Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You invested $ 1 0 0 , 0 0 0 in a 1 0 - year bond with a coupon rate of interest of 4

You invested $ in a year bond with a coupon rate of interest of The market rate of interest is Interest is paid semiannually. Compute the present value of the bond.

You invested $ in a year bond with a coupon rate of interest of The market rate of interest is Interest is paid semiannually. Compute the present value of the bond.

Your firm is considering a project with an initial cash outlay of $ Projected cash inflows are: Year : $; Year : $; Year : $; Year : $; Year :$ The discount rate is Required: Compute the Net Present Value; Should you invest in the project? Why?

Your firm is considering a project with an initial cash outlay of $ The discount rate is Projected cash inflows are $ for each of the next years. Required: Compute the Net Present Value; Should you accept the project? Why?

Company sales during the year were $ The gross profit percentage was Cash collected during the year related to these sales was of the sales. Make all related journal entries, using the installment sales method.

Based on the data below, complete an Income Statement Be sure to use proper form:

Sales $

Cost of Goods Sold $

S & A Expense $

Dividend Revenue $

Interest Expense $

Extraordinary Loss $

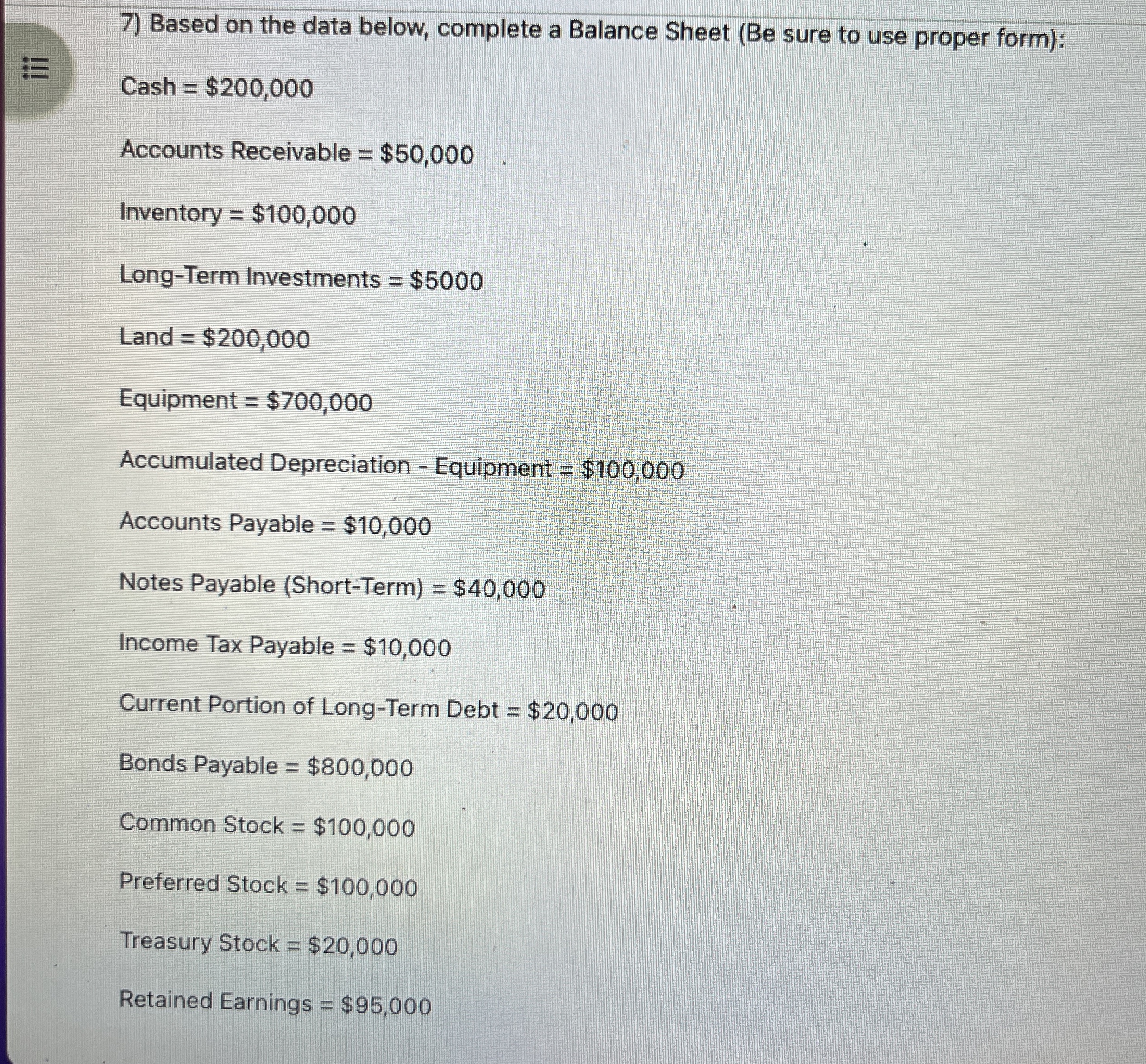

Based on the data below, complete a Balance Sheet Be sure to use proper form:

Cash $

Accounts Receivable $

Inventory $

LongTerm Investments $

Land $

Equipment $

Accumulated Depreciation Equipment $

Accounts Payable $

Notes Payable ShortTerm$

Income Tax Payable $

Current Portion of LongTerm Debt $

Bonds Payable $

Common Stock $

Preferred Stock $

Treasury Stock $

Retained Earnings $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started