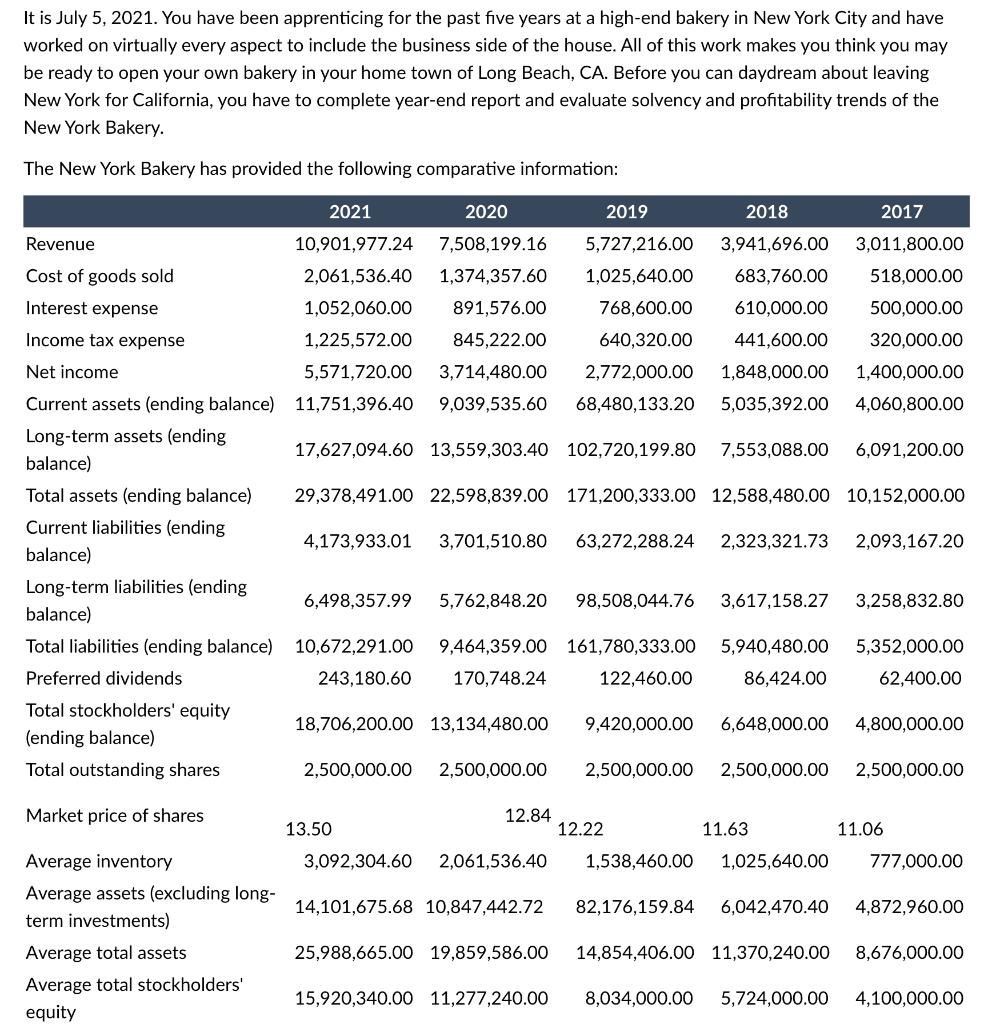

It is July 5, 2021. You have been apprenticing for the past five years at a high-end bakery in New York City and have worked on virtually every aspect to include the business side of the house. All of this work makes you think you may be ready to open your own bakery in your home town of Long Beach, CA. Before you can daydream about leaving New York for California, you have to complete year-end report and evaluate solvency and profitability trends of the New York Bakery. The New York Bakery has provided the following comparative information: Revenue Cost of goods sold Interest expense Income tax expense Net income Current assets (ending balance) Long-term assets (ending balance) Total assets (ending balance) Current liabilities (ending balance) Long-term liabilities (ending balance) 2021 2020 2018 2019 5,727,216.00 3,941,696.00 2017 3,011,800.00 10,901,977.24 7,508,199.16 2,061,536.40 1,374,357.60 1,025,640.00 683,760.00 518,000.00 768,600.00 610,000.00 500,000.00 1,225,572.00 640,320.00 441,600.00 320,000.00 2,772,000.00 1,848,000.00 1,400,000.00 1,052,060.00 891,576.00 845,222.00 5,571,720.00 3,714,480.00 11,751,396.40 9,039,535.60 68,480,133.20 5,035,392.00 4,060,800.00 17,627,094.60 13,559,303.40 102,720,199.80 7,553,088.00 6,091,200.00 29,378,491.00 22,598,839.00 171,200,333.00 12,588,480.00 10,152,000.00 4,173,933.01 Total liabilities (ending balance) 10,672,291.00 Preferred dividends 243,180.60 Total stockholders' equity (ending balance) Total outstanding shares Market price of shares Average inventory Average assets (excluding long- term investments) Average total assets Average total stockholders' equity 3,701,510.80 63,272,288.24 2,323,321.73 2,093,167.20 6,498,357.99 5,762,848.20 98,508,044.76 3,617,158.27 3,258,832.80 9,464,359.00 161,780,333.00 5,940,480.00 5,352,000.00 170,748.24 122,460.00 86,424.00 62,400.00 18,706,200.00 13,134,480.00 13.50 2,500,000.00 2,500,000.00 12.84 3,092,304.60 2,061,536.40 14,101,675.68 10,847,442.72 25,988,665.00 19,859,586.00 15,920,340.00 11,277,240.00 9,420,000.00 6,648,000.00 4,800,000.00 2,500,000.00 2,500,000.00 2,500,000.00 12.22 11.63 11.06 1,538,460.00 1,025,640.00 777,000.00 82,176,159.84 6,042,470.40 4,872,960.00 14,854,406.00 11,370,240.00 8,676,000.00 8,034,000.00 5,724,000.00 4,100,000.00

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of inventory turnover for 2021 Inventory turnover C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started