Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fancher Company has a single class of common stock and a single class of cumulative preferred stock. The cumulative preferred stock requires the corporation

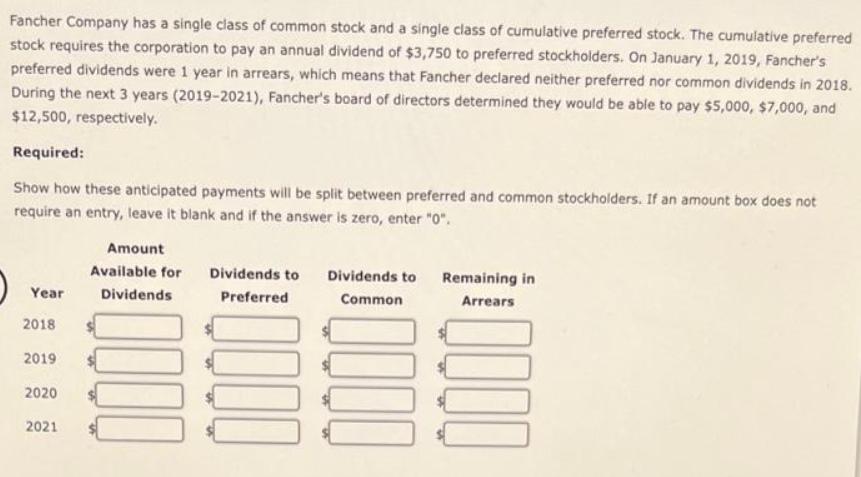

Fancher Company has a single class of common stock and a single class of cumulative preferred stock. The cumulative preferred stock requires the corporation to pay an annual dividend of $3,750 to preferred stockholders. On January 1, 2019, Fancher's preferred dividends were 1 year in arrears, which means that Fancher declared neither preferred nor common dividends in 2018. During the next 3 years (2019-2021), Fancher's board of directors determined they would be able to pay $5,000, $7,000, and $12,500, respectively. Required: Show how these anticipated payments will be split between preferred and common stockholders. If an amount box does not require an entry, leave it blank and if the answer is zero, enter "0". Year 2018 2019 2020 2021 Amount Available for Dividends to Dividends to Remaining in Dividends Common Preferred 0000 0000 1000 0000 Arrears

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement asked YearAmount available for Dividends Dividend to Preferred Dividen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started