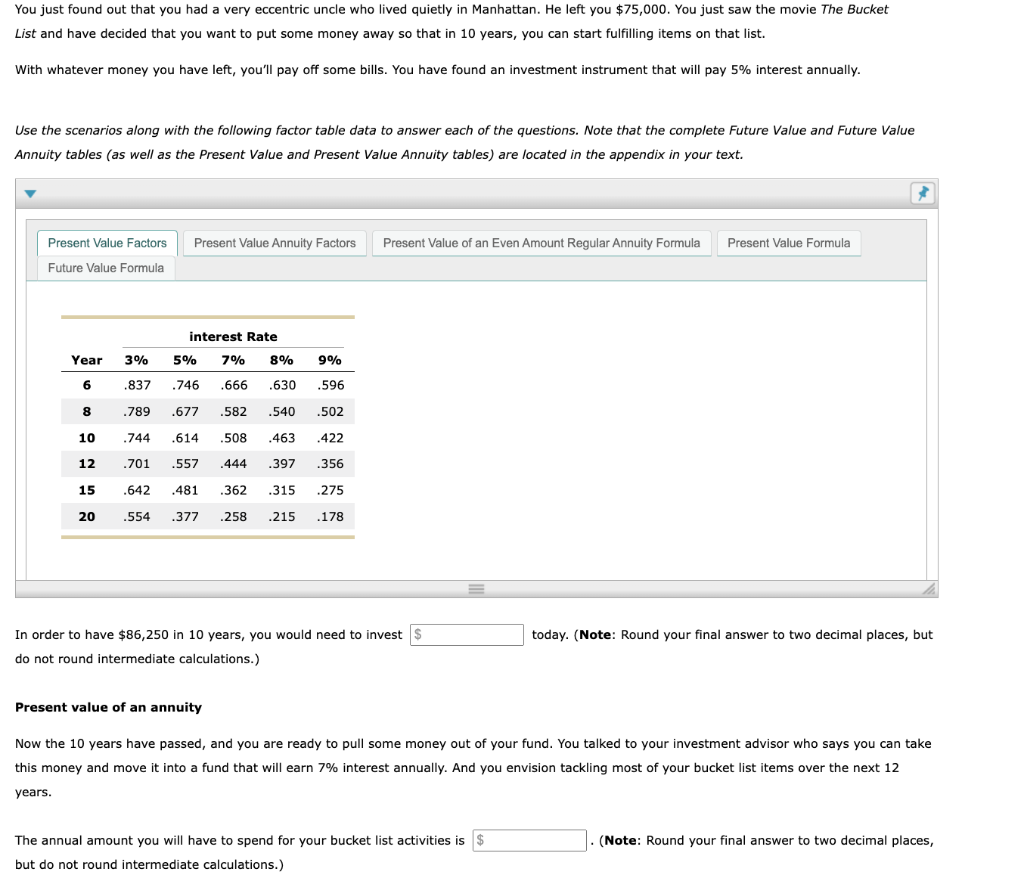

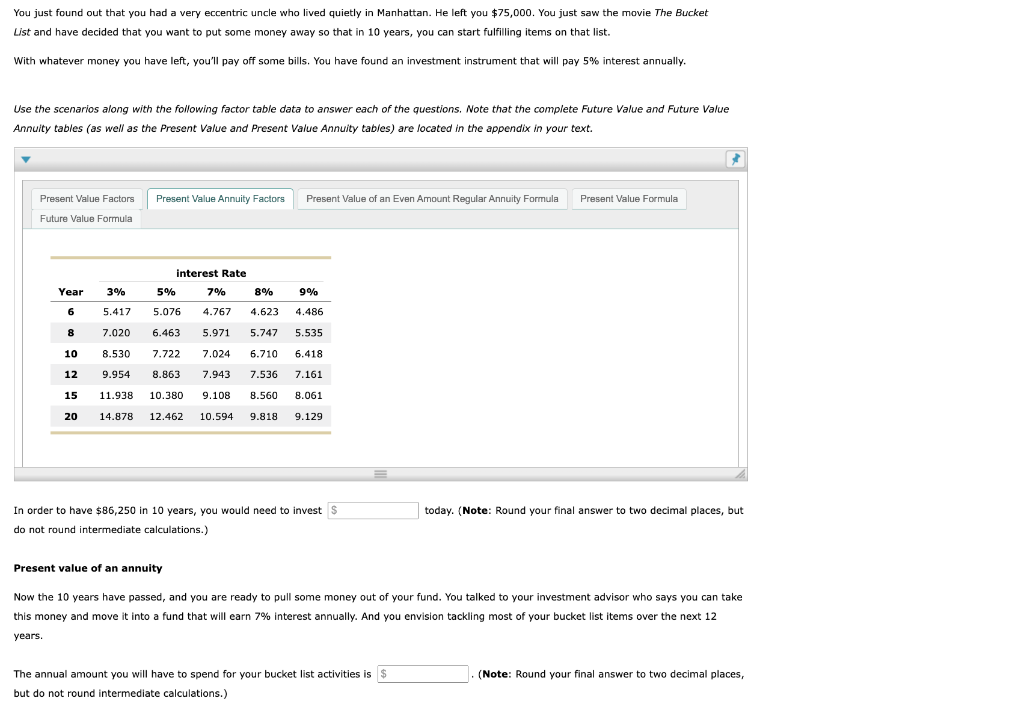

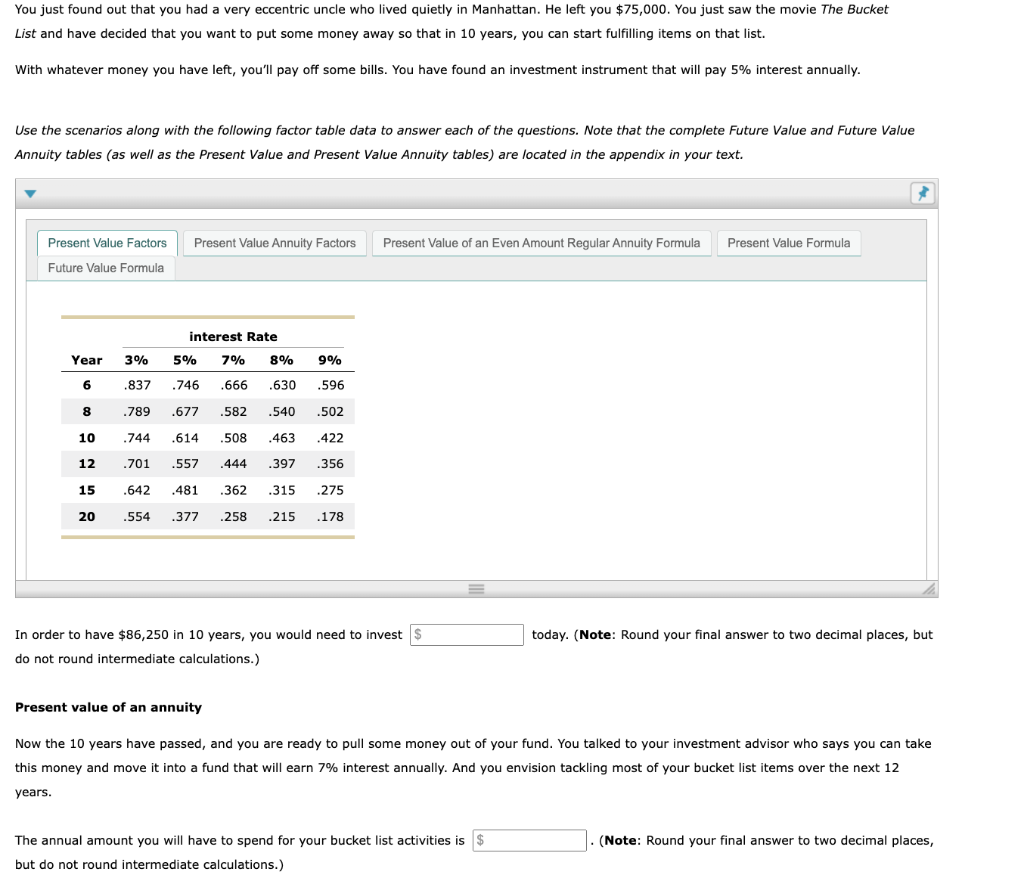

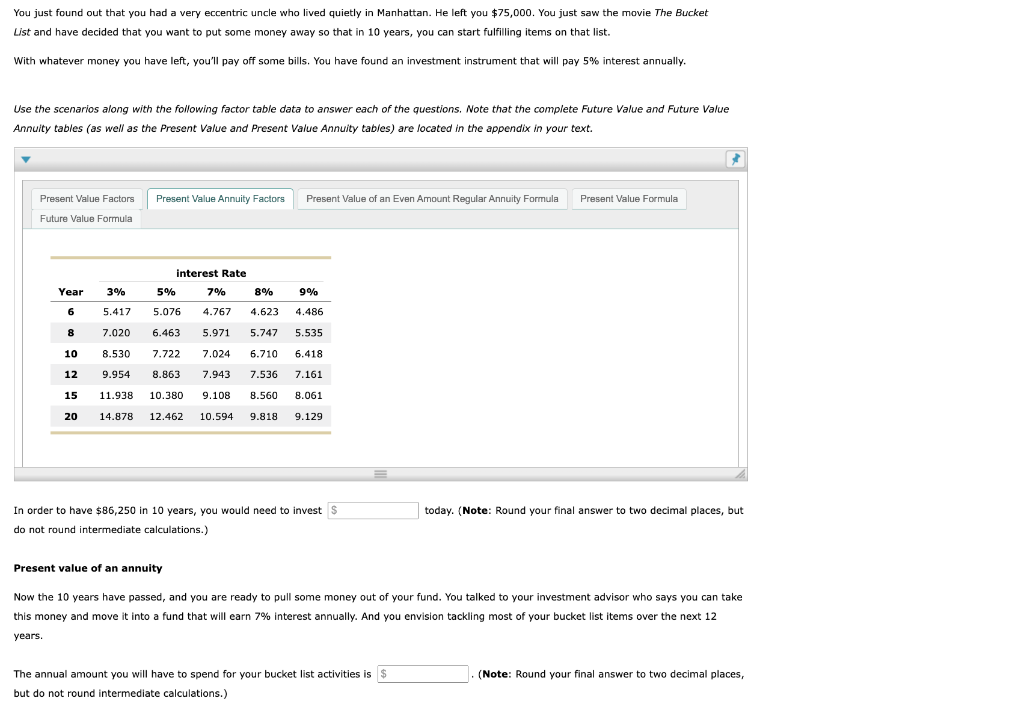

You just found out that you had a very eccentric uncle who lived quietly in Manhattan. He left you $75,000. You just saw the movie The Bucket List and have decided that you want to put some money away so that in 10 years, you can start fulfilling items on that list. With whatever money you have left, you'll pay off some bills. You have found an investment instrument that will pay 5% interest annually. Use the scenarios along with the following factor table data to answer each of the questions. Note that the complete Future Value and Future Value Annuity tables (as well as the Present Value and Present Value Annuity tables) are located in the appendix in your text. Present Value Annuity Factors Present Value of an Even Amount Regular Annuity Formula Present Value Formula Present Value Factors Future Value Formula interest Rate Year 3% 5% 7% 8% 9% .596 6 .837 .746 .666 .630 8 .789 .677 .582 .540 .502 10 .744 .614 .508 .463 .422 .701 .557 .444 .397 .356 12 15 .642 .481 .362 .315 .275 20 .554 .377 .258 .215 .178 today. (Note: Round your final answer to two decimal places, but In order to have $86,250 in 10 years, you would need to invest $ do not round intermediate calculations.) Present value of an annuity Now the 10 years have passed, and you are ready to pull some money out of your fund. You talked to your investment advisor who says you can take this money and move it into a fund that will earn 7% interest annually. And you envision tackling most of your bucket list items over the next 12 years. (Note: Round your final answer to two decimal places, The annual amount you will have to spend for your bucket list activities is $ but do not round intermediate calculations.) You just found out that you had a very eccentric uncle who lived quietly in Manhattan. He left you $75,000. You just saw the movie The Bucket List and have decided that you want to put some money away so that in 10 years, you can start fulfilling items on that list. With whatever money you have left, you'll pay off some bills. You have found an investment instrument that will pay 5% interest annually. Use the scenarios along with the following factor table data to answer each of the questions. Note that the complete Future Value and Future Value Annuity tables (as well as the Present Value and Present Value Annuity tables) are located in the appendix in your text. 7 Present Value Annuity Factors Present Value of an Even Amount Regular Annuity Formula Present Value Formula Present Value Factors Future Value Formula interest Rate Year 9% 5% 7% 8% 5.076 4.767 4.623 4.486 6 3% 5.417 7.020 8.530 8 6.463 5.971 5.747 5.535 10 7.722 7.024 6.710 6.418 12 9.954 8.863 7.943 7.536 7.161 15 11.938 10.380 9.108 8.560 8.061 20 14.878 12.462 10.594 9.818 9.129 today. (Note: Round your final answer to two decimal places, but In order to have $86,250 in 10 years, you would need to invest S do not round intermediate calculations.) Present value of an annuity Now the 10 years have passed, and you are ready to pull some money out of your fund. You talked to your investment advisor who says you can take this money and move it into a fund that will earn 7% interest annually. And you envision tackling most of your bucket list items over the next 12 years. The annual amount you will have to spend for your bucket list activities is $ (Note: Round your final answer to two decimal places, but do not round intermediate calculations.)