Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You just got your first job out of college ( congrats ! ) and have some money to invest for the future. You consider investing

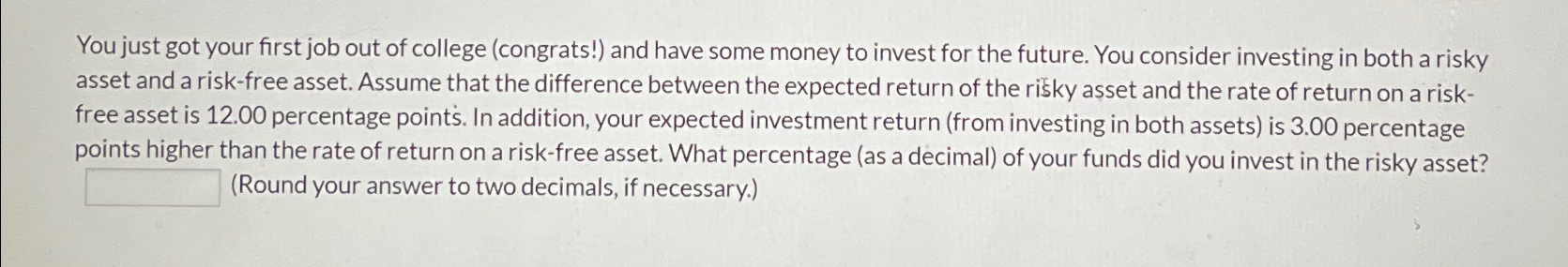

You just got your first job out of college congrats and have some money to invest for the future. You consider investing in both a risky asset and a riskfree asset. Assume that the difference between the expected return of the risky asset and the rate of return on a riskfree asset is percentage point's. In addition, your expected investment return from investing in both assets is percentage points higher than the rate of return on a riskfree asset. What percentage as a decimal of your funds did you invest in the risky asset?

Round your answer to two decimals, if necessary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started