Question

You invest in a 2 year AA rated corporate bond. The bond has a face value of $100 and a coupon rate of 3%

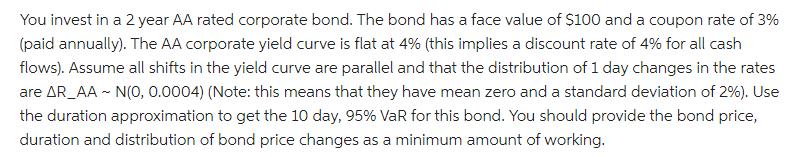

You invest in a 2 year AA rated corporate bond. The bond has a face value of $100 and a coupon rate of 3% (paid annually). The AA corporate yield curve is flat at 4% (this implies a discount rate of 4% for all cash flows). Assume all shifts in the yield curve are parallel and that the distribution of 1 day changes in the rates are AR_AA - N(0, 0.0004) (Note: this means that they have mean zero and a standard deviation of 2%). Use the duration approximation to get the 10 day, 95% VaR for this bond. You should provide the bond price, duration and distribution of bond price changes as a minimum amount of working.

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Futures and Options Markets

Authors: John C. Hull

8th edition

978-1292155036, 1292155035, 132993341, 978-0132993340

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App